With various methods to update a mailing address with the Internal Revenue Service (IRS) such as Form 8822, your tax return, by phone, in person, or by mail, it’s important to let the IRS know when you move to ensure important paperwork and checks reach you on time.

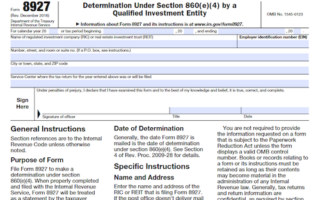

What is Form 8822?

Form 8822 is a way to update your address with the Internal Revenue Service (IRS) if you need to let them know you’ve moved. It is accessible online and can be sent by mail. To fill out the form, you will need your name, Social Security number, your old address, and your new one. You can also change your address with the IRS by providing your new address on your tax return, over the phone, in person, or with a signed statement. It is important to keep the IRS updated on your new address so that any paperwork and refund checks can be sent to the correct location.

IRS Form 8822 – Who Needs to Fill It Out?

When you move, you must inform the Internal Revenue Service (IRS) so that they can update their records and any forms or letters the IRS mails you regarding your taxes will reach you on time. There are five ways to update your address with the IRS: Form 8822, your tax return, by phone, in person and by mail. The IRS may require you to provide some identifying information, such as Social Security number, old and new address, and EIN (for businesses). If you are changing the address of another person, such as an elderly parent or relative, you must fill out Form 2848 for you to become their authorized representative. It usually takes 4-6 weeks for your address to be updated with the IRS.

Step-by-Step: Form 8822 Instructions For Filling Out the Document

Updating your address with the IRS can be done in five ways, such as through Form 8822 or through a tax return, and in three ways for updating someone else’s address with Form 2848. Ensure a smooth change by notifying the IRS of your move as soon as possible and also updating the U.S. Postal Service, as some documents or notices won’t be forwarded. Information needed includes your and your spouse’s name and Social Security numbers, prior names used, and your old and new address and, if applicable, your EIN and authorization from the representative. Once you’ve filled out the necessary forms, you should receive confirmation within four to six weeks.

Below, we present a table that will help you understand how to fill out Form 8822.

| Method | Details |

|---|---|

| Updating your address with the IRS | Can be done in five ways, such as through Form 8822 or through a tax return |

| Updating someone else’s address with Form 2848 | Can be done in three ways |

| Notification | Ensure a smooth change by notifying the IRS of your move as soon as possible and also updating the U.S. Postal Service, as some documents or notices won’t be forwarded |

| Required Information | Includes your and your spouse’s name and Social Security numbers, prior names used, and your old and new address and, if applicable, your EIN and authorization from the representative |

| Confirmation | Once you’ve filled out the necessary forms, you should receive confirmation within four to six weeks |

Do You Need to File Form 8822 Each Year?

Updating your information with the Internal Revenue Service (IRS) is important if you move. Letting them know about the change of address can be done in five different ways; Form 8822, through your tax return, by phone to a local office, in person, or by mail. Additionally, if you are an authorized representative of someone else’s taxes, you can report their address change. It is important to do this as soon as possible, so any documents or notices mailed won’t be sent to the wrong address. Doing so ensures that your refund check or any other forms get to the right place in a timely manner.

Download the official IRS Form 8822 PDF

Download the official IRS Form 8822 PDF to tell the IRS your new address. On the official IRS website, you will find a link to download Form 8822. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 8822

Sources:

https://www.irs.gov/forms-pubs/about-form-8822