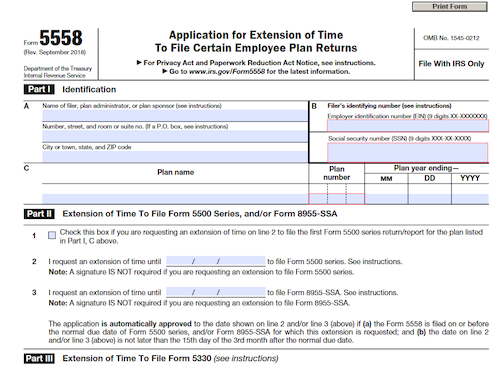

Form 5558 is an IRS form used to apply for an extension of time to file employee benefit plan returns, or Form 5500 series returns. All filed forms must include the plan’s name, address, EIN and plan number, the reason for the extension, and the signature of the plan administrator or other authorized person. All forms must be filed with the IRS office by the due date of the return.

What is Form 5558?

Form 5558 is a document used to extend the due date of filing certain employee benefit plan and Form 5500 series returns. It must be filled in and signed by the plan administrator or other authorized person, sent to the Internal Revenue Service office where the return is being filed, and include the name, address, and employer identification number of the plan, as well as the plan number (if applicable). Additionally, it should have the reason for the extension request and the signature and date of the person who signed the form.

IRS Form 5558 – Who Needs to Fill It Out?

The IRS Form 5558 must be completed and submitted by the due date of the employee benefit plan return that is being applied for an extension of time. The form must be signed by the plan administrator or other authorized person, and contain the name, address, Employer Identification Number (EIN) and plan number, if applicable. A rationale for the extension request must also be included. Once filled out, with all the necessary information specified, the form must be sent to the IRS office where the return is being filed.

Step-by-Step: Form 5558 Instructions For Filling Out the Document

Filing Form 5558 correctly is critical to getting an extension on employee benefit plan returns. To do so, the form must be completed and signed by the plan administrator or other authorized person, filed with the appropriate IRS office, and include the plan’s name, address, EIN, plan number (if applicable), the date signed, and the rationale for the extension request. All of these requirements must be satisfied on or before the due date of the return for which an extension is being requested.

Below, we present a table that will help you understand how to fill out Form 5558.

| Information Required for Form 5558 | Details |

|---|---|

| Filing Deadline | On or before the due date of the return for which an extension is being requested |

| Completeness | Complete and sign the form |

| Required Information | Plan name, address, EIN, plan number, date signed, and rationale for extension |

| Filing Location | File with the appropriate IRS office |

Do You Need to File Form 5558 Each Year?

Form 5558 needs to be filed each year in order to apply for an extension of time to file certain employee benefit plan returns and Form 5500 series returns. It must be filed with the Internal Revenue Service (IRS) office where the return is required to be filed, by the due date of the form. The form should include the name, address, and employer identification number (EIN) of the plan, the plan number (if applicable), a reason for the extension request, and the signature of the plan administrator or other authorized person, and the date the form is signed.

Download the official IRS Form 5558 PDF

On the official IRS website, you will find a link to download Form 5558. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 5558

Sources: