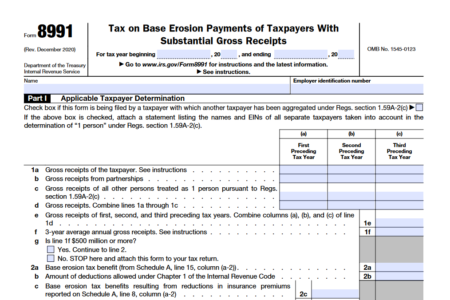

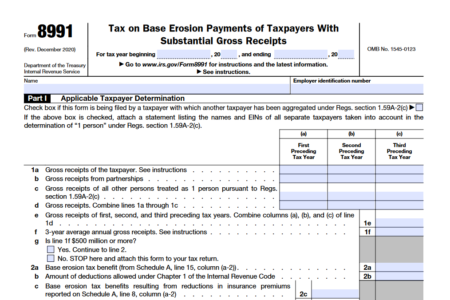

Form 8991 is used to determine an applicable taxpayer’s base erosion minimum tax amount based on their base erosion percentage, modified taxable income, and regular tax liability. Taxpayers must consider …

Form 8991 is used to determine an applicable taxpayer’s base erosion minimum tax amount based on their base erosion percentage, modified taxable income, and regular tax liability. Taxpayers must consider …

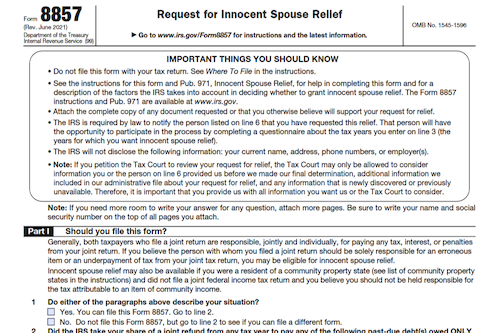

Married people who live in community property states can be held liable for tax attributable to an item of community income if they file a joint return – but now …

This article covers information about when to file Form 5316 with the IRS in order to request a determination letter proving that a trust is a group trust arrangement that …

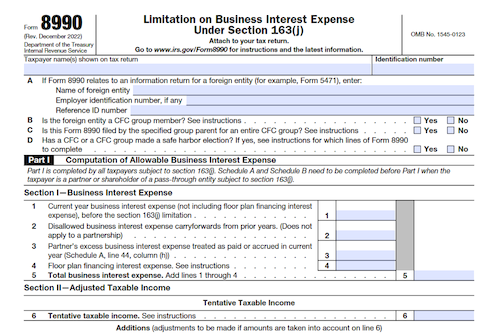

Taxpayers (individuals, partnerships, corporations, etc.) must file Form 8990 to calculate the deductible business interest expenses and carry forward any disallowed expenses to the next tax year. Exclusions from filing …

U.S. persons that own foreign disregarded entities (FDEs) and/or operate foreign branches (FBs) must file Form 8858 to satisfy the reporting requirements of various U.S. tax laws. This article overviews …

This article explains the purpose of Form 5310 and who may and may not use it to request an IRS determination of the qualified status of a pension, profit-sharing, or …

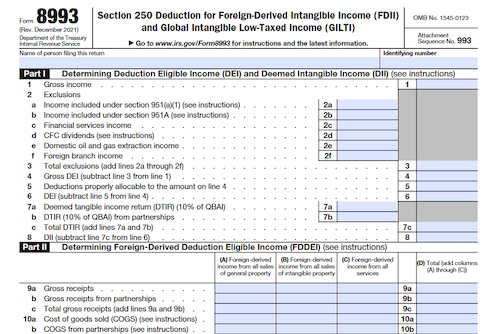

Domestic corporations and individual shareholders of controlled foreign corporations making a section 962 election must use Form 8993 to determine the deduction under section 250 of the Tax Cuts and …

Form 8850 is used by employers to pre-screen and request certification of individuals as a member of a targeted group for the purpose of qualifying for the work opportunity credit. …

