Have you been considering changing the tax status of your Limited Liability Company (LLC) to a corporation or an S corporation? Learn the process of filing IRS Form 8832 or 2553 to have your LLC taxed as a C corporation or an S corporation.

What is Form 8832?

An LLC can choose to be taxed as a sole proprietor, partnership, C Corporation, or an S Corporation. Changing the tax status requires the filing of IRS Form 8832 (for C Corporation) or Form 2553 (for S Corporation). The form(s) includes a consent statement which all LLC members must consent to, and must provide the name and identification numbers of all members. A single-member LLC does not require filing of either form, but can elect for either C or S corporate status if desired. In the case of an S Corporation, the election must be made no more than two months and 15 days after the beginning of the tax year. There are potential benefits to be had from electing either C or S corporation status, and tax professionals should be consulted for more information.

IRS Form 8832 – Who Needs to Fill It Out?

To elect to have an LLC taxed as a C corporation or S corporation, an owner must file IRS Form 8832 or Form 2553, respectively. Many owners of LLCs may see the potential benefits of being taxed as an S insorporation or a C corporation, however, the legal status of the LLC will not change. The process of changing the tax status of an LLC to a corporation or S corporation is called an election and must be done within the IRS time frames. Single-member LLCs can choose to be taxed as a disregarded entity, or can elect corporation or S-corporation status via the required forms. Knowing the details and timing of the form filings is critical, as it can have a major effect on income taxes and other financial components.

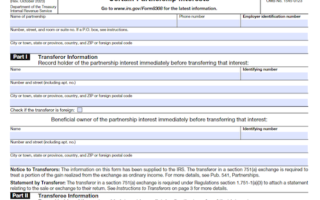

Step-by-Step: Form 8832 Instructions For Filling Out the Document

Filing IRS Form 8832 or 2553 is the process for an LLC to change its tax status and elect to be taxed as either a corporation or an S corporation. To make an election to be taxed as a C corporation, fill out and submit Form 8832. Single-member LLCs should check either Box C or F in Part I, Box 6. For an S corporation election, complete and file Form 2553 with the IRS – the LLC must make this election no more than two months and 15 days after the beginning of the tax year when the election is to go into effect. All the members must consent to this election and provide their name(s) and identifying number(s). These forms will guide you through the decisions and questions you must answer to complete the filing.

Below, we present a table that will help you understand how to fill out Form 8832.

| Form to Fill Out | Instructions |

|---|---|

| IRS Form 8832 | Use this form to change tax status to C corporation. |

| IRS Form 2553 | Use this form for S corporation election. |

| Single-member LLCs | Check either Box C or F in Part I, Box 6 for C corporation election. |

| S Corporation Election | Complete and file Form 2553 no more than two months and 15 days after the tax year’s start. |

| Member Consent | All members must consent and provide their names and identifying numbers. |

| Filing Assistance | These forms will guide you through the filing process. |

Do You Need to File Form 8832 Each Year?

When an LLC elects to be taxed as a corporation or an S Corporation, they must file IRS Form 8832 (Entity Classification Election) or IRS 2553 (Election by Small Business Corporation), respectively. An LLC with only one owner (a single-member LLC) can be classified as a disregarded entity and does not need to be taxed as a separate entity. For an LLC to elect S Corporation status, they must meet certain eligibility requirements and must file IRS Form 2553 no more than two months and 15 days after the beginning of the tax year when the election is to take effect. Form 2553 includes details about the LLC’s shareholders and must have consent from all members to establish the election. To take advantage of the benefits of electing to be an S Corporation, such as avoiding double taxation, research the filing process carefully and consult your financial advisor or tax professional.

Download the official IRS Form 8832 PDF

On the official IRS website, you will find a link to download Form 8832 – Election by a Small Business Corporation. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 8832

Sources:

https://www.irs.gov/forms-pubs/about-form-8832