Form 8947 is an IRS form which serves as a report of casualty or theft losses and any associated reimbursements claimed as an itemized deduction on one’s federal income tax return. The form records information such as the date and type of loss, the amount claimed, and any insurance or other payments received in relation to the loss.

What is Form 8947?

Form 8947 is an Internal Revenue Service (IRS) document used to report casualty or theft losses that are claimed as an itemized deduction on a taxpayer’s federal income tax return. The form must be used to report the date, type, and amount of the loss, and also any reimbursements or other payments received. It is necessary to provide all required information in order for the IRS to accurately assess the taxpayer’s deductions.

IRS Form 8947 – Who Needs to Fill It Out?

Form 8947 needs to be filled out by individuals who wish to claim casualty or theft losses as an itemized deduction on their federal income tax returns. The IRS form asks for information including the amount of the loss, date of the loss, type of property involved, and any reimbursements or other payments received for the loss.

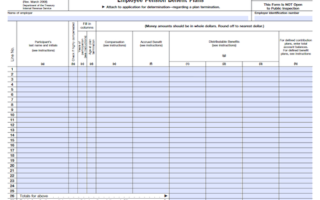

Step-by-Step: Form 8947 Instructions For Filling Out the Document

Filling out Form 8947 requires some important information about the taxpayer’s casualty or theft loss deduction. It requires reporting the amount of the loss, the date it occurred, the type of property lost and any reimbursements or payments received for the loss. Additionally, reports must be made of any insurance or other reimbursements received for the loss and any casualty or theft losses claimed as an itemized deduction on the taxpayer’s federal income tax return. It may appear a bit overwhelming, but completing Form 8947 should be done step-by-step and with the pertinent information at the ready.

Below, we present a table that will help you understand how to fill out Form 8947.

| Information Required for Form 8947 | Details |

|---|---|

| Loss Amount | Report the amount of the loss |

| Date of Loss | Provide the date the loss occurred |

| Type of Property Lost | Specify the type of property lost |

| Reimbursements/Payments | Report any reimbursements or payments received for the loss |

| Insurance Reimbursements | Include any insurance or other reimbursements received for the loss |

| Casualty/Theft Loss Deductions | Report any casualty or theft losses claimed as deductions |

Do You Need to File Form 8947 Each Year?

Form 8947 is used each year to report any casualty or theft losses that taxpayers claim as an itemized deduction on their federal income taxes. Taxpayers are also required to provide the amount of the loss, the date of the loss, and the type of property that was lost. Furthermore, the form is used to report any reimbursements, insurance payments, or other payments that were received for the loss. Consequently, all relevant information must be reported correctly and accurately to the Internal Revenue Service (IRS) each year.

Download the official IRS Form 8947 PDF

On the official IRS website, you will find a link to download Form 8947. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 8947

Sources: