The Form 990 is a detailed financial document mandated by the U.S. Internal Revenue Service (IRS) for tax-exempt organizations. It’s the public’s window into an organization’s finances, providing transparency of its operations.

What is Form 990?

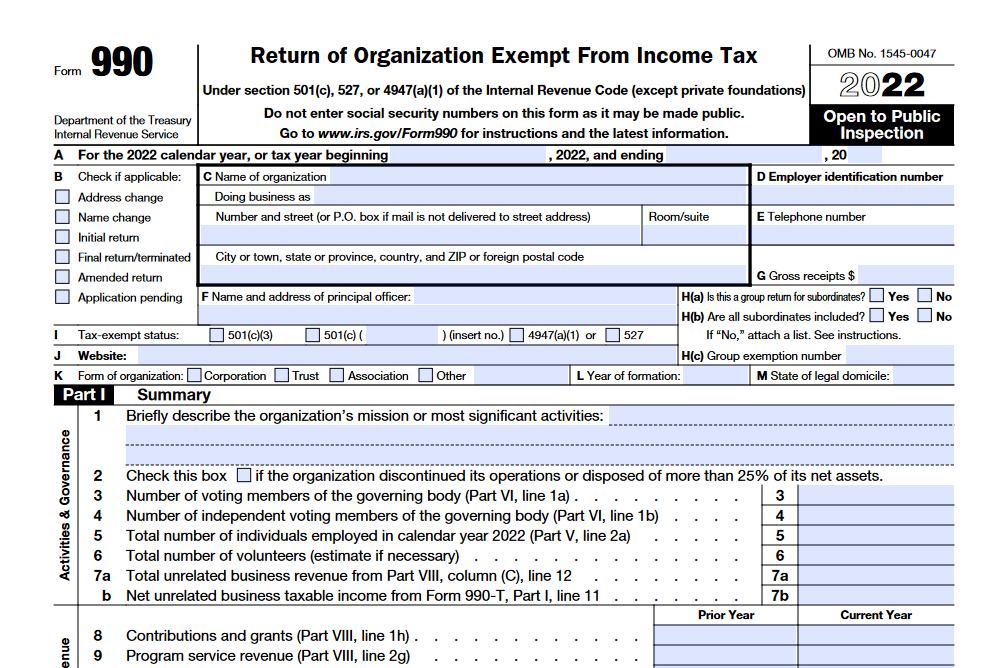

Form 990: Return of Organization Exempt From Income Tax is an annual reporting form used by certain tax-exempt organizations. It is required by the Internal Revenue Service (IRS) to report activities and the organization’s status under Section 501(c), Section 527, and Section 4947(a) of the Internal Revenue Code (IRC). Unlike income tax returns which are private, Form 990 is open to public inspection and includes 12 sections, each requiring extensive information from the organization. Form 990-EZ: Short Form Return of Organization Exempt from Income Tax is a simplified version of Form 990 for organizations with gross receipts of less than $200,000 and total assets of less than $500,000. It’s important for organizations to take filing Form 990 seriously, as it may be subject to more scrutiny from the IRS and donors may base their gifting decisions on it.

IRS Form 990 – Who Needs to Fill it Out?

Organizations that are exempt from paying federal income tax and have a tax-exempt status as classified by the IRS in the tax categories outlined in Section 501(c), Section 527, and Section 4947(a) of the Internal Revenue Code (IRC) must use Form 990: Return of Organization Exempt From Income Tax for their annual reporting. This form is open to public inspection and requires an extensive amount of information from the tax-exempt organization. Failure to file on time can lead to penalty. Form 990-EZ, a simplified version of Form 990, may be eligible for certain organizations with certain requirements. Tax professionals with knowledge in tax law are often needed to help prepare the form.

Step-by-Step: Form 990 Instructions for Filling Out the Document

Form 990, the Return of Organization Exempt From Income Tax, is a detailed yearly report required by the Internal Revenue Service for certain tax-exempt organizations. The required information specified in this form includes the organization’s mission, number of employees, revenue, expenses, and other income obtained. An organization that uses Form 990 must file the form, even without filing a Form 1023 for exemption status, and those that may qualify for a shorter version, Form 990-EZ, should use that if possible. All of the information necessary for completing the form, including accompanying schedules A-O and R, can be found on the IRS website, and a tax professional may need to be consulted for assistance. In addition, the completed form is open for public inspection, and may inform donors’ decisions, so it is important to provide accurate and thorough information.

Below, we present a table that will help you understand how to fill out Form 990.

| Information Category | Details |

|---|---|

| Form Name | Form 990 |

| Purpose | Annual report required by the IRS for tax-exempt organizations |

| Required Information | – Organization’s mission – Number of employees – Revenue – Expenses – Other income obtained |

| Exemption Status | Some organizations must file even without Form 1023 for exemption status |

| Alternative Form (if applicable) | Form 990-EZ for organizations that qualify |

| Information Sources | IRS website for form and accompanying schedules A-O and R |

| Professional Assistance | Tax professional consultation may be needed for completion |

| Public Inspection | Completed form is open for public inspection |

| Impact on Donors | Donors may use the information to inform their decisions, emphasizing the need for accuracy and thoroughness |

Do You Need to File Form 990 Each Year?

Some tax-exempt organizations must file Form 990: Return of Organization Exempt From Income Tax with the Internal Revenue Service (IRS) annually. These organizations are typically limited to those classified by the IRS as charitable organizations, political organizations, or nonexempt charitable trusts, and are federal income tax-exempt under 501(c), 527, or 4947(a) of the Internal Revenue Code (IRC). Though private foundations are also tax-exempt, they must file Form 990-PF instead. Organizations may also be eligible to file Form 990-EZ – an alternative, but simplified version of the form – if they have gross receipts of less than $200,000 and total assets of less than $500,000 at the end of the tax year. Failure to file on time could result in large penalties and the form is open to public inspection.

Download the official IRS Form 990 PDF

On the official IRS website, you will find a link to download Form 990: Return of Organization Exempt From Income Tax. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click the link to download the PDF: Form 990

Sources:

https://www.irs.gov/forms-pubs/about-form-990

https://www.irs.gov/instructions/i990