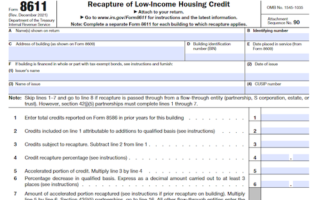

Form 8233 is an IRS form used to claim income exemption from US tax based on tax treaties with another country. To properly complete the form, one must know the terms of the tax treaty between the US and the other country. For the latest information, go to IRS.gov/Form8233.

What is Form 8233?

Form 8233 is a US tax form used to claim relief from US income tax under the terms of a tax treaty. To properly complete Form 8233, one must know and understand the terms of the specific tax treaty between the United States and the treaty country in question. Going forward, the IRS website (IRS.gov/Form8233) is the best source for staying up to date with any developments related to this form, such as changes in legislation.

IRS Form 8233 – Who Needs to Fill It Out?

Anyone who works as a non-resident alien in the United States and who is eligible for income benefits from the US-based employer is required to fill out IRS Form 8233. It’s important to understand the terms of the tax treaty between the US and the treaty country before completing the form. For the latest information and developments related to Form 8233, please visit IRS.gov/Form8233.

Step-by-Step: Form 8233 Instructions For Filling Out the Document

First, you must go to IRS.gov/Form8233 for the latest information on developments related to Form 8233 plus its instructions. Additionally, you must know the terms of the tax treaty between the United States and the treaty country to properly complete Form 8233. After that, you can fill out the document following the instructions and required information laid out in the form.

Below, we present a table that will help you understand how to fill out Form 8233.

| Information Required for Form 8233 | Details |

|---|---|

| IRS Website | IRS.gov/Form8233 |

| Tax Treaty | Terms of the tax treaty between the US and the treaty country |

| Form Completion | Follow the instructions on Form 8233 to complete it |

| Required Information | Information as per the instructions on the form |

Do You Need to File Form 8233 Each Year?

Yes, you must file an updated Form 8233 each year if you are claiming an exemption from payment of U.S. tax on income from dependent personal services. You should make sure to stay informed of any changes to the form or related instructions by checking the IRS website regularly. It is also important to know the terms of the tax treaty between the U.S. and the treaty country in order to complete Form 8233 correctly.

Download the official IRS Form 8233 PDF

On the official IRS website, you will find a link to download Form 8233. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click the link to download Form 8233

Sources: