Form 1040-ES is used to pay estimated tax for those with income not subject to withholding, such as self-employment earnings, rent, dividends, and alimony. It must be filed if you expect to owe at least $1,000 in tax for 2020, and your withholding and credits are less than the applicable limit. Payments are due on April 15, June 15, September 15, and January 15.

What is Form 1040-ES?

Form 1040-ES is used to figure and pay your estimated tax for 2020. Any income not subject to withholding, such as from self-employment, dividends, or alimony, can be reported on this form. If you expect to owe at least $1,000 in tax after subtracting withholdings and refundable credits, and if your withholdings and credits will be less than either 90% of your 2020 total tax or 100% of your 2019 total tax, you are required to make estimated tax payments. Payments are due on April 15, June 15, September 15, and January 15 of the following year. You can pay online, by phone, or by check or money order. For more information, see the Instructions for Form 1040-ES.

IRS Form 1040-ES – Who Needs to Fill It Out?

Anyone who expects to owe at least $1,000 in taxes for 2020, after subtracting their withholding and refundable credits, and who expect their withholding and refundable credits to be less than either 90% of the tax to be shown on their 2020 tax return or 100% of the tax shown on their 2019 tax return (that covers all 12 months) must submit their form 1040-ES to figure and pay their estimated taxes for the year 2020. The due dates for the estimated tax payments can be found in the table above, and payment must be made via online, by phone, or check or money order. For more information, please consult the Instructions for Form 1040-ES.

Step-by-Step: Form 1040-ES Instructions For Filling Out the Document

Filing Form 1040-ES is a way to figure out and pay estimated tax for 2020 on income not subject to withholding, such as self-employment earnings, dividends, alimony, or rent. You must file if you expect to owe at least $1,000 in tax for 2020 and 90% or more of that amount comes from withholding and refundable credits. Payments are due on the dates outlined in the table provided in the instructions. You can pay online, by phone, or with a check or money order. For more information, please refer to the Instructions for Form 1040-ES.

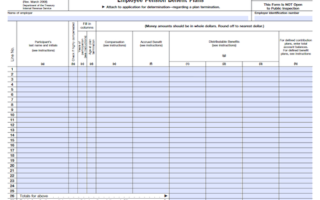

Below, we present a table that will help you understand how to fill out Form 1040-ES.

| Information Required for Form 1040-ES | Details |

|---|---|

| Estimated Tax Owed | Expected tax liability not subject to withholding |

| Payment Due Dates | Dates for making estimated tax payments |

| Payment Methods | Options for making payments |

Do You Need to File Form 1040-ES Each Year?

Form 1040-ES is used to figure and pay your estimated tax for 2020 on income not subject to withholding, such as self-employment earnings, interest, dividends, and more. You need to file Form 1040-ES if you estimate you will owe at least $1,000 in tax for 2020 after subtracting withholding and refundable credits, and those taxes and credits are less than 100% of the taxes you paid in 2019 or 90% of the taxes for 2020. Estimated tax payments should be made on the dates listed in the table – April 15, 2020, June 15, 2020, September 15, 2020, and January 15, 2021 – and can be done online, by phone, or by check/money order. For more information, consult the instructions for Form 1040-ES.

Download the official IRS Form 1040-ES PDF

On the official IRS website, you will find a link to download Form 1040-ES. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 1040-ES

Sources: