Trustees of trusts with taxable terminations must file Form 706-GS(T) by April 15 of the year following the calendar year of termination. The form is subject to the Generation-Skipping Transfer (GST) tax and must take into account irrevocable trusts, transition rules for revocable trusts, exceptions to the additions rule, and definitions of skip persons, interests, and non-skip persons.

What is Form 706-GS(T)?

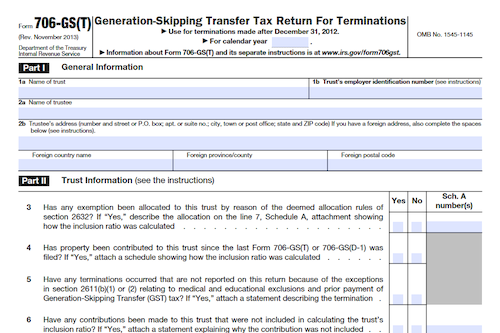

Form 706-GS(T) is a document used by trustees to calculate and report the tax due from certain trust terminations subject to the generation-skipping transfer (GST) tax. Generally, the trustee of any trust with a taxable termination must file Form 706-GS(T) by April 15 of the year following the calendar year in which the termination occurred. Exceptions to the GST tax may apply depending on whether the trust is revocable, irrevocable, or contains qualified terminable interest property, or if the transfer was made to cover medical or educational expenses. The form determines whether a transferor or beneficiary is classified as a skip person and assigns a generation to the transferor. Depending on these factors, the GST tax may or may not apply.

IRS Form 706-GS(T) – Who Needs to Fill It Out?

IRS Form 706-GS(T) must be filled out by the trustee of a trust for any taxable termination that is subject to the generation-skipping transfer tax. Generally, this form must be filed by April 15 of the year following the calendar year when the termination occurs. Depending on the trust and the transferor’s relationship to certain descendants, the GST tax may or may not apply. Additions to irrevocable trusts after September 25, 1985 and to revocable trusts after October 21, 1986 may also affect the applicability of this tax. Further exceptions and clarifications may apply.

Step-by-Step: Form 706-GS(T) Instructions For Filling Out the Document

Filling out form 706-GS(T) correctly is essential in order to properly figure and report the tax due from certain trust terminations that are subject to the generation-skipping transfer (GST) tax. Generally, trustees must file the form by April 15 of the year following the calendar year in which the termination occurred, but an extension of time to file may be requested by filing Form 7004. To ensure the form is correctly completed, trustees should be aware of definitions of key items such as skip persons, interests, non-skip persons, generation assignment, exemptions from additions rule, and the 90-day rule. Additionally, any additions to revocable or irrevocable trusts must be taken into consideration when completing the form.

Below, we present a table that will help you understand how to fill out Form 706-GS(T).

| Key Items for Form 706-GS(T) | Details |

|---|---|

| Form Filing Deadline | April 15 of the year following the termination (or request an extension with Form 7004) |

| Skip Persons | Individuals subject to the GST tax due to trust terminations |

| Interests | Assets or property subject to taxation |

| Non-Skip Persons | Individuals not subject to the GST tax |

| Generation Assignment | Assignment of individuals to specific generations for tax purposes |

| Exemptions from Additions Rule | Circumstances where certain additions to trusts are exempt from taxation |

| 90-Day Rule | Rules governing certain transfers within a 90-day period |

| Trust Additions | Additions to revocable or irrevocable trusts that affect taxation |

Do You Need to File Form 706-GS(T) Each Year?

Generally, the trustee of any trust that has a taxable termination must file Form 706-GS(T) for the tax year in which the termination occurs. For trusts existing prior to September 25, 1985, GST tax may not apply, unless additions are made to the trust after this date. Revocable trusts made prior to October 22, 1986 may also be exempt from GST tax. Otherwise, terminations in the trust may be subject to GST tax and may need to be reported on Form 706-GS(T).

Download the official IRS Form 706-GS(T) PDF

On the official IRS website, you will find a link to download Form 706-GS(T). However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click the link to download: Form 706-GS(T)

Sources: