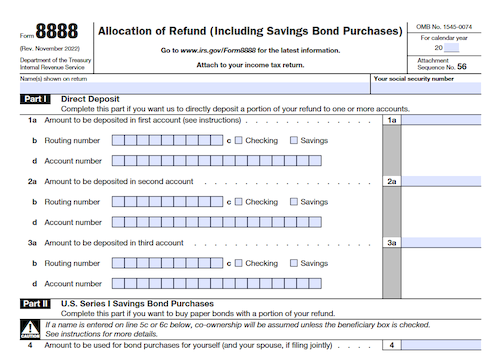

Form 8888 allows U.S. taxpayers to directly deposit their refund to two or three accounts at a bank or financial institution, or buy up to $5,000 in paper or electronic series I savings bonds with their refund.

What is Form 8888?

Form 8888 is used to request that part or all of an IRS refund be directly deposited into two or three accounts at a bank or other financial institution in the United States, or to buy up to $5,000 in paper or electronic series I savings bonds. Forms of account that can be specified include an individual retirement arrangement, health savings account, Archer MSA, Coverdell Education Savings Account, or TreasuryDirect® online account. Direct deposit is faster, more secure, and more cost-efficient than getting a check or paper savings bond.

IRS Form 8888 – Who Needs to Fill It Out?

Form 8888 is for individuals who want to request direct deposit of their tax refund to two or three accounts in the US, or to buy up to $5,000 in Series I Savings Bonds. The accounts can be checking, savings, IRAs, HSAs, Archers MSAs, Coverdell ESAs, or TreasuryDirect® accounts. Those who want to direct deposit to only one account, or buy Series I Savings Bonds without a TreasuryDirect® account, should not fill out Form 8888. Direct deposit is a fast, secure, and cost-effective alternative, and it can save taxpayers time and money.

Step-by-Step: Form 8888 Instructions For Filling Out the Document

Form 8888 provides the opportunity to directly deposit your refund into two or three accounts, or use part of your refund to buy up to $5,000 in series I savings bonds. All accounts must be in your name, and direct deposit to a single account can be requested on the tax return. It is important to note that you cannot use Form 8888 if you file as an injured spouse. Direct deposit is faster, safer, more convenient, and has the added benefit of saving tax dollars. IRA deposits are accepted, but not for SIMPLE IRA accounts. You can also use your refund to buy paper or electronic series I savings bonds via a TreasuryDirect® online account. Be sure to follow all detailed instructions depending on what type of account and savings bond you are depositing or purchasing.

Below, we present a table that will help you understand how to fill out Form 8888.

| Information Required for Form 8888 | Details |

|---|---|

| Form Purpose | Direct deposit of refunds into multiple accounts or purchase of savings bonds. |

| Required Information | Instructions for using direct deposit and purchasing savings bonds. |

Do You Need to File Form 8888 Each Year?

No, Form 8888 only needs to be filed when you want to deposit your refund (or part of it) in two or more accounts or when you want to use it to purchase up to $5,000 in series I savings bonds. You can also use the form to directly deposit your refund into an individual retirement arrangement (IRA), health savings account (HSA), Archer MSA, Coverdell education savings account (ESA), or a TreasuryDirect® online account. After filing Form 8888, you won’t need to file it again unless you make changes to your preferred method of refund delivery in the future.

Download the official IRS Form 8888 PDF

On the official IRS website, you will find a link to download Form 8888. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 8888

Sources: