IRS Form 4506 is the “Request for Copy of Tax Return” used to obtain a copy of a previous year’s tax return or a tax transcript. Several versions of the form exist, depending on the records you’re requesting and why. Notable features include fee requirements and various delivery options.

What is Form 4506-A?

IRS Form 4506 is a document used to request copies of tax returns and transcripts filed in previous years. To request a copy, one must enter pertinent information on the single page of the form, and include a fee of $43 per requested return (though some exceptions apply). Different versions of Form 4506 are used depending on the records requested and why they are being requested. Additional documents, such as Form 4506-A, are required for exempt or political organizations, while Form 4506-F is for victims of identity theft. To fill out Form 4506, one must include their name, address, Social Security or taxpayer identification number, and other pertinent return information. It must be sent to the appropriate IRS address, and cannot be e-filed but transcripts may be accessed electronically.

IRS Form 4506-A – Who Needs to Fill It Out?

IRS Form 4506 must be used by taxpayers to request a copy of their own tax return from previous years, or to designate a third party to receive it. Several versions of the form exist, depending on the type of tax return requested and why it is being requested. The form can be mailed or faxed in, and a fee of $43 must be included with it. Transcripts, which have most of the same information as the return itself, are also available at no charge. Knowing when and how to use Form 4506 is important for anyone seeking a copy of their return.

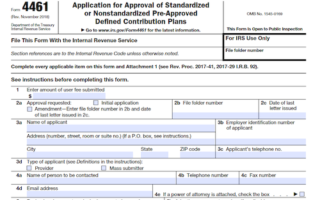

Step-by-Step: Form 4506-A Instructions For Filling Out the Document

Filling out Form 4506 is an essential step for requesting a copy of a previous year’s tax return or a tax transcript from the Internal Revenue Service (IRS). The main form, Form 4506, simply requires basic details like your name, Social Security or taxpayer identification number, and current address. You can select a third-party recipient on Line 5 and specify the type of tax return (e.g., 1040A) on Line 6. There are a few other versions of this form—for transcripts, exempt organizations, and victims of identity theft—and you must select the correct one and provide the appropriate accompanying information. You must mail your form in, and it will typically take around 75 days for the IRS to process your request. Fees and additional rules apply in certain cases, so make sure to read the instructions thoroughly and fill out the form correctly.

Below, we present a table that will help you understand how to fill out Form 4506-A.

| Information Required for Form 4506 | Details |

|---|---|

| Name | Individual’s full name |

| Address | Current mailing address |

| Social Security or Taxpayer Identification Number | Unique identification number |

| Third-Party Recipient | Name of the third party (Line 5) |

| Type of Tax Return | Specify the type of tax return (e.g., 1040A) (Line 6) |

| Form Versions | Various versions for transcripts, exempt organizations, and identity theft victims |

| Correct Form Selection | Select the correct form and provide necessary accompanying information |

| Mailing | Mail the form |

| Processing Time | Around 75 days for IRS to process the request |

| Fees and Rules | Read instructions for fees and additional rules |

Do You Need to File Form 4506-A Each Year?

No, Form 4506 is only used to request copies of a prior year’s tax returns or transcripts. It must be filled out if you need a copy of a tax return or transcript to apply for a loan, verify income, or to allow a third-party to access this information. A transcript consists of the key information from your return and can usually suffice for such purposes. There is no need to file Form 4506 each year, but if you do need to request a copy of a return, make sure to sign it, include payment and send it to the appropriate IRS address within 120 days of the signing date.

Download the official IRS Form 4506-A PDF

On the official IRS website, you will find a link to download form 4506-A. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 4506-A

Sources:

https://www.irs.gov/forms-pubs/about-form-4506