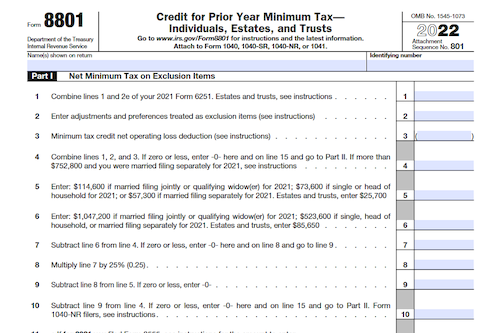

Have you paid alternative minimum tax (AMT) in a prior year? If so, make sure to calculate your minimum tax credit with IRS Form 8801, which can help you figure any credit carryforwards up to 2023.

What is Form 8801?

Form 8801 is an important document for individuals, estates, and trusts to figure the minimum tax credit they incurred for alternative minimum tax (AMT) in prior years and to carry forward a credit to 2023. It plays an essential role in ensuring that all individuals pay a certain amount of tax, regardless of any deductions or credits used. With Form 8801, you can calculate the exact amount of tax you are required to pay and receive any tax credits you are eligible for.

IRS Form 8801 – Who Needs to Fill It Out?

The IRS Form 8801 is to be completed by individuals, estates, or trusts who wish to calculate the minimum tax credit they are eligible for due to any alternative minimum tax (AMT) they paid in previous years, and to determine if they can carry any credits forward to 2023.

Step-by-Step: Form 8801 Instructions For Filling Out the Document

Follow these easy steps to fill out Form 8801 to figure your minimum tax credit: First, you must determine if you are an individual, estate, or trust and if you incurred an alternative minimum tax (AMT) in prior tax years. Second, add up the minimum tax credit for each year, including any credits that may have resulted from a deduction or exclusion in an earlier year. Third, subtract this amount from any AMT you paid in prior years. Fourth, take a look at your 2021 Form 6251 to figure the credit carryforward. Finally, once you have all the information, use the Form 8801 worksheet to figure the amount of credit to apply to your 2021 taxes.

Below, we present a table that will help you understand how to fill out Form 8801.

| Steps to Fill Out Form 8801 | Details |

|---|---|

| Determine Your Filing Status | Check if you are an individual, estate, or trust and if you incurred AMT in prior tax years. |

| Calculate Minimum Tax Credits | Add up the minimum tax credit for each year, including any credits resulting from deductions or exclusions. |

| Subtract Previous AMT Payments | Subtract the total credit from any AMT paid in prior years. |

| Check 2021 Form 6251 | Review your 2021 Form 6251 to determine the credit carryforward amount. |

| Use Form 8801 Worksheet | Apply the information to the Form 8801 worksheet to calculate the credit to apply to your 2021 taxes. |

Do You Need to File Form 8801 Each Year?

Filing Form 8801 each year is an important way of ensuring that you do not end up incurring unnecessary taxes. This form is used to figure out the minimum tax credit that you may be eligible for, due to any Alternative Minimum Tax (AMT) that you incurred in prior tax years. Filing this tax form also ensures that you correctly calculate any credit carryforward to 2023.

Download the official IRS Form 8801 PDF

On the official IRS website, you will find a link to download Form 8801. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 8801

Sources: