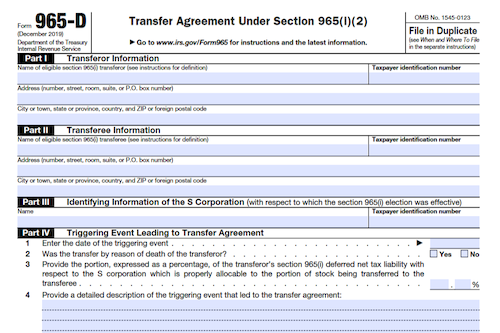

Form 965-D establishes the information and representations necessary to enter into a transfer agreement under section 965(i)(2) of the IRS when an S corporation’s shareholder has a section 965(i) net tax liability and transfers stock during a covered triggering event.

What is Form 965-D?

Form 965-D is a form filed by both an eligible section 965(i) transferor and transferee in order to enter into a transfer agreement under section 965(i)(2) in order to meet the requirements for the eligible section 965(i) transferee exception. Eligible transferors and transferees must file the form within 30 days of a covered triggering event, such as the transfer of any share of stock of an S corporation by a shareholder, a death of a transferor, or multiple partial transfers. If the form contains a material misrepresentation or omission or if the Commissioner requests additional information, the form may be rejected or the triggering event may be deemed to have occurred on the date of misrepresentation.

IRS Form 965-D – Who Needs to Fill It Out?

IRS Form 965-D should be filled out by both an eligible section 965(i) transferor and an eligible section 965(i) transferee to enter into a transfer agreement under section 965(i)(2). This form should be filed within 30 days of the covered triggering event, which is defined as the transfer of any S corporation stock (including by death or otherwise) that results in a change of ownership for federal income tax purposes. If an eligible section 965(i) transferor and eligible section 965(i) transferee properly complete and file the form, they will be considered to have properly entered into the transfer agreement. However, additional questions or information may be asked/required by the Commissioner.

Step-by-Step: Form 965-D Instructions For Filling Out the Document

Form 965-D should be completed and filed by an eligible section 965(i) transferor and an eligible section 965(i) transferee with respect to a covered triggering event within 30 days of the event (except in the case of death). This form provides information and representations needed to enter into a transfer agreement under section 965(i)(2). The Commissioner may review the transfer agreement and request additional information, so it is important to provide accurate information. A copy of the eligible section 965(i) transferor’s most recent Form 965-A must also be included with Form 965-D. In the case of death of the eligible section 965(i), the transfer agreement must generally be filed by the unextended due date for the eligible section 965(i) transferor’s final income tax return. Separate transfer agreements must be filed for each partial transfer treated as a covered triggering event.

Below, we present a table that will help you understand how to fill out Form 965-D.

| Information for Form 965-D | Details |

|---|---|

| Form Filing Requirement | Completed and filed by eligible section 965(i) transferor and transferee |

| Filing Deadline | Within 30 days of a covered triggering event (except in the case of death) |

| Purpose of Form | Provide information for a transfer agreement under section 965(i)(2) |

| Commissioner Review | The Commissioner may review the transfer agreement and request additional information |

| Additional Requirement | Include a copy of the eligible section 965(i) transferor’s most recent Form 965-A |

| Death of Transferor | File by the unextended due date for the transferor’s final income tax return in the case of death |

| Multiple Partial Transfers | Separate transfer agreements must be filed for each partial transfer treated as a covered triggering event |

Do You Need to File Form 965-D Each Year?

Form 965-D must be completed and filed by the eligible section 965(i) transferor and the eligible section 965(i) transferee with respect to a covered triggering event, which is the transfer of any share of stock of a S corporation (including by death or otherwise) by a shareholder that results in a change of ownership for federal income tax purposes. In the event of the death of the eligible section 965(i) transferor, special rules will apply, including a due date of the transfer agreement by the unextended due date for the tax return and an inclusion of an additional transfer agreement to be filed when the identity of the beneficiary or beneficiaries is not determined by that date. Both the eligible section 965(i) transferor and the eligible section 965(i) transferee must attach two copies of form 965-D to their tax returns, due by their respective due dates.

Download the official IRS Form 965-D PDF

On the official IRS website, you will find a link to download Form 965-D. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 965-D

Sources: