Taxpayers who need more time to file a federal income tax return can use Form 4868 to get a 6-month extension – however, it does not extend the time to pay any taxes they owe.

What is Form 4868?

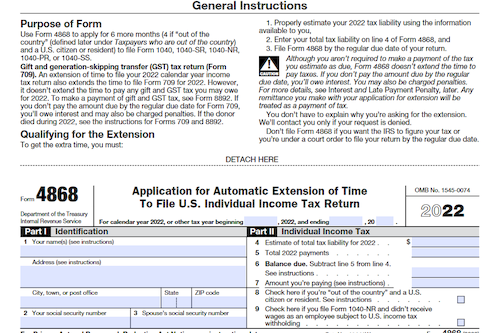

Form 4868, also known as the Application for Automatic Extension of Time to File U.S. Individual Income Tax Return, is the IRS’s official form for granting taxpayers a 6-month extension to file federal income tax returns, for any reason. It is important to note that this form grants extra time to fill out paperwork, not to pay taxes. For those wishing to obtain an extension, Form 4868 should be completed and submitted by the April tax filing deadline. By taking advantage of this form, taxpayers can avoid expensive late-filing penalties, but should remember that taxes must still be paid by the April deadline in order to avoid any additional interest or penalties.

IRS Form 4868 – Who Needs to Fill It Out?

IRS Form 4868: Who Needs to Fill It Out? Anyone who needs more time to file their federal income tax return can obtain an extension by submitting Form 4868. This form will extend the filing deadline six months to October, but keep in mind that any taxes due must still be paid by the April deadline to avoid interest and penalties. Additionally, taxpayers who live and/or work abroad may be entitled to an eight-month tax return filing extension with Form 4868. All versions of the form are available on the IRS website and can be filled out with ease. Pay attention to the instructions as it’s important to make sure to submit the form and any payments due by the original due date in April.

Step-by-Step: Form 4868 Instructions For Filling Out the Document

Form 4868 (Application for Automatic Extension of Time to File U.S. Individual Income Tax Return) is available to any taxpayer who needs extra time to file their federal tax return. Completing and submitting this form will give you an extra 6 months to file before October 15. Remember, even though you may obtain an extension for filing your tax return, the taxes you owe are still due by the April filing deadline. To fill out form 4868, you will need to provide your name, address, Social Security number, and (if applicable), your spouse’s Social Security number. Additionally, you will need to submit an estimated payment for the balance due on the form, and indicate whether you are “out of the country.” You can skip filling out the form and pay through Direct Pay, EFTPS, or by credit or debit card and indicate that payment is for an extension, if you prefer. Notable exceptions include if you live/work outside the US/Puerto Rico or are in the military, as an automatic two-month filing extension is provided.

Below, we present a table that will help you understand how to fill out Form 4868.

| Information Required for Form 4868 | Details |

|---|---|

| Name | Your full name |

| Address | Your current mailing address |

| Social Security Number | Your unique identification number |

| Spouse’s Social Security Number (if applicable) | Your spouse’s unique identification number |

| Estimated Payment | Payment of the balance due on the form |

| Out of the Country | Indicate whether you are “out of the country” |

Do You Need to File Form 4868 Each Year?

Do You Need to File Form 4868 Each Year? Form 4868 is an Internal Revenue Service (IRS) form available to any US taxpayer in need of extra time to file their federal tax return. It extends the filing deadline by six months to October 15th, as long as it is submitted by the April deadline. You must provide your name, address, social security number, estimated taxes payable for the year, and, if applicable, your spouse’s social security number. Filing an extension does not waive taxes due, which must still be paid by the April filing date; furthermore, interest and penalties may be charged if taxes are not paid by this time, even if an extension was filed. Form 4868 may also extend the deadline for your state income tax filing, depending on your state. Check the IRS website for all versions of the form and for eligibility for special disaster relief extensions.

Download the official IRS Form 4868 PDF

On the official IRS website, you will find a link to download Form 4868: Application for Automatic Extension of Time to File U.S. Individual Income Tax Return. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 4868

Sources:

https://www.irs.gov/forms-pubs/about-form-4868