Issuers of American Recovery and Reinvestment Act (ARRA) bonds, recovery zone economic development bonds (RZEDBs), and tax credit bonds must submit Form 8038-CP to the IRS to receive a refundable credit. The IRS outlines when and how to submit the form for fixed and variable rate bonds.

What is Form 8038-CP?

Form 8038-CP is used by issuers of American Recovery and Reinvestment Act of 2009 (ARRA) Build America Bonds (BABs), Recovery Zone Economic Development Bonds (RZEDBs), and specified tax credit bonds as defined in the Hiring Incentives to Restore Employment Act (HIRE Act) and the Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010 (the Tax Relief Act). It is used to request a refundable credit payment which must be completed no later than 45 days before the relevant interest payment date for fixed rate bonds, but no earlier than 90 days before the relevant interest payment date for either fixed rate or variable rate bonds. For variable rate bonds when the issuer doesn’t know the interest payment amount 45 days prior to the interest payment date, a Form 8038-CP must be filed quarterly.

IRS Form 8038-CP – Who Needs to Fill It Out?

Issuers of build America bonds (BABs), recovery zone economic development bonds (RZEDBs), and certain specified tax credit bonds, such as NCREBs, QECBs, QZABs, and QSCBs, must submit Form 8038-CP to the IRS to request a credit payment. Issuers must file separately for each bond issue and interest rate structure, and must submit no less than 45 days prior to the relevant interest payment date. For variable rate bonds, when the payment amount is unknown 45 days prior, issuers must aggregate all credit payments on a quarterly basis and file for reimbursement no later than 45 days after the last interest payment date within the period.

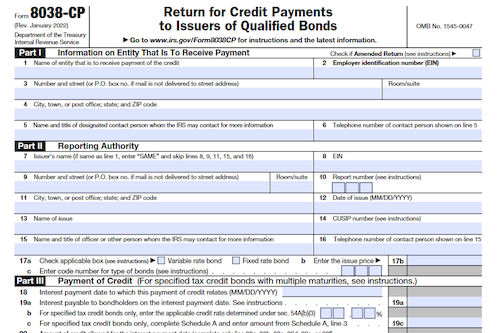

Step-by-Step: Form 8038-CP Instructions For Filling Out the Document

Issuers of Build America Bonds (BABs) (Direct Pay), Recovery Zone Economic Development Bonds (RZEDBs), and specified tax credit bonds must submit Form 8038-CP after the effective date of the form revision (e.g. the January 2022 version) to request the payment of a refundable credit. For fixed-rate bonds, the Form must be filed no later than 45 days before the interest payment date, but no earlier than 90 days before the interest payment date; for variable-rate bonds, Form must be filed within the same timeline but an additional form should be filed for reimbursement in arrears no later than 45 days after the last interest payment date within the quarter. Make sure to provide the full information on the return to avoid delays or normal processing.

Below, we present a table that will help you understand how to fill out Form 8038-CP.

| Instructions for Form 8038-CP | Details |

|---|---|

| Who must submit | Issuers of Build America Bonds (BABs), Recovery Zone Economic Development Bonds (RZEDBs), and specified tax credit bonds |

| When to submit | After the effective date of the form revision (e.g., the January 2022 version) |

| Filing deadline for fixed-rate bonds | Between 45 days and 90 days before the interest payment date |

| Filing deadline for variable-rate bonds | Within the same timeline as fixed-rate bonds, with an additional form for reimbursement in arrears |

| Important notes | Provide complete information to avoid delays in processing |

Do You Need to File Form 8038-CP Each Year?

Yes, a separate Form 8038-CP must be filed each year for BABs (Direct Pay), RZEDBs, and specified tax credit bonds. If the issue has both fixed rate bonds and variable rate bonds, a separate Form 8038-CP must be filed for each interest rate structure. For fixed rate bonds, the form must be filed no later than 45 days before the relevant interest payment date. For variable rate bonds when the issuer doesn’t know the interest payment amount 45 days prior to the interest payment date, the issuer must file a Form 8038-CP quarterly, no later than 45 days after the last interest payment date within the quarterly period.

Download the official IRS Form 8038-CP PDF

On the official IRS website, you will find a link to download Form 8038-CP. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Clicking it will bring you to the page with the PDF, ready to be downloaded. Get the most up-to-date version of Form 8038-CP

Sources: