This article provides an overview of Form 8933 that can be used to claim the section 45Q carbon oxide sequestration credit. It outlines how to calculate the credit, applicable dollar amounts and rates, and definitions for such terms as “qualified carbon oxide” and “carbon capture equipment.”

What is Form 8933?

Form 8933 is used to claim the Section 45Q carbon oxide sequestration credit. For partnerships with valid section 761(a) elections, the partner completes and files the form, corresponding to their undivided ownership interest in the qualified facility. All other taxpayers must report the credit directly to line 1x in Part III of Form 3800. The credit is $20 per metric ton for carbon oxide captured from an industrial source and not used as a tertiary injectant, and up to $10 or $180 per metric ton depending on service date and other qualifications. Generally, secure geological storage with U.S. approval is required, and definitions for applicable electric generating unit, baseline carbon oxide production, and other terms are available in the form instructions.

IRS Form 8933 – Who Needs to Fill It Out?

IRS Form 8933 is used to claim the section 45Q carbon oxide sequestration credit. For partnerships that have made a valid section 761(a) election, the partner is required to complete and file this form – otherwise, it is to be reported directly on line 1x in Part III of Form 3800. Taxpayers other than partnerships or S corporations must follow alternative filing procedures. The credit rates vary depending on when the equipment was placed in service, with the rates for liness 1b, 2b, and 3b being adjusted annually for inflation. Eligibility for the credit requires the carbon oxide capture from an industrial source, with the dollar amounts applying to lines 4b, 5b, and 6b determined by linear interpolation between $22.66 and $50, and $12.83 and $35, respectively. After 2022, the credit rates for direct air capture facilities change to $36, $26 and $26 per metric ton respectively. Specific definitions apply for qualified carbon oxide, carbon capture equipment, industrial facility, and secure geological storage.

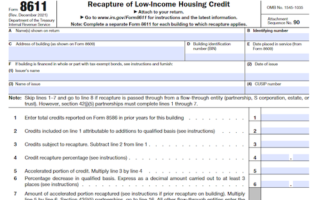

Step-by-Step: Form 8933 Instructions For Filling Out the Document

In the form 8933 youu have to claim the section 45Q carbon oxide sequestration credit. Depending on your election to use the NPRM or the TD, the credit rate for qualified carbon oxide captured ranges from $20 to $36 per metric ton depending on when the carbon capture equipment was originally placed in service. Additionally, the credit rate increases for production and utilization as eligible under sections 45Q(a)(2) and 45Q(a)(3). Secure geological storage is required and eligibility is limited to industrial and direct air capture facilities where construction begins before january 1, 2033. For more details, see section 193(b).

Below, we present a table that will help you understand how to fill out Form 8933.

| Form 8933 Information | Details |

|---|---|

| Claimed Credit | Section 45Q carbon oxide sequestration credit |

| Credit Rate | – $20 to $36 per metric ton – Depends on when equipment was placed in service |

| Credit Rate Increase | For production and utilization under sections 45Q(a)(2) and 45Q(a)(3) |

| Storage Requirement | Secure geological storage |

| Eligibility | – Limited to industrial and direct air capture facilities – Construction must begin before January 1, 2033 |

| Reference | See section 193(b) for more details |

Do You Need to File Form 8933 Each Year?

If you are claiming the Section 45Q Carbon Oxide Sequestration Credit via Form 8933, you will need to file the form each year. This credit covers carbon dioxide captured from an industrial source using carbon capture equipment placed in service before February 9, 2018, or capturing carbon dioxide directly from the atmosphere, and disposed of by the taxpayer in secure geological storage. Its dollar amounts can be found in Notices 2018-93 and 2022-38, and vary depending on the date the equipment was placed in service, the purposes for which it is used, and the amount of carbon oxide captured. Partnerships with valid Section 761(a) elections aren’t required to complete or file this form, while recipients of the credit from S corporations and other entities are to report it directly on Form 3800.

Download the official IRS Form 8933 PDF

On the official IRS website, you will find a link to download Form 8933. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 8933

Sources: