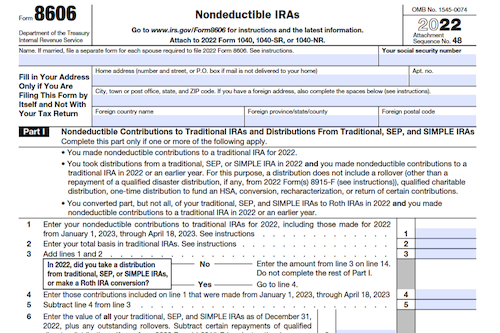

Form 8606 is an important document used for reporting nondeductible contributions to traditional IRAs, distributions from IRAs, conversions from IRAs to Roth IRAs, and distributions from Roth IRAs. Learn who must file, when and where to file, and more.

What is Form 8606?

Form 8606 is used to report: nondeductible contributions to traditional IRAs; distributions, conversions, and distributions from SEP, SIMPLE, and Roth IRA accounts; distributions from inherited traditional, SEP, or SIMPLE IRA accounts with basis; and Roth IRA conversions. Additionally, Form 8606 helps keep track of the basis in traditional, SEP, and SIMPLE IRA accounts in order to calculate the nontaxable part of future IRA distributions. This form must be filed with your Form 1040 by the due date. Various rules and limits for traditional and Roth IRAs and their contributions must be adhered to, such as Modified Adjusted Gross Income (MAGI) limitations and contribution limits to certain accounts. Recharacterizations of IRA contributions are also specified in this form.

IRS Form 8606 – Who Needs to Fill It Out?

IRS Form 8606 must be filled out by anyone who made nondeductible contributions to a traditional IRA, received distributions from a traditional, SEP, or SIMPLE IRA, transferred all or part of a traditional, SEP, or SIMPLE IRA under a divorce or separation agreement, converted an amount from a traditional, SEP, or SIMPLE IRA to a Roth IRA, or received distributions from a Roth IRA. If you are unsure if you need to fill out Form 8606, check out the detailed instructions found in Pub. 590-A and Pub. 590-B, and the instructions for Schedule 1 in the Instructions for Form 1040.

Step-by-Step: Form 8606 Instructions For Filling Out the Document

Form 8606 requires you to report nondeductible contributions to traditional IRAs, distributions from traditional, SEP, or SIMPLE IRAs and your basis in them, as well as conversions or distributions from Roth IRAs. If you have never made nondeductible contributions to these IRAs, you don’t need to report the distributions on Form 8606. You should also note the maximum contributions you can make to a traditional IRA and/or a Roth IRA, and keep record of any rollovers, conversions, recharacterizations, and returns of contributions you’ve made. When filing Form 8606, you may need to use the Maximum Roth IRA Contribution Worksheet, and recharacterizations can be made with a trustee-to-trustee transfer, though be aware that you cannot recharacterize conversions made after 2017. Be sure to attach any necessary statements to your return explaining the transfer.

Below, we present a table that will help you understand how to fill out Form 8606.

| Form 8606 | Instructions |

|---|---|

| Form 8606 requires you to report nondeductible contributions to traditional IRAs, distributions from traditional, SEP, or SIMPLE IRAs and your basis in them, as well as conversions or distributions from Roth IRAs. |

|

Do You Need to File Form 8606 Each Year?

You may need to file Form 8606 each year if you made nondeductible contributions to a traditional IRA, received distributions from a traditional, SEP, or SIMPLE IRA, transferred IRA between spouses, or converted or received distributions from a Roth IRA. For example, if you made contributions to a Roth IRA for 2022, you can check your modified AGI for Roth IRA purposes and use the Maximum Roth IRA Contribution Worksheet to determine the amount you can contribute for the year. However, if you contributed too much, you can recharacterize the contribution to a traditional IRA or another Roth IRA by making a trustee-to-trustee transfer. Depending on the circumstances, you may need to report the contribution and transfer on Form 8606 or your applicable tax return.

Download the official IRS Form 8606 PDF

On the official IRS website, you will find a link to download Form 8606. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 8606

Sources: