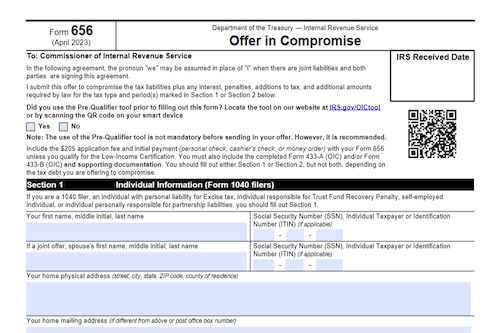

Struggling to pay off debt to the IRS? An IRS Offer in Compromise (Form 656) may provide citizens with the relief they need. Read on to learn more about the form, how it works, and to see if this is the best solution for you.

What is Form 656?

What is IRS Form 656 (Offer in Compromise)? IRS Form 656 (Offer in Compromise) is a form used to propose a portion of a taxpayer’s outstanding IRS debt as sufficient coverage for the entire owed amount. This form provides the IRS with a picture of the taxpayer’s household, assets, expenses, employment, and other factors that inform the decision to approve or reject the Offer in Compromise. Documented evidence and a fee are also required along with Form 656. The Offer in Compromise can be requested for three reasons: a doubt as to liability, a doubt as to collectibility, or effective tax administration. If approved, the offer allows the taxpayer to pay off their IRS debt over a set period of time.

IRS Form 656 – Who Needs to Fill It Out?

IRS Form 656: Who Needs to Fill Out? IRS Form 656 is the tax form required to make an Offer in Compromise, an agreement between a taxpayer and the IRS, whereby a taxpayer proposes to pay a smaller sum due to being in excessive financial hardship or other special circumstances. Individuals who owe the IRS a substantial amount of money and can no longer afford payments under an installment agreement or cannot pay their debt in full may qualify for an Offer in Compromise. To be accepted, applicants must submit the Offer in Compromise form along with a $186 application fee and documents and evidence to support their reasoning. Applicants must also submit their initial payment for their proposed Offer in Compromise and can qualify for an OIC based on three main reasons: doubt as to liability of the taxpayer or collectability of the debt or effective tax administration.

Step-by-Step: Form 656 Instructions For Filling Out the Document

Completing the IRS Form 656 Offer in Compromise requires a well-thought out and comprehensive application package containing your form, proper documentation, an application fee, and an initial payment. This application is then used to determine your eligibility and collect all the necessary information about your household, credit, debts, assets, and more. The form lets you enter your calculation for doubt as to liability, collectibility, and effective tax administration in order to propose a new offer to the IRS for the total sum of your debt. It’s important to include all requested evidence and adequately explain any special circumstances to aid the IRS in making a decision in your favor.

Below, we present a table that will help you understand how to fill out Form 656.

| Information Required for IRS Form 656 | Details |

|---|---|

| Form 656 | Completed IRS Form 656 |

| Documentation | Proper supporting documentation |

| Application Fee | Fee for submitting the offer |

| Initial Payment | Initial payment with the application |

| Household Information | Details about your household |

| Credit Information | Information related to your credit |

| Debt Details | Information about your outstanding debts |

| Asset Information | Details about your assets |

| Doubt as to Liability | Explanation and calculation for doubt as to liability |

| Doubt as to Collectibility | Explanation and calculation for doubt as to collectibility |

| Effective Tax Administration | Explanation and calculation for effective tax administration |

| Special Circumstances | Explanation of any special circumstances |

Do You Need to File Form 656 Each Year?

Each year, you must complete IRS Form 656, known as the Offer in Compromise Form, in order to apply for an Offer in Compromise. This form includes detailed information about your financial situation and will be used by the IRS to determine if you qualify for the Offer in Compromise. If accepted, this offer will allow you to settle your debt for a lesser sum than originally owed. To be approved, the IRS must decide that there is a doubt of liability, doubt of collectibility, or based on effective tax administration. Evidence and supporting documents must be provided with the form to make an informed decision. The form must be accompanied by a payment of the application fee plus an initial payment towards the proposed Offer.

Download the official IRS Form 656 PDF

On the official IRS website, you will find a link to download Form 656 (Offer in Compromise Form). However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 656

Sources:

https://www.irs.gov/forms-pubs/about-form-656