Employers and employees must be aware of certain rules and regulations governing the filing and distribution of Form W-2c. This article explains the requirements for the format and content of the official IRS form and its substitutes as outlined in Pub. 1223, as well as the prohibition of advertising on the Form W-2c.

What is Form W-2C?

Form W-2c is an important document used to report corrections to wages and taxes. It is commonly furnished to employees or used in filing with the Social Security Administration. While the official IRS form must be used to comply with regulations, employers can use substitute forms that adhere to the standards outlined in the Revenue Procedure 1223. These documents must not contain any advertising, and any coupons for tax preparation services must not be attached to the employee copy. This information can be found in further detail in the Publication 1223.

IRS Form W-2C – Who Needs to Fill It Out?

The IRS Form W-2c needs to be filled out by employers or businesses to provide employee’s corrected wage and tax information to both the employee and the Social Security Administration (SSA). IRS Pub. 1223 contains the rules for formatting and content of substitute forms and forbids attaching coupons providing discounts on tax preparation services to employee copies. All substitute forms must conform to the requirements laid out in Pub. 1223.

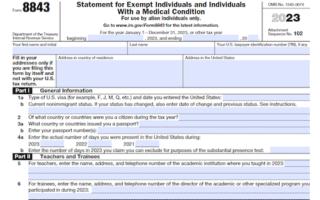

Step-by-Step: Form W-2C Instructions For Filling Out the Document

Form W-2c can be filled out using the official IRS form or an acceptable substitute form that complies with the rules in Pub. 1223. Doing so will ensure that the substitute form contains the correct format and content. Additionally, Pub. 1223 prohibits advertising on Form W-2c so it should not be present on any of the employee copies. More information can be found in the Pub. 1223 document.

Below, we present a table that will help you understand how to fill out Form W-2C.

| Form W-2c Information | Details |

|---|---|

| How to Fill Out | Use official IRS form or an acceptable substitute complying with Pub. 1223 |

| Format and Content | Ensure correct format and content for the substitute form |

| Advertising | Prohibited on Form W-2c, including employee copies |

| Additional Information | More details can be found in Pub. 1223 document |

Do You Need to File Form W-2C Each Year?

Yes, employers need to file Form W-2c each year to report corrections to their employees’ wages and withheld federal taxes. The Internal Revenue Service (IRS) provides an official form for this purpose, though employers may use a substitute form that complies with the rules in Pub. 1223. This revenue procedure outlines format and content requirements for substitute forms W-2c and W-3c, as well as prohibiting advertising on any copy of the form. Employers should make sure their substitute forms adhere to the guidelines set out in the publication.

Download the official IRS Form W-2C PDF

On the official IRS website, you will find a link to download Form W-2C. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form W-2C

Sources: