Are you thinking of purchasing an electric vehicle in 2022? If so, you may be eligible for a tax credit! The Internal Revenue Service (IRS) offers tax credits up to $7,500 for owners and manufacturers of certain plug-in electric drive motor vehicles, including passenger vehicles, light trucks, and two-wheeled vehicles. You must file Form 8936 with your income taxes to claim the tax credit. To qualify for the credit, your modified adjusted gross income and the cost of the vehicle must be within certain limits. Starting in 2023, qualified used vehicles can qualify for a smaller tax credit. Be aware: Tax laws are subject to change, so make sure to check the IRS website for updates.

What is Form 8936?

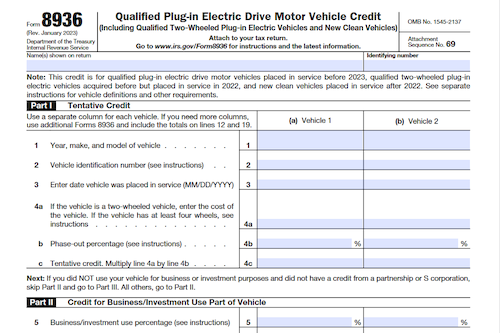

Form 8936 is an IRS form used to claim the Qualified Plug-in Electric Drive Motor Vehicle Credit when filing an individual’s tax return. Through this credit, taxpayers may receive a tax break for purchasing an eligible new or, starting in 2023, used electric vehicle. The credit may range anywhere from $2,500 to $7,500, depending on the size of the electric battery, and must be claimed in the year when the new vehicle is placed in service. Various eligibility requirements exist, such as price limitations and income limits, and the credit is only available until the manufacturer sells its 200,000th qualified vehicle (for four-wheeled electric plug-in vehicles). This credit is nonrefundable and can only be claimed once.

IRS Form 8936 – Who Needs to Fill It Out?

The IRS offers the Qualified Plug-in Electric Drive Motor Vehicle Credit to eligible taxpayers who own vehicles that qualify. The tax credit varies from $2,500 to $7,500 and/or $2,500 for 2-wheeled vehicles up to $4,000 for used qualifying vehicles, depending on the capacity of the electric battery. To qualify, the vehicle must meet certain criteria, the purchase must be made in the same year that the tax credit is claimed, and the modified adjusted gross income and the cost of the vehicle must be below certain limits. The credit is nonrefundable and not available for used electric vehicles purchased before January 1, 2023.

Step-by-Step: Form 8936 Instructions For Filling Out the Document

Specific instructions on how to fill out Form 8936 to claim the Qualified Plug-in Electric Drive Motor Vehicle Credit are available on the IRS website. To qualify, your modified adjusted gross income and the cost of the vehicle must be within certain limits. When filing your taxes, you will enter the make/model of the vehicle, the date you purchased and began using it in the same year, and the credit due in the form. Taking into account the tax credit phase out for manufacturers that have sold over 200,000 qualified vehicles, the credit ranges from $2,500 to $7,500, depending on the capacity of the electric battery. Additionally, certain two- and three-wheeled vehicles may qualify for a $2,500 tax credit, and beginning in 2023, some qualified used vehicles may be eligible for a $4,000 tax credit. Be sure to check the IRS website for full details.

Below, we present a table that will help you understand how to fill out Form 8936.

| Information for Claiming Form 8936 Tax Credit | Details |

|---|---|

| Modified Adjusted Gross Income Limit | Must be within certain limits |

| Vehicle Cost Limit | Must be within certain limits |

| Make/Model of Vehicle | Enter the make and model |

| Purchase and Usage Date | Date of purchase and first use in the same year |

| Tax Credit Amount | Varies based on battery capacity and manufacturer |

| Electric Battery Capacity | Determines the tax credit amount |

| Two/Three-Wheeled Vehicles | May qualify for a $2,500 tax credit |

| Qualified Used Vehicles (from 2023) | May be eligible for a $4,000 tax credit |

| IRS Website | Check for full details and instructions |

Do You Need to File Form 8936 Each Year?

Do You Need to File Form 8936: Qualified Plug-in Electric Drive Motor Vehicle Credit Each Year? Yes, you must file Form 8936 with your taxes each year to claim the electric vehicle tax credit for qualified four-wheeled plug-in vehicles and two-wheeled plug-in vehicles purchased between 2015 and the end of 2021. Your modified adjusted gross income and the cost of the vehicle must be below certain limits to qualify for the tax credit. The credit for four-wheeled vehicles ranges from $2,500 to $7,500, while two-wheeled vehicles are eligible for a 10% of the purchase price, up to $2,500, credit. Starting in 2023, used electric vehicles may be eligible for a 30% of the sale price tax credit, up to no more than $4,000. The credit is nonrefundable.

Download the official IRS Form 8936 PDF

On the official IRS website, you will find a link to download Form 8936. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 8936

Sources:

https://www.irs.gov/forms-pubs/about-form-8936

https://www.irs.gov/instructions/i8936