When a trade or business is sold, the transaction must be reported to the IRS by the buyer and seller using Form 8594. This article covers the reporting requirements, penalties, asset classifications, and other details of completing and filing Form 8594.

What is Form 8594?

Form 8594, also known as the Asset Acquisition Statement Under Section 1060, is a form used by both the seller and purchaser of assets that make up a trade or business in order to report when the purchase results in goodwill or going concern value being attached to the assets. In these cases, the purchaser’s basis is determined only by the amount paid for the assets and Form 8594 must be filed. Exceptions may apply, however, including when a group of assets is exchanged for like-kind property, when a partnership interest is transferred, or when the assets meet certain criteria. When filing Form 8594, both the purchaser and seller must attach it to their income tax returns, and the fair market value of the assets must be unreduced. Penalties are applicable if the form is not correctly filed.

IRS Form 8594 – Who Needs to Fill It Out?

IRS Form 8594 must be filled out by both the seller and purchaser of a group of assets that makes up a trade or business, if goodwill or going concern value attaches or could attach to the assets, and if the purchaser’s basis in the assets is determined only by the amount paid for the assets. Form 8594 must also be filed if the purchaser or seller is amending an original or previously filed supplemental Form 8594 due to an increase or decrease in the purchaser’s cost of the assets or the amount realized by the seller. Generally, exceptions do not apply, but if Form 8594 is not filed or a correct Form 8594 is not completed by the due date, penalties may be assessed.

Step-by-Step: Form 8594 Instructions For Filling Out the Document

Form 8594 must be filled out and filed by the purchaser and seller of a group of assets that make up a trade or business when there is a transfer between the two parties and the purchaser’s cost is determined by the amount paid for the assets. Careful consideration should be allocated in the form, as an increase or decrease in the purchase price must be taken into account and allocated among the different classifications of assets (Class I-VII) based on their fair market value on the purchase date utilizing the residual method as outlined in sections 1.338-6 and 1.338-7. Penalties for not filing Form 8594 correctly may apply if you cannot give reasonable cause.

Below, we present a table that will help you understand how to fill out Form 8594.

| Form 8594 | Instructions |

|---|---|

| Form 8594 must be filled out and filed by the purchaser and seller of a group of assets that make up a trade or business when there is a transfer between the two parties and the purchaser’s cost is determined by the amount paid for the assets. |

|

Do You Need to File Form 8594 Each Year?

Generally, both the purchaser and seller must file Form 8594 and attach it to their income tax returns when transferring a group of assets that makes up a trade or business. Exceptions may apply, such as if the transaction is subject to section 1031 or a partnership interest is transferred. The form should be filed by the due date of the income tax return for the year in which the sale date occurred, with any subsequent increases or decreases in the allocated amount being reported in the income tax return for the year in which the increase or decrease is taken into account. Failing to file a correct Form 8594 may result in penalties.

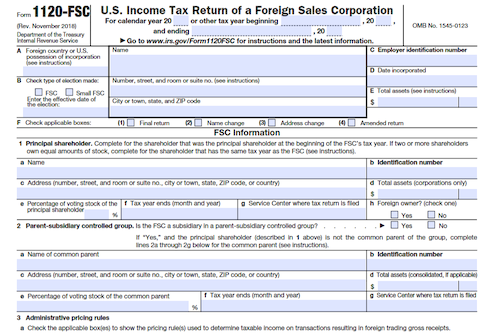

Download the official IRS Form 8594 PDF

On the official IRS website, you will find a link to download Form 8594. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 8594

Sources: