For Puerto Rican employers, the Social Security Administration (SSA) provides guidance on reporting employee wages, as well as some COVID-19-related tax relief. Learn more about form submission details, Additional Medicare Tax, and SSA’s Business Services Online (BSO) services.

What is Form W-3 PR?

Forms 499R-2/W-2PR and W-3PR are used to report and collect wage information for the tax year and calculate payroll taxes. These documents are managed by the Social Security Administration (SSA), which takes into account COVID-19-related tax relief when calculating taxes. Contractors are also required to consider the Additional Medicare Tax, which is 0.9% of wages or compensation exceeding $200,000. This information is submitted to the SSA through their Business Services Online (BSO), which has been improved to facilitate the registration and completion of Forms 499R-2/W-2PR.

IRS Form W-3 PR – Who Needs to Fill It Out?

Entities responsible for Form 499R-2/W-2PR must consider some special aspects when dealing with the IRS. Payments related to COVID-19 and other tax relief measures may create discrepancies in form reconciliations, and certain publications need to be consulted. The deadline for filing Form 499R-2/W-2PR with the Social Security Administration is January 31, 2024. The SSA will reject reports if Medicare or Social Security contribution wages and tips are inconsistent. Additional Medicare Tax must be withheld if wages exceed $200,000 per year. SSA’s BSO has improved its website for easier access to these documents. Entities need to understand these details to meet IRS requirements.

Step-by-Step: Form W-3 PR Instructions For Filling Out the Document

Read important information for correctly completing Forms 499R-2/W-2PR and W-3PR, along with Forms 941-PR, 943-PR, 944(SP), and Schedule H-PR (Form 1040-PR), including information about COVID-19-related tax credits. The filing deadline is January 31, 2024. Reports may be denied under various circumstances, and the SSA will notify you if a report is denied. Businesses can take advantage of the benefits of the Business Services Online (BSO) page to register, process, verify, and store wage files. Don’t forget to review the Federal Tax Guide for Puerto Rican Employers and the Additional Medicare Tax. The SSA provides forms, instructions, and specific guidance to help you save time with electronic filing.

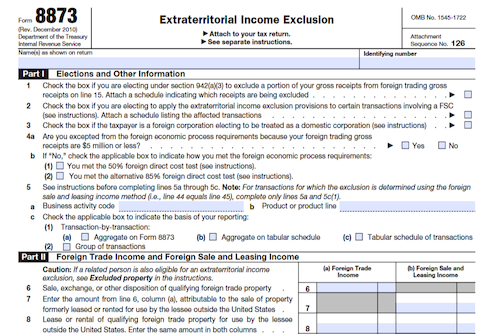

Below, we present a table that will help you understand how to fill out Form W-3 PR.

| Form Name | Information Required | Details |

|---|---|---|

| Form W-3 PR | Instructions for Form W-3 PR | Instructions for completing Form W-3 PR, including information on filing requirements, deadlines, and the use of online services for businesses. |

Do You Need to File Form W-3 PR Each Year?

It is important for employers to file Forms 499R-2/W-2PR and W-3PR, Forms 941-PR, 943-PR, 944(SP), and Schedule H-PR (Form 1040-PR) each year, typically by January 31. If notified by email or mail of discrepancies in the mentioned reconciliations, employers should attempt to correct and resubmit the report to the SSA. Additionally, employers must withhold a 1.45% Medicare contribution and, if paying wages or compensation exceeding $200,000 to an employee, also withhold an additional 0.9% for the Additional Medicare Tax. There are various online tools to assist employers in filing wage reports with the SSA, including Business Services Online (BSO).

Download the official IRS Form W-3 PR PDF

On the official IRS website, you will find a link to download Form W-3PR. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form W-3 PR

Sources: