Corporations that are required to file Form 1120-FSC must do so by the 15th day of the 4th month after the end of its tax year. If the due date falls on a Saturday, Sunday, or legal holiday, the designated FSC may file on the next business day. An extension of time to file can be requested by filing Form 7004.

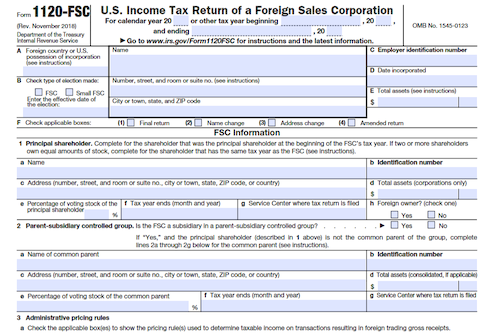

What is Form 1120-FSC?

Form 1120-FSC must be filed by corporations that have elected to be treated as a Foreign Sales Corporation (FSC) or Small FSC, and the election is still in effect. Generally, the due date is the 15th day of the 4th month after the end of the tax year; for short tax years ending anytime in June, the due date is the 15th day of the 3rd month following the end of the tax year. If the due date falls on a weekend or legal holiday, the FSC may file on the next business day. If more time is needed, FSCs may file Form 7004 to request an extension. The return must be signed and dated by a corporate officer (e.g. president, treasurer) or, if applicable, a fiduciary such as receiver or trustee. Returns filed by an employee should not include a paid preparer signature.

IRS Form 1120-FSC – Who Needs to Fill It Out?

Form 1120-FSC must be filled out and filed by a corporation that has elected to be treated as a FSC or small FSC, and the election is still in effect. Generally, the filing deadline is the 15th day of the 4th month after the end of the tax year, however that may change if the tax year ends in June. Those needing more time can file Form 7004, Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns. The return must be signed by the president, treasurer, chief accounting officer, or any other corporate officer authorized to sign. Furthermore, anyone who is paid to prepare the return must also sign and indicate themselves in the “Paid Preparer Use Only” area.

Step-by-Step: Form 1120-FSC Instructions For Filling Out the Document

Filing Form 1120-FSC is necessary for those corporations which have elected to be treated as a FSC or Small FSC, and the election is still in effect. This form is generally due by the 15th day of the 4th month after the corporation’s tax year end, or by the 15th day of the 3rd month after the tax year end in the case of a June 30 fiscal tax year end. An extension of time to file can be requested by filing Form 7004 prior to the due date. The form must be signed and dated by either the president, vice president, treasurer, assistant treasurer, chief accounting officer, or other authorized corporate officers, or a trustee, assignee or receiver if filing on behalf of the FSC. Paid preparers must sign the form and fill out the “Paid Preparer Use Only” area. Lastly, the form must be filed with the Internal Revenue Service Center in Ogden, UT.

Below, we present a table that will help you understand how to fill out Form 1120-FSC.

| Information for Form 1120-FSC | Details |

|---|---|

| FSC or Small FSC Election | File if the election is in effect |

| Due Date | 15th day of the 4th month after tax year end |

| Extensions | Apply for extension via Form 7004 |

| Filing Location | IRS Center address in Ogden, UT |

Do You Need to File Form 1120-FSC Each Year?

Yes, corporations who have elected to be treated as a FSC or small FSC must file Form 1120-FSC by the 15th day of the 4th month after the end of their tax year (or 3rd month if their tax year ending June 30). To file for an extension, a FSC must fill out Form 7004, which must be filed by the original due date. Form 1120-FSC must be signed and dated by a corporate officer, a receiver/trustee/assignee if the FSC is insolvent, or a paid preparer if the services were compensated. The paid preparer must give the return to the FSC and provide their signature in the “Paid Preparer Use Only” area.

Download the official IRS Form 1120-FSC PDF

On the official IRS website, you will find a link to download Form 1120-FSC. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 1120-FSC

Sources: