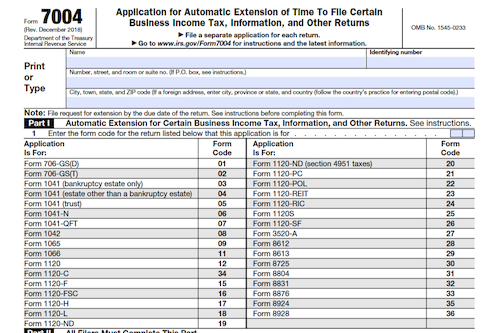

Form 7004 is used to request an automatic extension of time to file certain business income tax, information, and other returns. Properly filing Form 7004 will give you the maximum extension allowed from the due date of your return. However, the IRS may also terminate the automatic extension at any time by mailing a notice of termination.

What is Form 7004?

Form 7004 allows businesses to request an automatic extension of time to file certain income tax returns. Generally, the form must be filed on or before the due date of the applicable tax return, with exceptions indicated in the instructions. Filing the form electronically, as well as filing the form with the Internal Revenue Service, is an option. No signature is required on the form but separate forms must be filed for each return. The IRS may terminate the automatic extension at any time. Benefits of filing Form 7004 include no penalty for filing late provided a proper estimate of the tax is made, and an automatic extension of the originally allotted time is granted.

IRS Form 7004 – Who Needs to Fill It Out?

Form 7004 must be filled out for those needing an automatic extension of time to file certain business income tax, information, and other returns. It must be filed on or before the due date of the return, which can be found in the relevant instructions. There are exceptions for foreign corporations and certain domestic corporations and partnerships. Form 7004 can be filed electronically for most returns, or sent by paper to the Internal Revenue Service Center for the applicable return address. Payment of taxes is still due by the due date of the return, and those who do not pay may be charged a penalty or interest.

Step-by-Step: Form 7004 Instructions For Filling Out the Document

Filing Form 7004 is a way to request an automatic extension of time to file certain business income taxes, information returns, and other returns. Generally, the extension must be filed before the due date of the applicable tax return. Forms 7004 can be filed electronically for most returns, but if you are unable to file electronically, it should be filed with the Internal Revenue Service Center at the applicable address. For each return that requires an extension, a separate Form 7004 should be filed and each form applies only to the specific return indicated. The maximum extension for time to file is generally 6 months and exceptions can be found in the instructions for Part II, line 2 and 4. In addition, a penalty may be assessed if a return is filed late or taxes remain unpaid. To avoid penalties, payment of the balance due and filing before the due date of the return is required.

Below, we present a table that will help you understand how to fill out Form 7004.

| Form 7004 | Instructions |

|---|---|

| Filing Form 7004 is a way to request an automatic extension of time to file certain business income taxes, information returns, and other returns. |

|

Do You Need to File Form 7004 Each Year?

Form 7004 is used to request an automatic extension of time to file certain business income tax, information, and other returns. Generally, Form 7004 must be filed on or before the due date of the applicable return as specified in the return’s instructions. The extension period is generally six months, although certain filers may be eligible for a longer period. If the extension is granted, it allows an additional 6-7 months from the due date to file the return. Note that this extension does not extend the time to pay any taxes due. A penalty and interest may be charged if the return is filed after the due date and/or the tax is not paid on time.

Download the official IRS Form 7004 PDF

On the official IRS website, you will find a link to download Form 7004. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 7004

Sources: