The 1099 form is used to report non-employment income to the IRS. Whether you’ve received interest payments from a bank account, stock dividends, freelance earnings, unemployment benefits, or other types of income – the 1099 form is essential for reporting it to the IRS. Learn the basics of the form and discover what to do if you don’t receive yours.

What is Form 1099-S?

The 1099 form is an important document for reporting non-employment income to the IRS, such as dividends, interest, or payment received for contract work. Businesses are required to issue a 1099 to a taxpayer if they earned at least $600 or more from non-employment sources during the tax year. The deadline to mail 1099s to taxpayers is usually by January 31st, with some exceptions due the following February. Taxpayers must pay taxes on income reported on their 1099 forms, but there may be offsets or exceptions to reduce taxable income. If you don’t receive a 1099 form that has been reported to the IRS, contact the employer or payer to request the missing documents.

IRS Form 1099-S – Who Needs to Fill It Out?

The 1099 form is used to report various types of non-employment income, such as dividends, interest payments, and pay for independent contractors and freelancers, to the IRS. Businesses must issue a 1099 form to any payee who has received greater than $600 in non-employment income in the tax year. Different types of 1099 forms are used to report different types of income, such as 1099-INT for interest payments and 1099-DIV for dividend income. All income reported on 1099 forms goes to the IRS as well, so if you don’t receive yours, still ensure to pay the taxes owed. Errors in a 1099 form should also be reported immediately as there may still be time before it is sent to the IRS. Note that if you don’t get a 1099 but still had income, it must still be reported. Seek the help of a tax professional if you are unsure of how to accurately report that income.

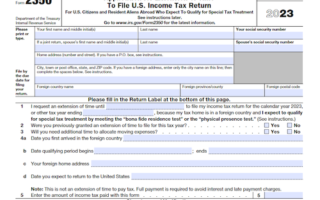

Step-by-Step: Form 1099-S Instructions For Filling Out the Document

The 1099 form is used to report non-employment income received from a bank account (e.g. interest, dividends from stock, prizes/awards, pension/retirement distributions) to the IRS. Businesses must send a 1099 to any individual (other than a corporation) that receives at least $600 in non-employment income during the year. It is important to note that some income sources may require separate 1099 forms such as 1099-INT for interest received and 1099-NEC for non-employee compensation. Taxpayers should stay on top of their address to ensure the information is sent to the IRS correctly. Furthermore, if the taxpayer has not received a 1099 form or if there is an error, the taxpayer should contact the originator in order to obtain a correct form or dispute any discrepancies. Additionally, taxpayers should not forget to explore possible exemptions and offsets that could reduce their taxable income.

Below, we present a table that will help you understand how to fill out Form 1099-S.

| Information for 1099 Form | Details |

|---|---|

| Income Source | Types of income reported on Form 1099 (e.g., interest, dividends, prizes, pension) |

| Recipient | Individuals (excluding corporations) receiving at least $600 in non-employment income |

| Specific 1099 Forms | Various 1099 forms for different income sources (e.g., 1099-INT for interest, 1099-NEC for non-employee compensation) |

| Address Verification | Importance of maintaining a correct address to ensure IRS receives accurate information |

| Handling Missing or Incorrect Forms | Instructions for taxpayers to contact originators to obtain correct forms or dispute discrepancies |

| Tax Reduction Strategies | Encouragement for taxpayers to explore exemptions and offsets to reduce taxable income |

Do You Need to File Form 1099-S Each Year?

The 1099 form is used to report non-employment income to the IRS from a variety of sources. These include dividends, interest earned from a bank account, real estate transactions, payments from a pension or retirement plan, and unemployment benefits. Companies must file a 1099 to the IRS for anyone who has earned $600 or more in non-employment income during the tax year. Although taxpayers may not always receive a 1099 form, they are still responsible for reporting and paying taxes on any income they earned during the tax year. It’s also important to always keep track of 1099 forms that you have received and be sure to address any errors that arise as soon as possible. The IRS matches nearly all forms against your tax returns, so failing to report income appropriately can result in owing more money. Contact a tax professional for assistance in managing your 1099s in order to ensure that you pay the correct taxes.

Download the official IRS Form 1099-S PDF

On the official IRS website, you will find a link to download Form 1099-S. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 1099-S

Sources:

https://www.irs.gov/forms-pubs/about-form-1099-s

https://www.irs.gov/instructions/i1099s