For those with a surviving spouse who is not a US citizen, Form 706-QDT is used to figure and report the estate tax due on QDOT distributions, remaining the value of the property in the trust, and certain annuity payments. This article covers who must file, when to file, how to pay the tax, and other related details.

What is Form 706-QDT?

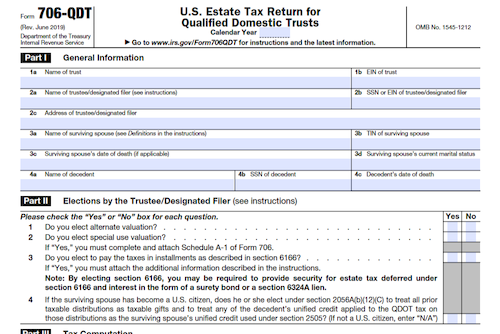

Form 706-QDT is a tax form used by the trustee or designated filer of a qualified domestic trust (QDOT) to figure and report the estate tax due on specific distributions, the value of property remaining in the QDOT, and the corpus portion of certain annuity payments. Under certain circumstances, the trustee/designated filer uses Form 706-QDT to notify the IRS that the trust is exempt from future filing. The QDOT rules apply to those situations where a decedent’s surviving spouse is not a U.S. citizen. This form must be filed annually, either by the trustee who is liable for filing the return and paying the tax, or by a designated filer selected by the executor of the estate. Certain documents, such as a copy of the trust instrument and a death certificate, must be attached to the form. Penalties may be imposed for late filing and payment, willful attempts to evade payment, underpayment due to valuation understatements, and preparing a return with an understatement of tax liability.

IRS Form 706-QDT – Who Needs to Fill It Out?

IRS Form 706-QDT is to be filled out by either the trustee or designated filer of a qualified domestic trust (QDOT), depending on the circumstances of the surviving spouse. This form is to be used in order to calculate the taxes due on any distributions from the QDOT, the value of property left in the QDOT upon the surviving spouse’s death, and the corpus portion of certain annuity payments. In certain cases, this form can also be used to notify the IRS of the trust exempt from future filing if the surviving spouse is a U.S. citizen and meets the requirements listed. Checks should be made out to “United States Treasury” and must include the SSN or IIT of the surviving spouse and “Form 706-QDT”. Returns must generally be filed on or after January 1 and no later than April 15 with extensions available for up to 6 months, however should the surviving spouse have died during the filing year then the tax liability is due within 9 months of the date of death.

Step-by-Step: Form 706-QDT Instructions For Filling Out the Document

Filing Form 706-QDT is a necessary step for a trustee or designated filer of a qualified domestic trust (QDOT) to figure and report the estate tax due. Depending on the assets of the trust, this may involve filing a bond or letter of credit to accompany the form. Anyone filing the form may also need to include supplemental documents such as death certificates or copies of the trust instrument. Penalties for inaccuracy orLate filing/payment may be imposed. All signatures on the return must be verified, and paid preparers must provide written proof of mailing the return and include their valid PTIN if filing on behalf of the trustee/designated filer. The return should be filed either at the Department of the Treasury at the Internal Revenue Service Center or the Internal Revenue Submission Processing Center using a private delivery service, depending on the circumstances.

Below, we present a table that will help you understand how to fill out Form 706-QDT.

| Form Name | Form 706-QDT |

|---|---|

| Purpose | File to figure and report the estate tax due for a qualified domestic trust (QDOT). |

| Filing Requirements | May involve filing a bond or letter of credit. Include supplemental documents such as death certificates or trust instrument copies. |

| Additional Information | Verify all signatures, provide proof of mailing, and include valid PTIN for paid preparers. File at the appropriate IRS center using private delivery service. |

Do You Need to File Form 706-QDT Each Year?

Form 706-QDT is an annual return used by trustees or designated filers of a qualified domestic trust (QDOT) to figure and report the estate tax. The return is due on or after January 1, but not later than April 15 of the year following any calendar year in which a taxable event occurred or a distribution was made on account of hardship with the exception of when the surviving spouse died during the year, in which case the trust must be filed within 9 months. Extensions of time to file can be obtained using Form 4768. Penalties are imposed for both late filing and late payment, unless there is reasonable cause for the delay. Trustees must verify the return and may authorize someone else to act on their behalf using Form 2848. When filing, remember to attach copies of the trust instrument and death certificate (if filing due to death).

Download the official IRS Form 706-QDT PDF

On the official IRS website, you will find a link to download Form 706-QDT. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 706-QDT

Sources: