Form 1099-A is a federal tax form that lenders file with the IRS to report properties transferred due to foreclosure. The form provides details of the sale, including fair market value, and is used to calculate capital gains and report debt cancellation.

What is Form 1099-A?

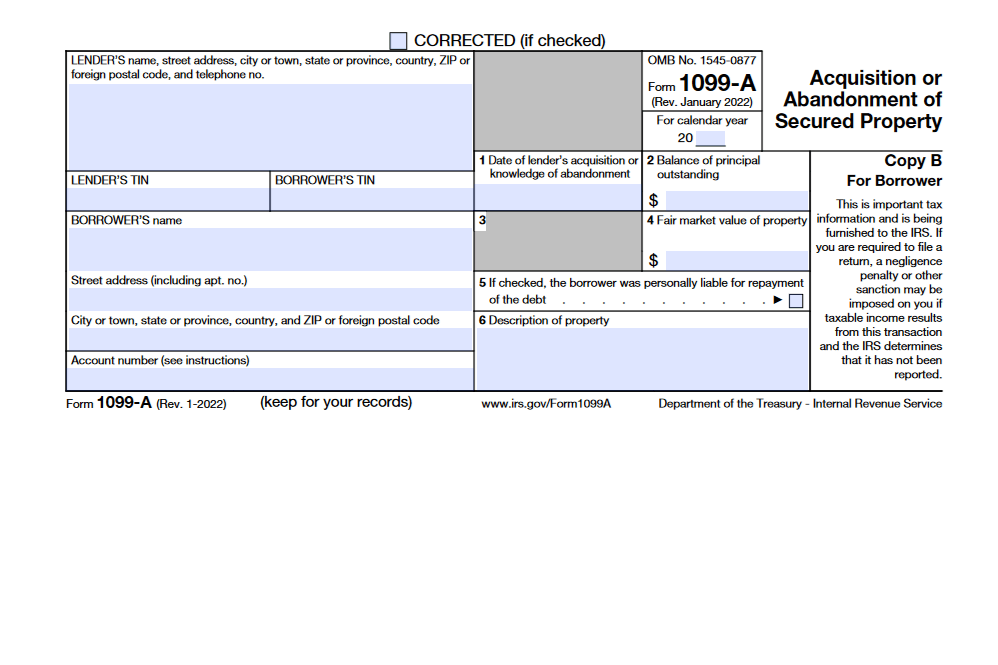

Form 1099-A is a federal tax form that is used by lenders to report properties transferred due to foreclosure. Issuers must include the date of transfer and the property’s fair market value (FMV). Who can file Form 1099-A? It is applicable to all lenders, such as banks and other financial institutions, who must submit a copy of the form in the year after the calendar year someone acquires an interest in the property. It includes debt-liability information and the description of the property. Generally, taxpayers must report this information on Schedule D of their tax return. Taxpayers may also receive Form 1099-C if the foreclosure includes cancellation of debt. The form can help them calculate any capital gains or losses for taxation. It must be downloaded from the IRS website and sent on January 31 each year.

IRS Form 1099-A – Who Needs to Fill It Out?

Form 1099-A is used by lenders to report properties taken through foreclosure or abandoned. The IRS requires lenders to provide taxpayers with the form by the end of January, which contains details about the sale, such as the date of transfer and the property’s fair market value. Taxpayers must enter the information from Form 1099-A on Schedule D of their tax return in order to calculate any capital gains or losses from the foreclosure. The information on the form may also help them determine whether they are due Form 1099-C, Cancellation of Debt. In order to determine a gain or loss from a foreclosure, taxpayers need to add their purchase price plus the cost of any improvements to the property, then subtract any allowable depreciation and casualty and theft losses.

Step-by-Step: Form 1099-A Instructions For Filling Out the Document

Filling out Form 1099-A requires lenders to include details such as the date of transfer, fair market value of the property, and information on the borrower. This form should be sent to the borrower as well as the IRS with the left side containing information on the lender and borrower and the right side containing 6 boxes with various information. The taxpayer then inputs the information onto Schedule D of their tax return to determine any capital gains or losses. All real estate sales must be reported to the IRS, and any canceled debt must be reported on 1099-C. The gain or loss on the sale is found by subtracting the purchase price and cost of improvements from the FMV and allowable depreciation and casualty and theft losses. This helps taxpayers determine their capital gains and taxes due.

Below, we present a table that will help you understand how to fill out Form 1099-A.

| Form 1099-A Details | |

|---|---|

| Date of Transfer | Fair Market Value of Property |

| Information on the Borrower | |

| Form Components | |

| Left Side | Right Side |

| Information on Lender and Borrower | 6 Boxes with Various Information |

| Taxation | |

| Input on Schedule D of Tax Return | Determine Capital Gains or Losses |

| All Real Estate Sales Must Be Reported to IRS | Cancelled Debt on 1099-C |

| Calculate Gain/Loss: FMV – (Purchase Price + Cost of Improvements + Allowable Depreciation + Casualty and Theft Losses) | Helps Determine Capital Gains and Taxes Due |

Do You Need to File Form 1099-A Each Year?

Form 1099-A, or Acquisition or Abandonment of Secured Property, is used by lenders such as banks to report properties transferred due to foreclosure to the IRS. It is issued in the year following the calendar year in which a taxpayer acquires an interest in the property. All taxpayers who have property foreclosed or abandoned must receive a Copy B from the lender, along with Form 1099-C if the debt is canceled. This should be reported on Schedule D of Form 1040 to calculate any capital gains or losses from the foreclosure. These gains are treated the same as traditionalsales. Taxpayers should keep copies of all Forms 1099-A and 1099-C received for their records.

Download the official IRS Form 1099-A PDF

On the official IRS website, you will find a link to download What Is Form 1099-A: Acquisition or Abandonment of Secured Property? Form 1099-A: Acquisition or Abandonment of Secured Property. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 1099-A

Sources:

https://www.irs.gov/forms-pubs/about-form-1099-a

https://www.irs.gov/instructions/i1099ac