Form 1099-MISC is used to report miscellaneous compensation such as rent, royalties, prizes, awards, healthcare payments, and payments to an attorney to both the Internal Revenue Service (IRS) and the payees. In 2020, the IRS introduced Form 1099-NEC for nonemployee compensation, which is tracked separately in the 1099 series.

What is Form 1099-MISC?

Form 1099-MISC is used by businesses to report payments of $10 or more in royalties or $600 or more in other listed incomes, such as rents, prizes and awards, healthcare payments, and payments to attorneys. Those who make these payments must complete and file a Form 1099-MISC with the IRS, along with sending a copy to the recipient. The form must be sent to the recipient by February 1 and to the IRS by March 1 (or March 31 if filing electronically). The adjustments made to the 2020 tax year included introducing a new form, Form 1099-NEC, for nonemployee compensation that was previously reported in Box 7 of Form 1099-MISC. Recipients must report payments found on the 1099-MISC on their tax returns.

IRS Form 1099-MISC – Who Needs to Fill It Out?

Form 1099-MISC must be filled out by business payers if they paid out at least $10 in royalties or broker payments in lieu of dividends or tax-exempt interest to another person, or at least $600 for certain rent payments, prizes, and awards, healthcare payments, and payments to an attorney. The payer must then send the form to the recipient by Feb. 1 and file it with the IRS by March 1 (March 31 if filing electronically). The payee must then report the income shown on the form to the IRS when filing their taxes, as well as filing the form with their state tax department. The change for the 2020 tax year is that nonemployee compensation is now reported on Form 1099-NEC, instead of Form 1099-MISC.

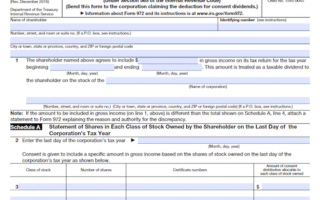

Step-by-Step: Form 1099-MISC Instructions For Filling Out the Document

Form 1099-MISC is required to be filled out by anyone who has paid out at least $10 in royalties or broker payments in lieu of dividends or tax-exempt interest, as well as anyone who has paid at least $600 in the categories of rents, prizes and awards, other income payments, medical and healthcare payments, cash payments for fish purchased, cash paid from a notional principal contract to an individual, partnership or estate, payments to an attorney, and fishing boat proceeds. It is to be sent to the recipient by Feb 1 and filed with the IRS by March 1 (March 31 if electronically). The form can be found on the IRS website in fillable form and certain information such as the payer’s and recipient’s name, address, and tax identification number are to be included. Once the form is completed, it must be sent to the recipient and filed with the IRS, with copies retained by the payer for record keeping. Starting with the 2020 tax year, nonemployee compensation is reported on Form 1099-NEC, rather than Form 1099-MISC.

Below, we present a table that will help you understand how to fill out Form 1099-MISC.

| Information Required for Form 1099-MISC | Details |

|---|---|

| Royalties or Broker Payments | At least $10 in payments |

| Rents | At least $600 in payments |

| Prizes and Awards | At least $600 in payments |

| Other Income Payments | At least $600 in payments |

| Medical and Healthcare Payments | At least $600 in payments |

| Cash Payments for Fish Purchased | At least $600 in payments |

| Cash Paid from Notional Principal Contract | At least $600 in payments to an individual, partnership, or estate |

| Payments to an Attorney | At least $600 in payments |

| Fishing Boat Proceeds | At least $600 in payments |

| Filing Deadline for Recipient | February 1 |

| Filing Deadline with IRS (Paper) | March 1 |

| Filing Deadline with IRS (Electronic) | March 31 |

| Form Location | Available on the IRS website in a fillable form |

| Required Information | Payer’s and recipient’s name, address, and tax identification number |

| Form Change | Starting with the 2020 tax year, nonemployee compensation is reported on Form 1099-NEC |

Do You Need to File Form 1099-MISC Each Year?

Form 1099-MISC is required to be sent each year to any recipient that a business has paid at least $10 in royalties or broker payments in lieu of dividends or tax-exempt interest to, or at least $600 in rent, prizes, and awards, as well as other listed income payments. It must be sent to the recipient by Feb. 1 and filed with the IRS by March 1 (March 31 if filing electronically). Recipients are then responsible for attaching a copy of the form when they file their tax returns. The new Form 1099-NEC is used to report nonemployee compensation, such as independent contractors, freelancers, sole proprietors, and self-employed individuals.

Download the official IRS Form 1099-MISC PDF

On the official IRS website, you will find a link to download Form 1099-MISC: Miscellaneous Income. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 1099-MISC

Sources:

https://www.irs.gov/forms-pubs/about-form-1099-misc

https://www.irs.gov/instructions/i1099mec