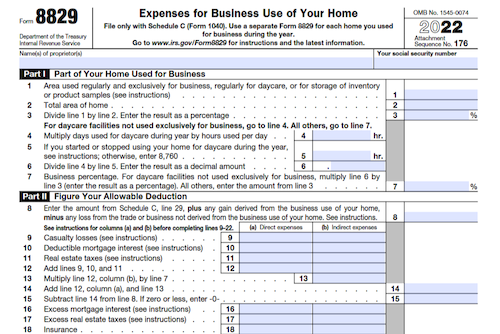

Use Form 8829 when filing your taxes to determine the full extent of the allowable expenses for business use of your home, and any carryover to the next tax year. While some taxpayers cannot use Form 8829, those who do must meet certain requirements in order to qualify for the deductions associated with business use of a home.

What is Form 8829?

Form 8829 is used to calculate the allowable expenses associated with the business use of one’s home, as reported in Schedule C (Form 1040), and any associated expenses that can be carried over into the following year. It is not used for businesses with employees or with any expenses that are properly allocable to inventory costs. Those who may use Form 8829 include those who use their home exclusively and regularly for administrative and management activities of their business, or for the storage of inventory or product samples. An exception exists for daycare providers who have, or are exempt from, license, certification, registration, or approval under state law. Expenses related to tax-exempt income such as parsonage allowance or military housing allowance, however, may be deductible under normal rules.

IRS Form 8829 – Who Needs to Fill It Out?

The IRS Form 8829 must be completed by individuals who need to claim deductions for the business use of their home on their Schedule C (Form 1040) and any excess deductions to be carried over to 2023. This form cannot be used if the individual is claiming expenses as a partner or on Schedule F (Form 1040). It also cannot be used if the expenses are partly or completely allocable to inventory costs. For those who choose the simplified method, Form 8829 must still be used to claim expenses for other homes used throughout the year. In general, individuals can only deduct expenses for the business use of a home that is exclusively and regularly used for administrative or management activities. Certain exceptions to the exclusivity requirement apply for those who use the space for storage of inventories and product samples or as a daycare facility. Further details are available in Pub. 587, Business Use of Your Home.

Step-by-Step: Form 8829 Instructions For Filling Out the Document

Form 8829 is used to figure the allowable expenses for the business use of your home. You must meet specific requirements and your deductible expenses may be limited. Each home you used for business must have its own Form 8829; there are some situations in which it cannot be used. For more information on what counts as a business use of your home, as well as exceptions to the exclusivity requirement for certain spaces, please see Pub. 587, Business Use of Your Home. To qualify as your principal place of business, two items must be considered: the relative importance of business activities, and the amount of time spent there. You can also deduct expenses related to the storage of inventory or product samples, as well as for certain daycare facilities, provided certain requirements are met. Lastly, if you receive a tax-exempt parsonage allowance or military housing allowance, mortgage interest and real property taxes may be deductible. All other expenses related to the allowance are not deductible.

Below, we present a table that will help you understand how to fill out Form 8829.

| Form 8829 | Instructions |

|---|---|

| Form 8829 is used to figure the allowable expenses for the business use of your home. You must meet specific requirements and your deductible expenses may be limited. Each home you used for business must have its own Form 8829; there are some situations in which it cannot be used. For more information on what counts as a business use of your home, as well as exceptions to the exclusivity requirement for certain spaces, please see Pub. 587, Business Use of Your Home. To qualify as your principal place of business, two items must be considered: the relative importance of business activities, and the amount of time spent there. You can also deduct expenses related to the storage of inventory or product samples, as well as for certain daycare facilities, provided certain requirements are met. Lastly, if you receive a tax-exempt parsonage allowance or military housing allowance, mortgage interest and real property taxes may be deductible. All other expenses related to the allowance are not deductible. |

|

Do You Need to File Form 8829 Each Year?

Yes, you must file Form 8829 each year if you are claiming expenses for the business use of your home on your Schedule C (Form 1040). You must also meet specific requirements to deduct your expenses, and your allowable deduction may be limited. This form does not apply if you are claiming these expenses as an employee or as a partner; for those cases, refer to Pub. 587, Business Use of Your Home, for additional information. Furthermore, the form does not apply if you have elected to use the simplified method or if all of your expenses are allocated to inventory costs for Schedule C, Part III.

Download the official IRS Form 8829 PDF

On the official IRS website, you will find a link to download Form 8829. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 8829

Sources: