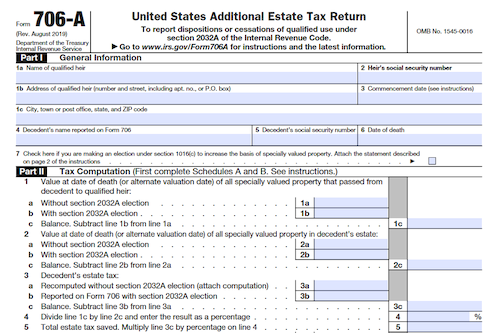

Qualified heirs must file Form 706-A to report the additional estate tax imposed for an early disposition of specially valued property or for an early cessation of a qualified use. The form must be filed within 6 months, unless an extension has been granted, and includes reporting taxable events, calculating penalties, and an election to increase basis.

What is Form 706-A?

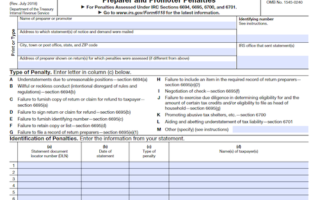

Form 706-A is an Internal Revenue Service (IRS) form that must be completed by a qualified heir of a decedent who has elected special-use valuation for specially valued property. The form is used to report additional estate tax imposed by section 2032A(c) for an early disposition of the specially valued property or cessation of its qualified use. Who must file Form 706-A, when to file and pay, where to file, and other details are addressed in the instructions. The amount of additional estate tax imposed is limited to the tax savings attributable to the property actually disposed of (or for which qualified use ceased) rather than to the tax savings attributable to all the specially valued property received by the heir. Penalties are assigned to return preparers upon an understatement of taxes due to an unreasonable position or a willful or reckless conduct. To determine if a taxable event has occurred, such as a disposition of an interest or cessation of a qualified use, several terms, such as specially valued property, qualified heir, and member of family, require specific definitions. Interest is paid on the additional estate tax if a qualified heir elects to increase the basis of the property. A two-year grace period may be applicable. Form 706-A is comprehensive, and it is important to read the instructions for guidance in completing the form.

IRS Form 706-A – Who Needs to Fill It Out?

The IRS Form 706-A must be filled out by qualified heirs in order to report any additional estate taxes due. This includes any taxable event such as the disposal of an interest in any specially valued property, the cessation of a qualified use of such property, or an involuntary conversion or exchange of such property, even if it is nontaxable. Heirs must file the form within 6 months after the taxable event, unless an extension has been granted. They must also include any agreement to be personally liable, provide the applicable IRS address for filing, and check the “Form 706-A” box in Part II of Form 4768. Qualified heirs may also be subject to certain penalties and interest for understating their tax liability.

Step-by-Step: Form 706-A Instructions For Filling Out the Document

Form 706-A must be used by an heir when the estate tax imposed by section 2032A(c) has been triggered by a disposition of specially valued property, or a cessation of a qualified use of the property. The qualified heir must file the Form and pay any additional taxes due within 6 months of the taxable event (unless the time has been extended). Definitions and taxable events must be reviewed in order to accurately complete the Form. Additional information regarding statues of limitation, liens, penalties, and elections to increase basis must also be considered. Form 706-A must be filed using the designated address, and requires the qualified heir’s signature. For multiple qualified heirs, a separate Form 706-A must be completed for each. To accurately fill out the Form, a review of instructions for the Form 706 must also be conducted.

Below, we present a table that will help you understand how to fill out Form 706-A.

| Information Required for Form 706-A | Details |

|---|---|

| Purpose | Used by heirs when estate tax imposed by section 2032A(c) has been triggered |

| Filing Deadline | Must be filed within 6 months of the taxable event (unless extended) |

| Definitions | Review definitions and taxable events for accurate completion |

| Additional Information | Consider statutes of limitation, liens, penalties, and elections to increase basis |

Do You Need to File Form 706-A Each Year?

Form 706-A is required to report the additional estate tax imposed by section 2032A(c) for an early disposition of specially valued property or for an early cessation of the qualified use of specially valued property. The qualified heir must file Form 706-A and pay any taxes due within 6 months, unless an extension of time is granted. Those who fail to comply are subject to a penalty of up to 75% of the income for the preparation of the return. The additional estate tax may not be assessed after 3 years from the notice of the qualified heir’s taxable event. Those inheriting a special-use valuation must understand the rules for material participation, disposition to family members, disposal of timber, and other important elements.

Download the official IRS Form 706-A PDF

The official IRS website provides you with the ability to download Form 706-A. For your convenience, we have included a link to the form directly from the official irs.gov website! Click the link below to download the latest version of Form 706-A

Sources: