Companies with affiliated groups must adhere to filing requirements for Form 851. Such requirements include knowing the definition of an affiliated group, addressing corporate numbers, and providing information on Principal Business Activity, Nondividend Distributions, and Equitable Owners.

What is Form 851?

Form 851 is an Internal Revenue Service document used by parent corporations to file a consolidated tax return for their affiliated group. An affiliated group is one or more connected includible corporations led by a common parent, and must meet requirements of having the parent own at least 80% of the voting power and value of the stock of one of the other corporations and the other corporations owning at least 80% voting power and value of the other subsidiaries. Form 851 includes information like principal business activities, nondividend distributions, transfers, equitable owners, and arrangements, as well as entering the tax and estimated payments for the parent and subsidiaries.

IRS Form 851 – Who Needs to Fill It Out?

Form 851 must be filled out by a parent corporation for itself and any corporations in its affiliated group. An affiliated group is a common parent corporation with at least one other corporation connected through stock ownership. To qualify, the common parent must have at least 80% total voting power and total value of the stock for each corporation in the group (except for the common parent). Form 851 must include the suite, room, or other unit number, the principal business activity and code number, as well as information regarding any nondividend distributions, transfers, and/or equitable owners of stock. Additionally, answers are needed regarding any arrangements by which a nonmember could acquire any voting power in the corporation.

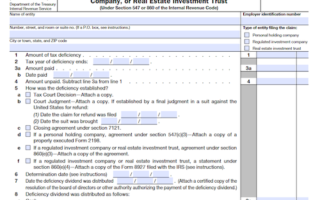

Step-by-Step: Form 851 Instructions For Filling Out the Document

Filing Form 851 requires following specific instructions. A group of companies must be affiliated with a common parent to be included, and there are four qualifications to meet the affiliated group criteria. Additionally, the address, corporation numbers, principal business activities and codes, and information about nondividend distributions must be accurately submitted. Lastly, Parts III and IV of the form require answering certain questions and providing a brief description of any arrangements for acquiring stock or voting power outside the affiliated group. Be sure to read the instructions carefully, and be aware of the Paperwork Reduction Act, as well as the confidential nature of the information you provide.

Below, we present a table that will help you understand how to fill out Form 851.

| Information Required for Form 851 | Details |

|---|---|

| Qualifications | Must meet affiliated group criteria |

| Required Information | Address, corporation numbers, principal activities, etc. |

| Additional Statements | May require additional statements for certain situations |

| Confidentiality | Be aware of the confidential nature of the information |

Do You Need to File Form 851 Each Year?

Form 851 must be filed each year by a parent corporation of an affiliated group for itself and for all corporations in the group. An affiliated group is defined as a common parent corporation and multiple other includible corporations connected through stock ownership. The common parent must possess direct ownership of stock representing at least 80% of the total voting power and value of the stock of at least one other corporation. Moreover, there are a number of regulations and Information RETURN explanations that need to be adhered to in order to properly file this form.

Download the official IRS Form 851 PDF

On the official IRS website, you will find a link to download Form 851. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 851

Sources: