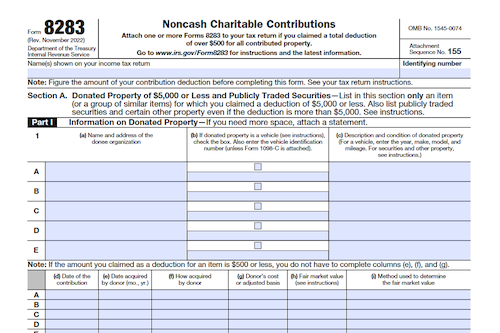

Counting on the IRS to help minimize taxes for charitable giving? Filing IRS Form 8283 can help individuals, corporations, and partnerships take advantage of tax deductions for noncash donations—but make sure you meet the criteria for these deductions and have the right documents before filing. Learn more in this article about who should file Form 8283, how to do so, and more.

What is Form 8283?

IRS Form 8283 is an official form from the Internal Revenue Service (IRS) designed for individuals, corporations, and partnerships to report their noncash charitable contributions during a given tax year. Filing this form can reap benefits like tax deductions that minimize the amount paid to the IRS and maximize the amount of money kept in one’s pocket. To be eligible for deductions and for filing Form 8283, donations must meet certain criteria: must be noncash, made to an IRS-accepted charity, collectively valued over $500, and have proper documentation and appraisals. Those who are unsure of the fair market value of their donations may find help from organizations like Goodwill. Filing Form 8283 is an important step in claiming tax deductions to reduce taxable income and overall taxes paid.

IRS Form 8283 – Who Needs to Fill It Out?

IRS Form 8283 is used to report your noncash charitable contributions to the IRS, and filing it may allow you to claim a tax deduction. To be eligible, your donation must meet certain criteria, such as being gifted to an accepted IRS charity, not being a cash, check, credit, debit donation, and individually being worth more than $500. Additionally, the value of your donation must be fair market value, which you can determine with the help of a tax professional. If you meet the criteria and decide to fill out Form 8283, taxation filing instructions are available on the IRS website. Don’t forget that filing Form 8283 is due along with your tax return, with a filing deadline of May 17th this year.

Step-by-Step: Form 8283 Instructions For Filling Out the Document

In order to claim the tax deductions available for qualified noncash charitable donations, individuals, corporations, and partnerships must file Form 8283. This form should be filed after determining which donations are eligible, what their fair market value is, and other important information about the donation. In order to file Form 8283, Step 1 is to download the form from the IRS website and Step 2 is to fill out Section A, B or both in accordance with the total donation value. In addition to this, the donating party should include the date of contribution, a description of the donation and other relevant information. Once you have completed the form, depending on the size of your donation you may need to attach an appraisal and acknowledge receipt with an official of the charitable organization. Finally, the tax return with Form 8283 should be filed no later than May 17th of the given tax year.

Below, we present a table that will help you understand how to fill out Form 8283.

| Information Required for Form 8283 | Details |

|---|---|

| Form Download | Download Form 8283 from IRS website |

| Section A | Fill out if the total donation value is $5,000 or less |

| Section B | Fill out if the total donation value is over $5,000 |

| Date of Contribution | Date when the donation was made |

| Description of Donation | Details about the donated items or property |

| Appraisal Attachment | If required, attach an appraisal of the donation |

| Acknowledge Receipt | Receipt acknowledgment by the charitable organization |

| Filing Deadline | File Form 8283 by May 17th of the given tax year |

Do You Need to File Form 8283 Each Year?

Individuals, corporations, and partnerships are required to file Form 8283 if they made qualified noncash donations to IRS-approved charities during a tax year that are worth over $500. This form allows taxpayers to receive tax deductions on acceptable donations and minimize the amount they pay in taxes. Depending on the type of taxpayer and value of the donation, you may be required to fill out only Section A or both Section A and B. Filing Form 8283 helps you capitalize on the opportunity to save money at tax time, and it must be included with your tax return before the 2021 deadline of May 17.

Download the official IRS Form 8283 PDF

On the official IRS website, you will find a link to download IRS Form 8283: Noncash Charitable Contributions. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 8283

Sources:

https://www.irs.gov/forms-pubs/about-form-8283

https://www.irs.gov/instructions/i8283