Form 5310-A must be filed by any sponsor or plan administrator of a pension, profit-sharing or deferred compensation plan if they are involved in a merger, spinoff or transfer of plan assets or liabilities to another plan. Learn more about when to file and exceptions from filing.

What is Form 5310-A?

Form 5310-A is used by employers to give notice of plan mergers/consolidations, plan spinoffs, or the transfer of plan assets/liabilities to other plans. It is required for pension, profit-sharing, or other deferred compensation plans, and any sponsor or plan administrator of such plans must file Form 5310-A when the plan merger/consolidation, spinoff, or transfer of assets/liabilities does not meet specified conditions to be exempted from filing. The form must be filed for each plan with a separate employer identification and plan number involved in a merger/transfer, and different filing requirements apply for initial notices, modifications/revocations, and plan transfers.

IRS Form 5310-A – Who Needs to Fill It Out?

IRS Form 5310-A must be filled out by any sponsor or plan administrator of a pension, profit-sharing, or other deferred compensation plan who is involved in a plan merger, spinoff, or transfer of plan assets or liabilities to another plan. It is to be used to give the IRS notice of certain transactions such as combining multiple plans into a single plan, splitting a single plan into multiple spinoff plans, or the splitting off, and then the acquisition or assumption of split-off assets or liabilities by another plan. Exceptions to filing are available in certain conditions such as direct rollover to an eligible retirement plan or specific requirements being met in the case of a plan merger or spinoff. Generally, Form 5310-A must be filed at least 30 days prior to the transaction’s occurrence.

Step-by-Step: Form 5310-A Instructions For Filling Out the Document

To correctly fill out Form 5310-A, it is important for employers to understand why and when it is required. Employers must use the form to give notice of a plan merger or consolidation, a plan spinoff, a transfer of plan assets or liabilities to another plan, or a qualified separate lines of business (QSLOB). The form must be filed at least 30 days before a plan merger or consolidation, spinoff, or transfer of plan assets or liabilities to another plan. If filing for a QSLOB, the form must be filed on or before the notification date of the testing year. Furthermore, if the employer modifies or revokes a previously filed notice, Form 5310-A must be filed with the changes by the notification date. It is important to note that certain scenarios may require exceptions from filing or special instructions depending on the situation.

Below, we present a table that will help you understand how to fill out Form 5310-A.

| Reason for Form 5310-A | Filing Deadline |

|---|---|

| Plan merger or consolidation | At least 30 days before the merger or consolidation |

| Plan spinoff | At least 30 days before the spinoff |

| Transfer of plan assets or liabilities to another plan | At least 30 days before the transfer |

| Qualified Separate Lines of Business (QSLOB) | On or before the notification date of the testing year |

| Modification or revocation of a previously filed notice | With changes by the notification date |

| Exceptions or special instructions | Dependent on the situation |

Do You Need to File Form 5310-A Each Year?

Employers, plan administrators, and sponsors of pension, profit-sharing, or other deferred compensation plans must file Form 5310-A at least 30 days in advance of any plan merger or consolidation, split-off, or transfer of plan assets or liabilities to another plan. If they choose to treat themselves as operating QSLOBs, or modify or revoke a previously filed notice, Form 5310-A must be filed on or before the notification date for the testing year. Exceptions exist for those plans fulfilling certain criteria.

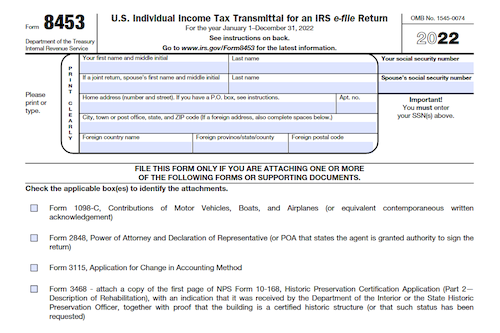

Download the official IRS Form 5310-A PDF

On the official IRS website, you will find a link to download Form 5310-A. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 5310-A

Sources: