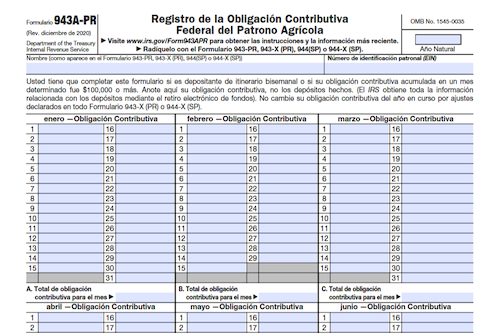

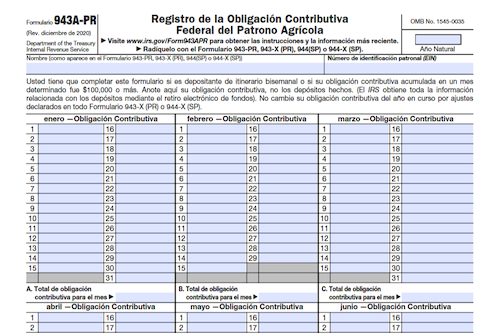

Federal tax filers in Puerto Rico must use Form 943A-PR to report their tax obligation when they are biweekly schedule depositors. This form must be included with Form 943-PR, 943-X …

Federal tax filers in Puerto Rico must use Form 943A-PR to report their tax obligation when they are biweekly schedule depositors. This form must be included with Form 943-PR, 943-X …

As taxpayers continue to file their taxes, it is important to keep up-to-date with any changes to IRS forms like Form 3903. For the latest information related to the form …

Form 8288 is an important document used by withholding agents to report and pay over amounts withheld for certain dispositions and distributions of U.S. real property interests, transfers of partnership …

Form 8233 is an IRS form used to claim income exemption from US tax based on tax treaties with another country. To properly complete the form, one must know the …

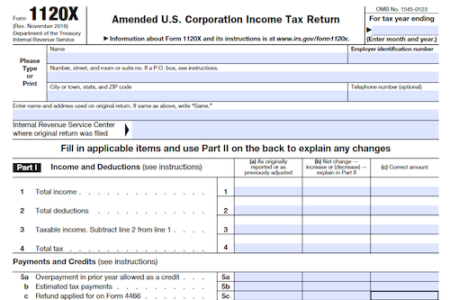

Form 1120X allows corporations to adjust their returns by filing a claim for refund or election after the prescribed deadline, or to correct an originally filed return. It should not, …

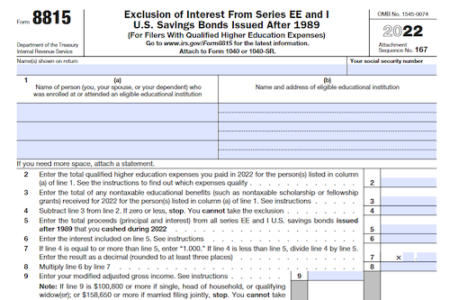

This article provides detailed information about form 8815, which can be used to determine the amount of any interest that can be excluded from the taxpayer’s income for cashing series …

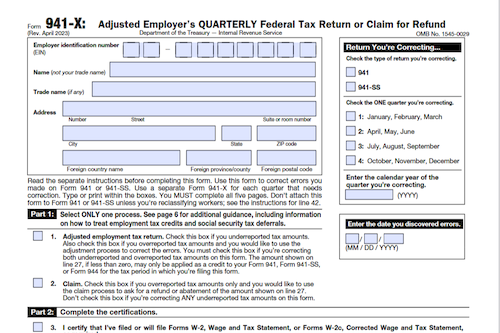

Learn the intricacies of IRS Form 941 and proper filing and correction procedures for COVID-19-related tax credits using Form 941-X, including when to file and what can be corrected. What …

Understand the tax implications of Employee Stock Purchase Plans (ESPPs), which offer a fringe benefit to employees the option to purchase a company’s stock at a discounted rate. ESPPs often …

Have you been considering changing the tax status of your Limited Liability Company (LLC) to a corporation or an S corporation? Learn the process of filing IRS Form 8832 or …

Understanding a business’s fiscal and tax year is important for filing taxes correctly. This article outlines how to determine a fiscal year, how a business fiscal year is different from …

With various methods to update a mailing address with the Internal Revenue Service (IRS) such as Form 8822, your tax return, by phone, in person, or by mail, it’s important …

The foreign tax credit is a credit U.S. taxpayers can use to offset income taxes paid to a foreign government, preventing double taxation on income earned in both the U.S. …

With various methods to update a mailing address with the Internal Revenue Service (IRS) such as Form 8822, your tax return, by phone, in person, or by mail, it’s important …

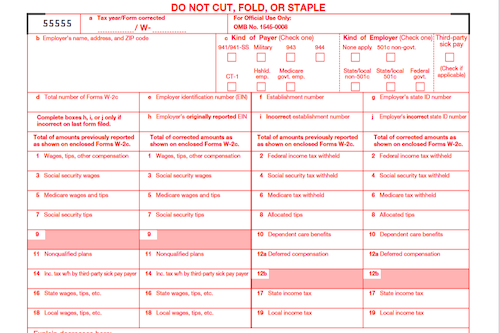

Learn how to correct errors on filed W-2 forms, how to get the forms you need, and the penalties imposed for incorrect information on those forms. What is Form W-3-C? …

From the time of death to the end of a fiduciary relationship, IRS Form 56 must be filed to notify the IRS of changes and to list a fiduciary as …

IRS Form W-3 is an important summary transmittal tax form businesses must file with federal agencies along with annual wage and tax forms for employees. It compiles employee salaries and …

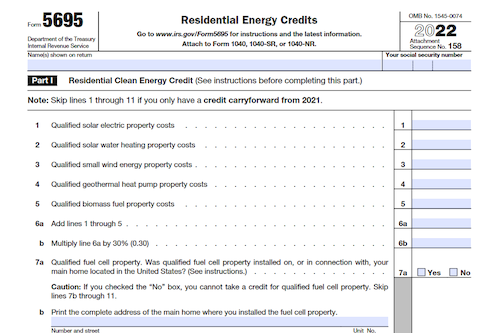

Reduce your utility bills and lower your tax obligation with federal tax credit Form 5695 – “Residential Energy Credits”. Learn more about which energy efficiency upgrades qualify, how to claim …

Struggling to pay off taxes owed to the IRS? Don’t worry – the IRS has options to help, from installment plans to offers in compromise. Find out how you can …

IRS Form 4506-T-EZ is used to gain access to financial records from the IRS, either for yourself or to send to a third party. It is often required when applying …

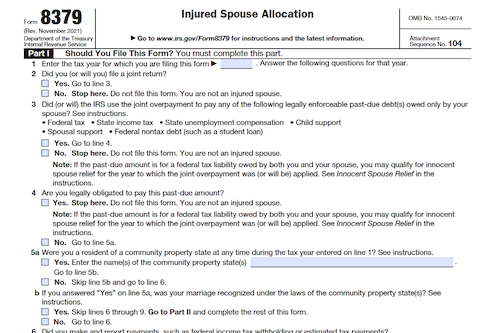

Have you lost your portion of a joint tax refund due to your spouse’s unpaid obligations? Learn how to apply for injured spouse allocation and get back your owed refund …