Form 1099-C is a required federal tax form sent to taxpayers by lenders and creditors whenever they cancel or forgive a debt worth $600 or more. Knowing when to file it and how to report the amount listed is crucial for taxpayers, as it is typically considered taxable income, but with exceptions like student loan forgiveness and mortgage debt relief.

What is Form 1099-C?

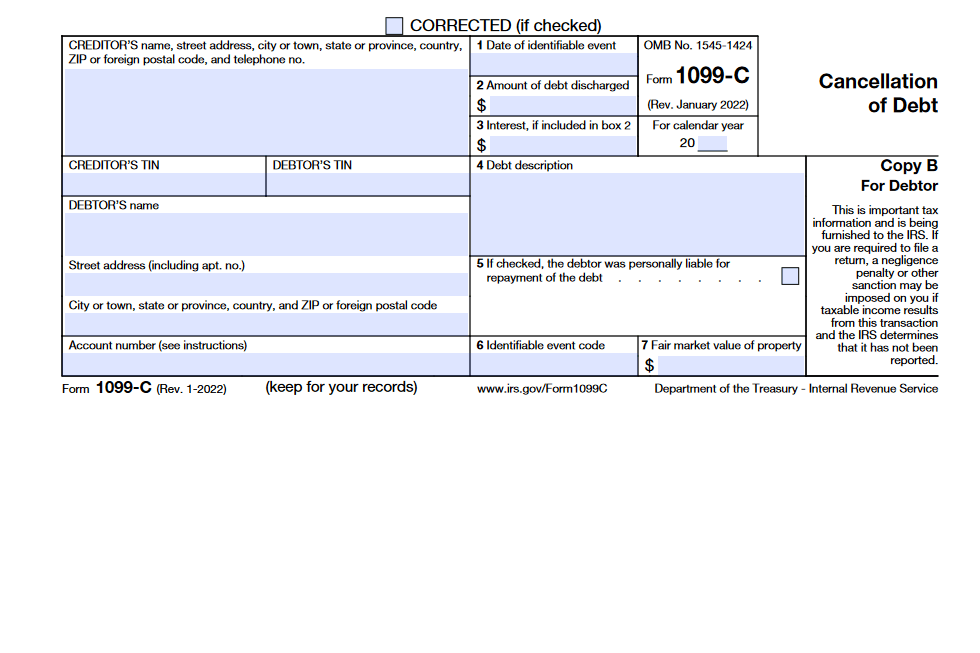

Form 1099-C: Cancellation of Debt is a federal tax form used to report debts of $600 or more that have been canceled or forgiven by a lender or creditor, including in the case of foreclosures, repossessions, loan modifications, or resolutions of credit card debts. Taxpayers who receive Form 1099-C must include the amount listed on the form on their annual income tax return on the “Other Income” line. Creditors must file Copy A with the IRS, Copy B with the taxpayer, and retain Copy C. There are exemptions from taxation for certain forms of canceled debt – bankruptcy, insolvency, certain farm debts, and education loan forgiveness. Knowing what constitutes an exemption is important to ensure you don’t owe any taxes that you don’t have to pay.

IRS Form 1099-C – Who Needs to Fill It Out?

Who Needs to Fill Out Form 1099-C: Cancellation of Debt? If you borrowed money from a commercial lender and at least $600 of that debt was canceled or forgiven, you should receive Form 1099-C from the lender. The creditor must file Copy A with the IRS, send you Copy B, and retain Copy C. You must report the amount indicated on Copy B of the form as taxable income on your income tax return, even if it’s less than $600 and no form is issued. If you receive the form, you can download all three copies from the IRS website. The information on the form needs to be reported in your income tax return to the IRS – typically done on the “Other income” line of Form 1040 or 1040-SR.

Step-by-Step: Form 1099-C Instructions For Filling Out the Document

Form 1099-C is used to declare debt cancellation of $600 or more by lenders or creditors and is required by the IRS to report to both the debtor and the agency. The form contains seven boxes with information about the borrower and creditor, such as names, addresses, and account numbers. You should receive the form by January 31st of the following year. Taxpayers must report the amount from Box 1 as other income on their income tax return. Common exempted debts include bankruptcy, insolvency, certain farm debts, student loan forgiveness, and secured property foreclosure or abandonment. It is important to know if your canceled debt qualifies for exemption before filing taxes. For debts not exempt, use IRS Form 982 to determine the amount that can be excluded from gross income.

Below, we present a table that will help you understand how to fill out Form 1099-C.

| Information Required for Form 1099-C | Details |

|---|---|

| Debtor’s Name | Full name of the debtor |

| Creditor’s Name | Full name of the creditor |

| Debtor’s Address | Current mailing address of the debtor |

| Creditor’s Address | Current mailing address of the creditor |

| Account Numbers | Account numbers related to the debt |

| Date of Debt Cancellation | Date when the debt was canceled |

| Amount of Canceled Debt | Total amount of debt canceled |

Do You Need to File Form 1099-C Each Year?

You must file Form 1099-C: Cancellation of Debt with the IRS each year if $600 or more in debt is canceled or forgiven. The form must be sent to taxpayers by Jan. 31 and is required to report various payments and transactions made to taxpayers by lenders and creditors. Taxpayers must then report the amount from Box 1 as other income on their tax return. Even if the issuer doesn’t send a Form 1099-C, you are still responsible for reporting the canceled debt as taxable income if it is less than $600. The Consolidated Appropriations Act, which was extended to Dec. 31, 2025, allowed individuals to exclude up to $750,000 of certain mortgage debt canceled by a lender. Furthermore, the American Rescue Plan provides that student loan forgiveness from Jan. 1, 2021, to Dec. 31, 2025, is completely tax-free. Be sure to understand the circumstances in which canceled debt may not be taxable.

Download the official IRS Form 1099-C PDF

On the official IRS website, you will find a link to download Form 1099-C: Cancellation of Debt. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 1099-C

Sources:

https://www.irs.gov/forms-pubs/about-form-1099-c

https://www.irs.gov/instructions/i1099ac