Form 8332 is a form used in cases of divorce or separation when the release of the custodial parent’s right to claim a child as a dependent is given to the noncustodial parent. It offers tax benefits through claiming additional child tax credits or child tax credits, resulting in increased tax refunds for the noncustodial parent.

What is Form 8332?

Form 8332 (Release/Revocation of Release of Claim to Exemption for Child by Custodial Parent) is used when a custodial parent wishes to release, or revoke a prior release, their right to claim a child as a dependent to the noncustodial parent. The form must be completed by the custodial parent and attached to the noncustodial parent’s tax return. By doing so, noncustodial parents may increase their tax refund substantially, by up to $2,000 per child. As the form contains three parts, and must be completed for each child, it is important to be sure that both the custodial and non-custodial parent’s name and Social Security number are entered at the top.

IRS Form 8332 – Who Needs to Fill It Out?

Form 8332 (Release/Revocation of Claim to Exemption for Child by Custodial Parent) is used when a custodial parent wants to release the right to claim a child as a dependent to the non-custodial parent, or when the non-custodial parent wants to revoke a prior release of the exemption. This form must be filled out by the custodial parent, signed, and attached to the noncustodial parent’s return in order to receive the tax benefits associated with claiming the dependent. By filling out a separate Form 8332 for each child, a non-custodial parent could receive a tax refund of up to $2,000 per child through the child tax credit, despite the elimination of dependent exemptions until 2025.

Step-by-Step: Form 8332 Instructions For Filling Out the Document

Form 8332 is used by the custodial parent to release the right to claim a child as a dependent to the noncustodial parent. The form must be completed accurately, signed and dated by the custodial parent, and attached to the noncustodial parent’s tax return. It includes specific information such as the child’s name, tax year, and Social Security number. Additionally, a separate Form 8332 must be filled out for each child, with the non-custodial parent’s name and Social Security number always written at the top of the form. Doing so allows the noncustodial parent to benefit from additional tax credits, making it a worthwhile process for both parties.

Below, we present a table that will help you understand how to fill out Form 8332.

| Information Required for Form 8332 | Details |

|---|---|

| Release of Dependent Claim | Releasing the right to claim a child as a dependent to the noncustodial parent |

| Completing the Form | Completing the form accurately and attaching it to the noncustodial parent’s tax return |

Do You Need to File Form 8332 Each Year?

Form 8332 is an annually recurrent form that can be used by the custodial parent when they want to release the right to claim an exemption for a child to the noncustodial parent or when the noncustodial parent wants to revoke a prior release of the exemption. It must be filed every tax season, as the custodial parent must sign and date the form, provide details such as the child’s name, tax year and their own Social Security number, and the noncustodial parent must then attach the form to their tax return. Filing Form 8332 can be beneficial to the noncustodial parent, as they may be able to increase their tax refunds by $1,500 to $2,000 per child by claiming a child tax credit or additional child tax credit. A distinct Form 8332 is required for each child, with three parts that must be completed even if just specified information is provided.

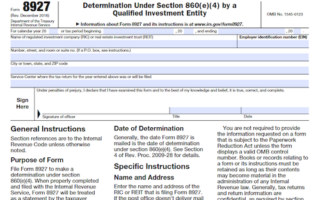

Download the official IRS Form 8332 PDF

On the official IRS website, you will find a link to download Form 8332. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 8332

Sources: