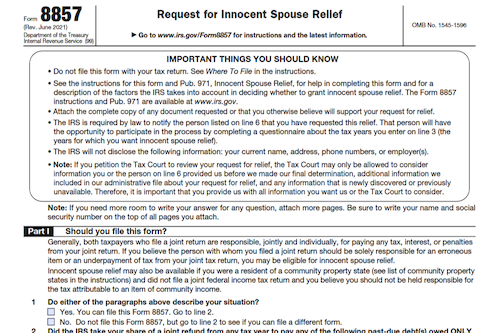

Married people who live in community property states can be held liable for tax attributable to an item of community income if they file a joint return – but now …

Married people who live in community property states can be held liable for tax attributable to an item of community income if they file a joint return – but now …

This article covers information about when to file Form 5316 with the IRS in order to request a determination letter proving that a trust is a group trust arrangement that …

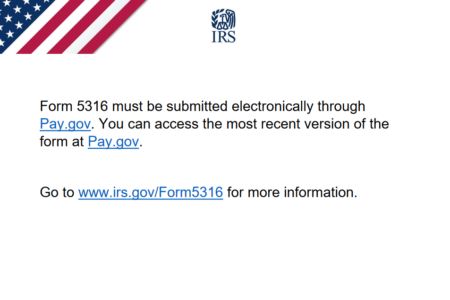

Taxpayers (individuals, partnerships, corporations, etc.) must file Form 8990 to calculate the deductible business interest expenses and carry forward any disallowed expenses to the next tax year. Exclusions from filing …

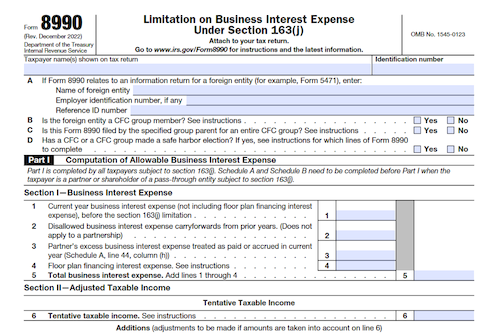

U.S. persons that own foreign disregarded entities (FDEs) and/or operate foreign branches (FBs) must file Form 8858 to satisfy the reporting requirements of various U.S. tax laws. This article overviews …

This article explains the purpose of Form 5310 and who may and may not use it to request an IRS determination of the qualified status of a pension, profit-sharing, or …

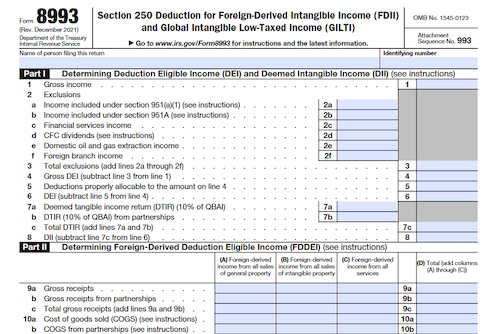

Domestic corporations and individual shareholders of controlled foreign corporations making a section 962 election must use Form 8993 to determine the deduction under section 250 of the Tax Cuts and …

Form 8850 is used by employers to pre-screen and request certification of individuals as a member of a targeted group for the purpose of qualifying for the work opportunity credit. …

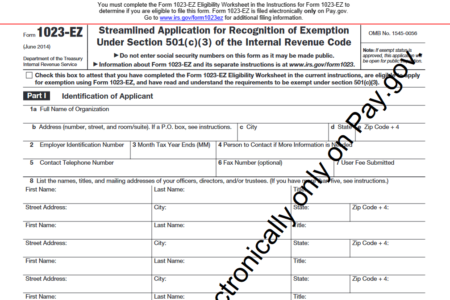

Form 1023-EZ is the streamlined version of Form 1023, allowing certain organizations to apply for recognition of federal tax exemption under Section 501(c)(3). This article breaks down who is eligible …

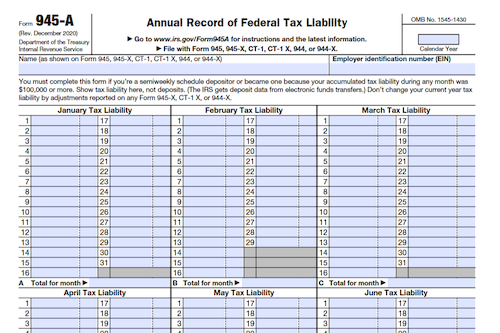

With the help of Form 945-A, employers can report their federal tax liability based on the following tax returns: Forms 945 and 945-X, Forms CT-1 and CT-1 X, or Forms …

With the Black Lung Benefits Revenue Act of 1977, those responsible for black lung benefit trusts and coal mine operators must file Form 6069 by the 15th day of the …

This article outlines the requirements for correcting administrative errors on a previously filed Form 945, including when to use the adjustment or claim processes, the applicable deadline, and filing instructions. …

Form 8959 is used to figure the amount of Additional Medicare Tax owed with any of the six specified returns, which applies to wages, Railroad Retirement Tax Act (RRTA) compensation, …

When you discover an error on a previously filed Form 944, use Form 944-X to make corrections on wages, tips, other compensation, tax withheld, tax credits and to request a …

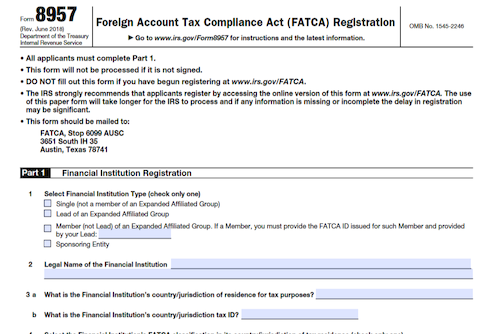

This article outlines the instructions for registering as a Financial Institution under FATCA, including the FI’s jurisdiction of residence for tax purposes, FATCA classification, mailing address, and information on designating …

As of January 2017, IRS has updated instructions for Form W-8EXP, regarding foreign Taxpayer Identification Numbers (TINs) and use of electronic signatures. What is Form W-8 EXP? Form W-8EXP is …

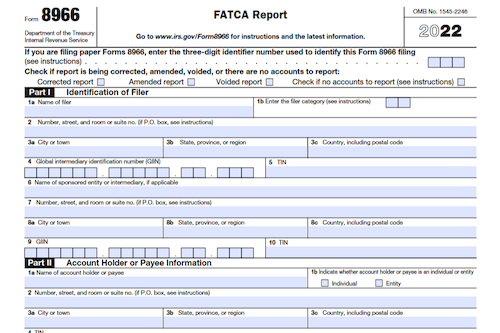

Form 8966 is required to be filed for the 2022 calendar year by March 31, 2023. The filing requirement applies to a variety of entities such as PFFIs, U.S. branches, …

For employers with domestic employees, agricultural workers, and/or H-2A visa holders working in Puerto Rico, Form 943-PR, Employer’s Annual Federal Tax Return for Agricultural Employees, must be filed with the …

For U.S. citizens and residents, filing Form 8960 is necessary if their modified adjusted gross income (MAGI) exceeds a certain threshold, in order to determine their Net Investment Income Tax …

Employers who operate a large food or beverage establishment must file Form 8027 to report annual receipts and tips from customers, as well as allocated tips for tipped employees. This …

Form 8938 is the form you will have to complete to report specified foreign financial assets, if you are a specified individual or a specified domestic entity. It requires you …