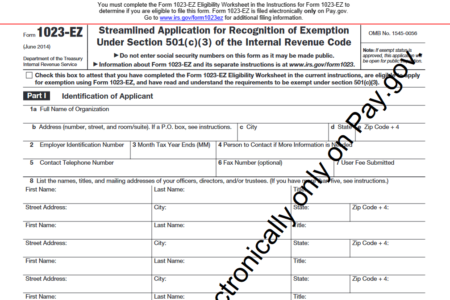

Form 1023-EZ is the streamlined version of Form 1023, allowing certain organizations to apply for recognition of federal tax exemption under Section 501(c)(3). This article breaks down who is eligible …

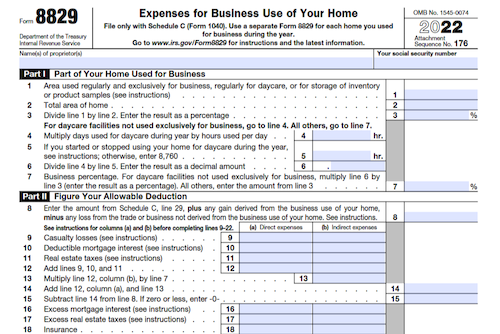

Use Form 8829 when filing your taxes to determine the full extent of the allowable expenses for business use of your home, and any carryover to the next tax year. …

If you are looking to claim the EIC, CTC, RCTC, ACTC, ODC, or AOTC on your tax return, you must complete Form 8862 and attach it to your return to …

Form 5500-EZ is used to fulfill federal filing obligations for one-participant plans and foreign plans that do not file Form 5500-SF electronically. It is important to know if filing Form …

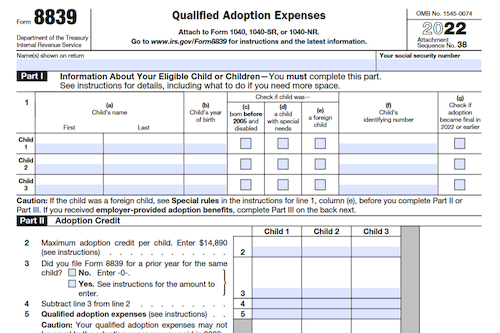

Taking an adoption credit or exclusion for employer-provided adoption benefits can help reduce your tax liability. Learn the requirements for taking an adoption credit or exclusion, as well as how …

Form 8864 (Rev. January 2023) is used to claim the section 40A biodiesel and renewable diesel fuels credit or the section 40B sustainable aviation fuel credit. Partnerships, S corporations, cooperatives, …

Form 706-NA is an Internal Revenue Service form used to compute the estate and generation-skipping transfer (GST) tax liability for nonresident not a citizen (NRNC) decedents. This article covers information …

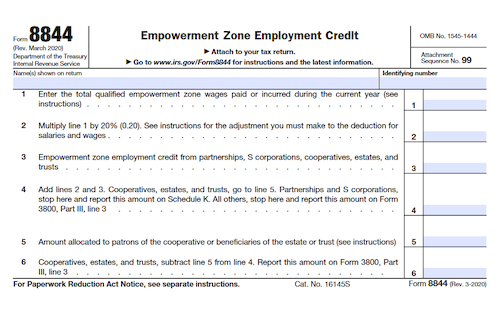

This article explores Form 8844 and how to use it to claim the empowerment zone employment credit, including instructions on who may be a qualified zone employee and what types …

For tax purposes, the IRS uses Form 5227 for split-interest trusts to report financial activities, charitable deductions, distributions, and to determine if the trust is treated as a private foundation …

Flying or departing from the US this year? Learn about the final return, certificate of compliance, and alien status rules you need to consider before taking off. What is Form …

Claim the Indian Employment Credit with Form 8845! Partnerships, S corporations, cooperatives, estates, and trusts must file the form to claim the credit. Wages paid must meet all the requirements …

Form 6478 (Rev. January 2020) can be used to figure your section 40 biofuel producer credit for tax years beginning after 2017. Qualified second generation biofuel production includes liquid fuel …