Form 8288 is an important document used by withholding agents to report and pay over amounts withheld for certain dispositions and distributions of U.S. real property interests, transfers of partnership interests, and distributions from qualified investment entities.

What is Form 8288?

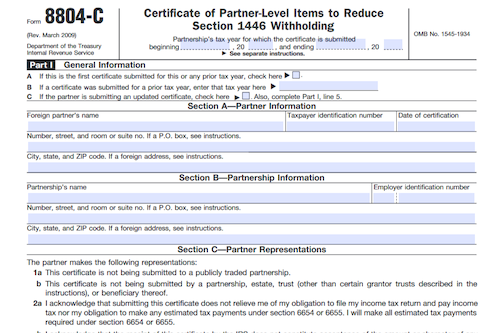

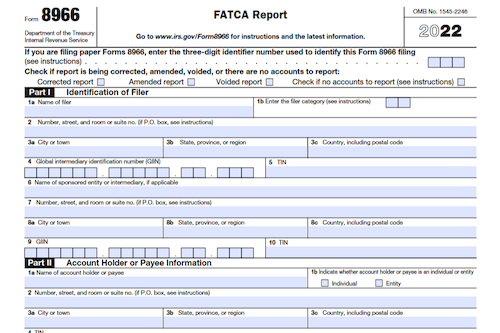

Form 8288 is a form used to report and transmit an amount of tax that is withheld from a transferred U.S. Real Property Interest (USRPI) from a foreign person, foreign or domestic corporation, qualified investment entity (QIE) or the fiduciary of certain trusts and estates under section 1445. It is also used to report and transmit amounts withheld under section 1446(f)(4) or to claim a credit or refund if there is an excess amount of withholding. Exceptions may apply in certain cases which may reduce the amount of tax to be withheld or may not require withholding at all. However, Forms 8288 and 8288-A are not to be used for reporting and paying amounts withheld for certain distributions, dividends or transfers of effectively connected taxable income.

IRS Form 8288 – Who Needs to Fill It Out?

IRS Form 8288 must be filled out by withholding agents who are responsible for the obligation of withholding tax when a U.S. real property interest (USRPI) is transferred from a foreign person. Withholding agents may also be required to submit the form when they make certain distributions with respect to partnership interests or make a distribution of effectively connected taxable income. Exceptions to withholding may apply in some cases. If the transfer or distribution involves stock regularly traded on a U.S. securities market, withholding may be subject to section 1441 or 1442 instead.

Step-by-Step: Form 8288 Instructions For Filling Out the Document

Form 8288 and 8288-A are used to report and transmit amounts withheld for certain dispositions and distributions that are subject to sections 1445 and 1446(f)(1), as well as report and transmit amounts withheld and refund/credit amounts under section 1446(f)(4). All withholding payments must be reported on Forms 1042 and 1042-S for dividend distributions from a QIE, distributions with respect to gains from a trust that is regularly traded on a securities market, distributions of effectively connected taxable income by a PTP, and transfers of a PTP interest. Exceptions to withholding may apply in some cases.

Below, we present a table that will help you understand how to fill out Form 8288.

| Form | Purpose |

|---|---|

| Form 8288 | Report and transmit amounts withheld for certain dispositions and distributions subject to sections 1445 and 1446(f)(1). |

| Form 8288-A | Report and transmit amounts withheld and refund/credit amounts under section 1446(f)(4). |

| Forms 1042 and 1042-S | Report withholding payments for the following:

|

| Exceptions | Exceptions to withholding may apply in some cases. |

Do You Need to File Form 8288 Each Year?

Form 8288 is used by taxpayers to report and remit amounts withheld when buying or disposing of U.S. real property interests from foreign persons, when making distributions from qualified investments entities, or when making distributions connected to the gains of a partnership. Form 8288 should not be used to report amounts withheld from dividend distributions, transfers of qualified partnership interests, or distributions of effectively connected income from a PTP. Each year, it is required that any person with applicable withholding obligations file Form 8288 to ensure they are not liable for any additional taxes or penalties.

Download the official IRS Form 8288 PDF

On the official IRS website, you will find a link to download Form 8288. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 8288

Sources: