Form 8830 can help businesses claim a tax credit for increasing their research activities. This form can be used to figure out this credit for the tax year and can potentially help businesses save in taxes.

What is Form 8830?

Form 8830 is used to claim the credit for increasing research activities. It is one of the forms mandated by the IRS and is used to figure the credit for increasing research activities for a given tax year. By using Form 8830, businesses and individuals can claim a credit for research expenses they may have incurred for the year. The credit is applied as a dollar for dollar reduction of their tax liability. It is an important tool which businesses and taxpayers should consider when filing their taxes.

IRS Form 8830 – Who Needs to Fill It Out?

Form 8830 is required for any individual or corporation claiming the research credit. It must be filled out and submitted for each tax year in order to calculate the amount of credit they are eligible to receive. This form requires such information as the taxpayer’s total qualified research expenses, the gross receipts, and the base-period qualified research expenses. It is important to keep in mind that the credit may not be claimed for any expenses incurred in a tax year after the one in which the form is filed.

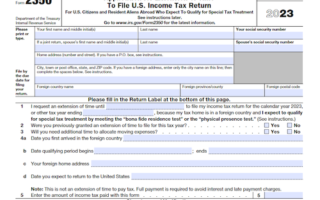

Step-by-Step: Form 8830 Instructions For Filling Out the Document

Form 8830 is an important document used to claim the IRS/Internal Revenue Service’s research credit. It is necessary to complete the form accurately in order to correctly figure the credit for the year. To use the form, you must first gather information regarding research activities performed during the tax year, such as research expenses made and wages paid to qualifying employees. Once this information is compiled, you will need to enter the information onto Form 8830, also known as the “Credit for Increasing Research Activities”. You will then use the calculations from the form to arrive at a total amount of the credit for increasing research activities for the tax year. Finally, post the total figure to your taxes and submit the form to the Internal Revenue Service. With these easy steps, you can successfully complete Form 8830.

Below, we present a table that will help you understand how to fill out Form 8830.

| Information Required for Form 8830 | Details |

|---|---|

| Research Activities | Gather information on research expenses and wages paid |

| Form Completion | Enter information onto Form 8830 |

| Calculation | Use the form’s calculations to determine the credit |

| Filing | File with your federal income tax return for the tax year |

Do You Need to File Form 8830 Each Year?

Form 8830 is required to be filed for each tax year if you are wanting to claim the credit for increasing research activities. It can be used to figure the amount of credit that you can claim and it needs to be filled out completely and accurately. This form must be filed annually if you are claiming this credit, so make sure to set aside the necessary time to fill it out each year.

Download the official IRS Form 8830 PDF

On the official IRS website, you will find a link to download Form 8830. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 8830

Sources: