U.S. persons with certain foreign activities are required to file Form 8806 to report information related to foreign trusts, foreign partnerships, foreign corporations, and foreign disregarded entities, as well as certain foreign gifts and bequests.

What is Form 8806?

Form 8806 is an important form for any U.S. person with foreign activities to file. It pertains to foreign trusts, partnerships, corporations, disregarded entities, and foreign gifts/bequests. This form is necessary for the IRS to accurately assess taxes related to these activities, and ensure compliance with regulations.

IRS Form 8806 – Who Needs to Fill It Out?

U.S. persons who are required to file Form 3520, Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts, or Form 3520-A, Annual Information Return of Foreign Trust With a U.S. Owner, must file Form 8806. This form is used to report certain information related to the foreign activities of a U.S. person, such as foreign trusts, partnerships, corporations, and disregarded entities, as well as certain foreign gifts and bequests.

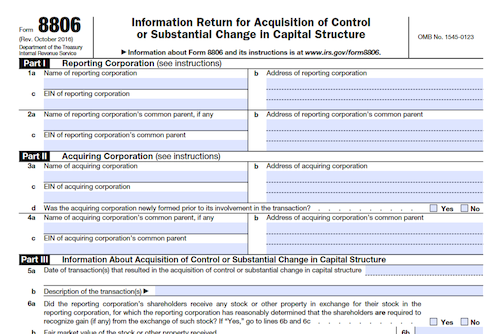

Step-by-Step: Form 8806 Instructions For Filling Out the Document

Form 8806 must be completed and filed by all U.S. persons who have certain foreign activities and files such as Form 3520, Form 3520-A, or Annual Information Return of Foreign Trust With a U.S. Owner. This package contains Form 8806 and its instructions to help you report the required information related to your foreign activities, foreign trusts, foreign partnerships, foreign corporations, foreign disregarded entities, and foreign gifts and bequests. Following the instructions provided in this package will help you complete Form 8806 correctly and efficiently.

Below, we present a table that will help you understand how to fill out Form 8806.

| Information Required for Form 8806 | Details |

|---|---|

| Form Purpose | Report certain foreign activities for U.S. persons who file specific forms. |

| Required Information | Related to foreign activities, foreign trusts, foreign partnerships, and more. |

Do You Need to File Form 8806 Each Year?

Yes, if as a U.S. person you have certain foreign activities, such as foreign trusts, foreign partnerships, foreign corporations, and foreign disregarded entities, you must file Form 8806. In addition, Form 8806 must be filed when reporting certain foreign gifts and bequests. This package contains Form 8806 and its instructions, which should be used to help with the filing process.

Download the official IRS Form 8806 PDF

On the official IRS website, you will find a link to download Form 8806. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 8806

Sources: