Understanding the intricacies of IRS forms can be daunting, especially when it comes to declaring specific types of income like interest and dividends. This comprehensive guide delves into IRS Form 1040 Schedule B, providing detailed insights and actionable advice to ensure accurate and hassle-free reporting of your interest and dividend income. Whether you’re a seasoned taxpayer or new to the process, this article is an invaluable resource for navigating the complexities of Schedule B, making your tax preparation less stressful and more efficient.

What is Schedule B?

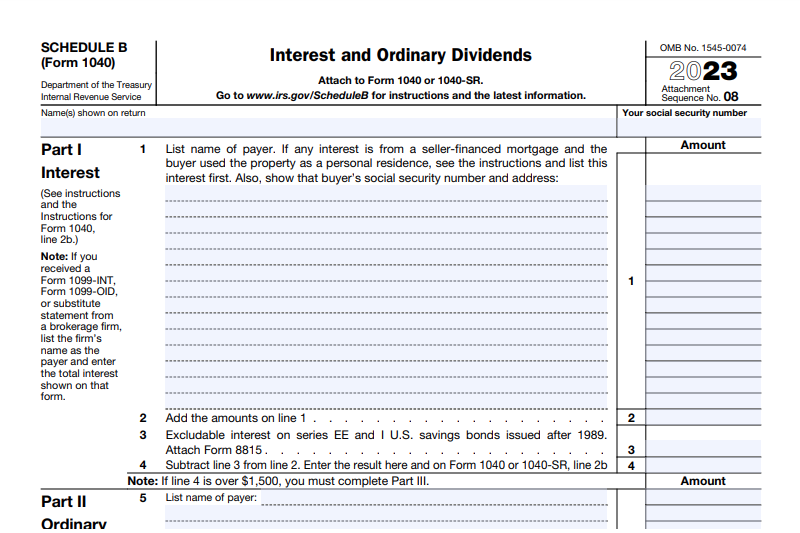

IRS Form 1040 Schedule B, a part of the individual tax return process, is designed for reporting interest and ordinary dividends received during a tax year. It’s integral to your personal income tax return, especially if you receive a form 1099-INT or earn dividends subject to federal tax. Schedule B’s role extends beyond mere form-filling; it’s a crucial component of your tax return that reflects your overall tax liability.

Understanding this form’s purpose is not just about fulfilling a requirement; it’s about ensuring compliance with IRS regulations. In the intricate web of tax season, Schedule B stands out as a specific tool for declaring certain types of income, directly impacting your income tax due on interest. It’s not just a form, but a testament to the complexity and necessity of detailed financial reporting, ensuring that taxpayers pay tax on those amounts rightfully owed to the government. This detailed approach underscores the importance of accurate tax reporting and its role in maintaining the integrity of the individual income tax system.

Who Needs to File Schedule B?

Understanding who must file Schedule B is a critical aspect of tax season. Not every individual tax return requires a Schedule B; it’s contingent on specific financial thresholds related to interest and dividend income. Taxpayers need to file Schedule B if their combined interest and dividend income surpass a certain limit, necessitating the attachment of Schedule B every year to their 1040 tax return.

This requirement highlights the IRS’s method of categorizing taxpayers based on their income types and amounts. It’s a selective process, ensuring that only those who meet certain criteria need to engage with this additional paperwork. The necessity of Schedule B is emblematic of a larger principle in tax law: the tailored approach to different income levels and sources. Filing a Schedule B is not just a bureaucratic step; it’s a reflection of the nuanced nature of tax law, which aims to appropriately tax individuals based on their specific financial situations. This system reinforces the principle of equitable taxation, ensuring that those with certain types of income contribute their fair share to the public coffers.

Understanding Ordinary Dividends and Interest Income

Ordinary dividends and interest income, the bedrock of Schedule B, are vital to comprehend for accurate tax filing. These income types, typically reported on Schedule B, encompass various financial gains subject to taxation. Ordinary dividends, often stemming from stock investments, are payments made to shareholders from a corporation’s profits. Interest income, on the other hand, can arise from various sources like savings accounts or bonds. Both these income types are crucial elements of a taxpayer’s financial portfolio and have distinct implications for their tax liabilities.

Understanding these income categories goes beyond mere identification; it involves grasping their role in the broader context of your financial health and tax obligations. Reporting them on Schedule B is not just a procedural requirement; it’s a reflection of your financial interactions over the tax year. This understanding is key to ensuring that taxpayers accurately report their income and pay the appropriate amount of tax, thus adhering to the principles of fiscal responsibility and transparency. This clarity in income types underscores the importance of informed financial decision-making and its impact on tax obligations.

How to Fill Out Schedule B: A Step-by-Step Guide

Filling out Schedule B, an essential component of the IRS Form 1040, can often seem daunting due to its intricate details and the importance of accuracy in tax filing. This guide aims to demystify the process, providing a clear, step-by-step approach to completing Schedule B. First, it’s crucial to understand that Schedule B is used for reporting interest and ordinary dividends, and it’s a crucial component of your tax return. It’s particularly relevant if you receive a Form 1099-INT or 1099-DIV, which report interest or dividend income respectively.

| Step | Description |

|---|---|

| Understanding Schedule B | Schedule B is used for reporting interest and ordinary dividends as part of IRS Form 1040. It’s necessary if you receive Form 1099-INT or 1099-DIV. |

| Gather Documentation | Collect all your Form 1099s which report interest (1099-INT) and dividend (1099-DIV) income. |

| List Sources | In Part I or Part II of Schedule B, list each source of interest or dividends. |

| Report Accurately | Accurately report the amount of interest or ordinary dividends, as these affect your tax liability. |

| Filing Requirement | File Schedule B with your tax return if your total interest and dividend income exceeds certain thresholds. |

| Foreign Accounts | Disclose any accounts in foreign banks and file additional forms like FinCEN Form 114 if applicable. |

| Follow Instructions | Refer to the instructions for Schedule B for guidance on reporting interest and dividend income. |

| Importance of Accuracy | Ensure accurate and complete filings to avoid penalties; careful completion of Schedule B is crucial. |

To begin, gather all your Form 1099s and list each source of interest or dividends in Part I or Part II of Schedule B. It’s important to accurately report the amount of interest or ordinary dividends, as these figures directly affect your tax liability. If your total interest and dividend income exceeds certain thresholds, you’re required to file Schedule B with your tax return. The form also asks if you have accounts in foreign banks, requiring additional forms like the FinCEN Form 114 if applicable. Pay close attention to the instructions for Schedule B, as they provide valuable guidance on how to report interest and dividend income and help ensure compliance with IRS regulations. Remember, inaccurate or incomplete filings can result in penalties, making careful completion of Schedule B a crucial component of your individual tax return.

The Importance of Form 1099-INT and 1099-DIV in Schedule B Reporting

The Forms 1099-INT and 1099-DIV are integral to accurate tax preparation, especially when filling out Schedule B for your individual tax return. These forms report the amount of interest and dividends you earned during the tax year, and are essential for correctly reporting your income tax. When you receive interest income from a bank or financial institution, you should receive a Form 1099-INT. This form will detail the total interest you earned, which is necessary for completing Schedule B.

Similarly, Form 1099-DIV is received when you earn dividend income, and it reports the total dividends during the tax year, including both qualified and ordinary dividends. It’s important to use these forms to report interest and dividend income accurately on Schedule B. This is not just about reporting income; it’s also about ensuring that you’re paying the correct amount of tax on those amounts. If you receive these forms, you need to file Schedule B with your tax return, attaching a copy of Schedule B to it. The IRS uses this information to verify the accuracy of your reported income and calculate your overall tax liability. Failing to report this income correctly can lead to penalties and interest on any unpaid tax due.

Navigating Taxable Interest: What Counts and What Doesn’t

Understanding what constitutes taxable interest is key to accurately completing Schedule B of your tax return. Not all interest income is subject to federal income tax, and it’s important to discern the differences to ensure correct reporting. Taxable interest includes interest from bank accounts, CDs, and bonds, which is typically reported on Form 1099-INT. This is the interest income you need to report on Schedule B. However, certain types of interest may be tax-exempt, such as interest from certain municipal bonds.

This non-taxable interest should be reported directly on your Form 1040, but it doesn’t need to be included on Schedule B. It’s crucial to report the correct amount of taxable interest on Schedule B to ensure accurate calculation of your income tax due. Misreporting can lead to either overpaying or underpaying your taxes, both of which have significant consequences. For taxpayers uncertain about what counts as taxable interest, consulting IRS regulations or a tax professional is advisable. This ensures compliance and accuracy in your tax filings, ultimately contributing to a correct assessment of your tax liability.

Reporting Foreign Bank Accounts on Schedule B

Schedule B is not only for reporting interest and ordinary dividends but also plays a crucial role in disclosing foreign bank accounts. If you have interest in or signature authority over foreign bank accounts, you may need to report this information on Schedule B, particularly if the total value of those accounts exceeds certain thresholds. This requirement is in line with U.S. tax laws aimed at preventing tax evasion through offshore accounts. To report foreign accounts, you’ll also need to complete additional forms like FinCEN Form 114 (Report of Foreign Bank and Financial Accounts, or FBAR) and possibly IRS Form 8938 (Statement of Specified Foreign Financial Assets), depending on your situation.

Reporting these accounts is a crucial component of your tax return and ensures compliance with IRS regulations. Failing to disclose foreign bank accounts can result in severe penalties, making it important to understand when and how to report them. Taxpayers with foreign accounts should consider seeking guidance from a tax professional to navigate these requirements correctly. This is particularly important if you are required to file Schedule B every year due to foreign interests, as the rules can be complex and the stakes high.

Qualified Dividends vs. Ordinary Dividends: The Tax Implications

Understanding the distinction between qualified dividends and ordinary dividends is a crucial aspect of tax preparation, especially when completing Schedule B. Qualified dividends are taxed at the lower capital gains rates, whereas ordinary dividends are taxed at the higher ordinary income tax rates. This distinction significantly impacts your overall tax liability. When reporting dividends on Schedule B, it’s important to differentiate between these two types of dividends. Qualified dividends are typically reported on Form 1099-DIV in a separate box from ordinary dividends.

When completing Schedule B, ensure that you correctly classify and report each type of dividend, as this affects the tax calculation on your income tax return. Misclassifying dividends can result in either overpaying or underpaying your taxes. Taxpayers who are unsure about how to report dividends on Schedule B or the nature of their dividends should consult with a tax professional or refer to IRS Form 1040 instructions for clarity. Correct reporting is essential for compliance and avoiding potential issues with the IRS.

Common Mistakes to Avoid When Filing Schedule B

Filing Schedule B requires attention to detail, and even experienced taxpayers can make mistakes. Common errors include:

- Failing to report all sources of interest or dividends,

- Misreporting the amount of interest or dividends,

- Not disclosing foreign bank accounts when required,

- Incorrectly classifying dividends as ordinary or qualified, which can significantly impact your tax liability.

To avoid these errors, double-check all entries against your Form 1099-INT and 1099-DIV and ensure that the total interest and dividend income reported matches these forms. Additionally, be mindful of the IRS regulations concerning foreign accounts and accurately report any foreign interest or signature authority. It’s also important to understand when you are required to file Schedule B—generally, if your total interest and dividend income exceeds a certain threshold, or if you have foreign accounts. Paying close attention to these details can help ensure a smoother tax filing experience and prevent potential issues with the IRS.

Using Tax Software and Professional Help for Schedule B

For many individuals, completing Schedule B and other tax forms can be overwhelming. Fortunately, there are resources available to simplify the process. Tax software has become increasingly sophisticated, offering step-by-step guidance and error-checking features to ensure accurate completion of Schedule B and other parts of your tax return. These programs can automatically import information from your Form 1099-INT and 1099-DIV, reducing the likelihood of errors.

Additionally, tax professionals offer invaluable assistance, especially for more complex tax situations such as those involving foreign accounts or a mix of ordinary and qualified dividends. Consulting with a tax professional can provide peace of mind and ensure that your tax return complies with IRS regulations. Whether you choose to use tax software or seek professional help, it’s important to select a method that aligns with your individual tax situation and comfort level with tax preparation. This can help minimize errors, reduce stress during tax season, and potentially save you money by avoiding costly mistakes.

Key Takeaways to Complete Schedule B IRS Tax Form

- Understand the Role of Schedule B: It’s used for reporting interest and ordinary dividends.

- Know Who Must File: Not everyone needs to file Schedule B; it depends on the amount of your interest and dividend income.

- Distinguish Between Interest and Dividend Types: Recognize the difference between taxable and non-taxable interest, and between ordinary and qualified dividends.

- Accuracy is Key: Ensure correct and complete filling of Schedule B to avoid common errors and potential penalties.

- Seek Help When Needed: Utilize tax software or professional assistance to navigate the complexities of Schedule B and ensure compliance.

Navigating IRS Form 1040 Schedule B doesn’t have to be a daunting task. With this guide, you’re equipped to accurately report your interest and dividend income, making your tax filing process smoother and more efficient.