Organizations that issue specified securities must file Form 8937 with the IRS if an organizational action affects the basis of a security or class of the security. Examples include cash …

Organizations that issue specified securities must file Form 8937 with the IRS if an organizational action affects the basis of a security or class of the security. Examples include cash …

Form 5310-A must be filed by any sponsor or plan administrator of a pension, profit-sharing or deferred compensation plan if they are involved in a merger, spinoff or transfer of …

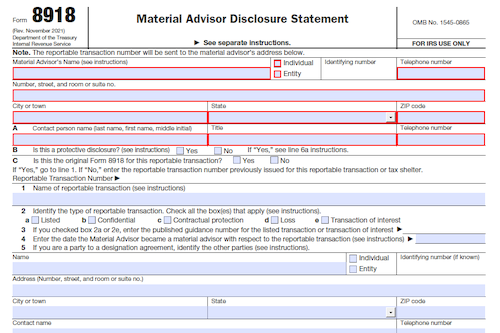

Filing Form 8918 with the IRS is now required by material advisors to any reportable transaction in order to disclose certain information related to the transaction and receive a reportable …

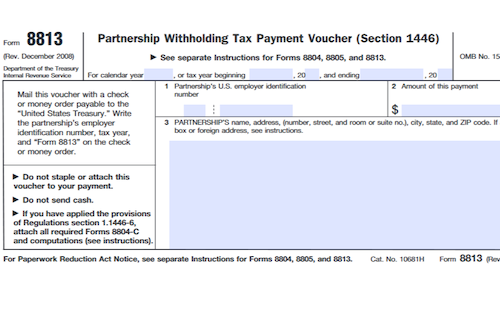

Ever wondered what forms to use to report and pay withholding tax under section 1446? This article will cover General Instructions, Purpose of Forms, Taxpayer Identification Numbers (TINs), Applying for …

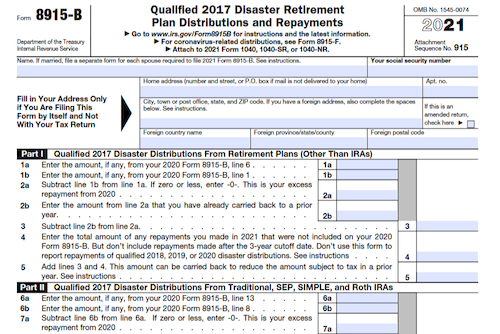

Individuals adversely affected by a 2017 disaster who received a qualifying distribution may need to file Form 8915-B to report repayments of qualified 2017 disaster distributions made in 2021. What …

With Form 8804, 8805, and 8813, partnerships must pay and report the section 1446 withholding tax based on effectively connected taxable income (ECTI) allocated to foreign partners per U.S. regulations. …

Business credits can be claimed by filing Form 3800. Partnerships, S Corporations, Estates, Trusts, and Cooperatives have special filing exceptions depending on the type of credit being claimed. All other …

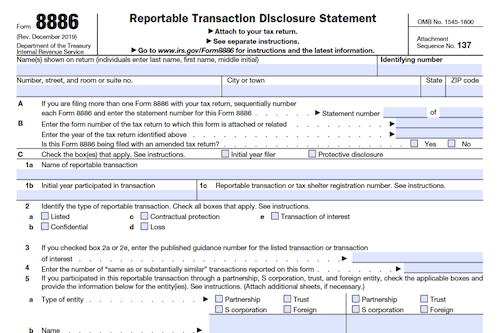

Individuals, trusts, estates, partnerships, S corporations, and other corporations that participate in reportable transactions for federal tax purposes must file Form 8886. This form helps disclose information regarding the tax …

Organizations that operate private foundations or claim private foundation status (including charitable trusts treated as private foundations) must file Form 990-PF to figure their tax based on investment income and …

Expatriates must file Form 8854 to comply with their initial and annual information reporting obligations and taxation requirements when relinquishing or terminating their U.S. citizenship or residency on or after …

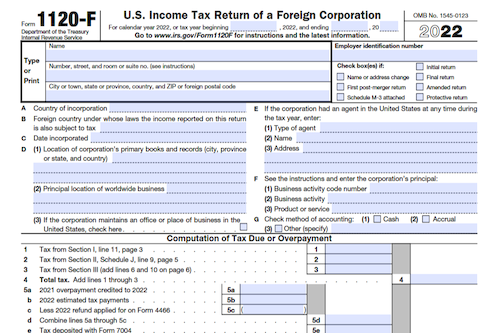

For foreign corporations conducting business in the United States, Form 1120-F must be filed to report income, deductions, credits, and figure U.S. tax liability. Unless one of the exceptions applies, …

U.S. persons filing Form 8865 must provide information about the entity’s Controlled Foreign Partnership (CFP) activities, as required under sections 6038, 6038B, and 6046A. Depending on the category of which …

Form 1120-C, U.S. Income Tax Return for Cooperative Associations, must be filed by corporations operating on a cooperative basis, allocating amounts to patrons, except for certain exempt organizations. The filing …

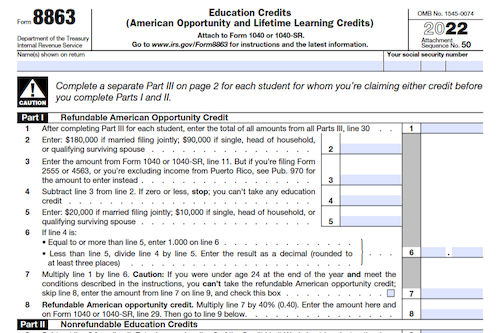

Brushing up on your taxes for 2022? It’s important to be aware of the differences between the two education credits the American opportunity credit and the lifetime learning credit. Both …

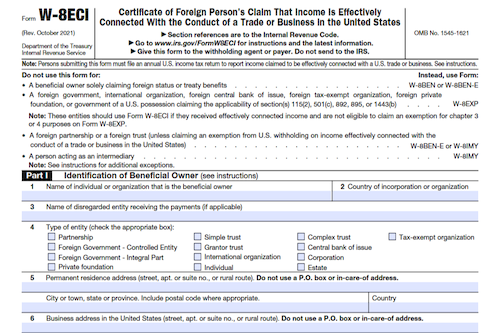

Foreign persons are generally required to provide Form W-8ECI to establish that they are not U.S. persons and to claim that their income from U.S. sources is effectively connected with …

What is Form SS-4-PR? Form SS-4PR is used to request an Employer Identification Number (EIN). The EIN is a nine-digit number assigned to sole proprietors, corporations, heirs, trusts, and other …

U.S. residents who are meeting certain qualifications can use Form 1040-NR-EZ to submit their tax return. Eligibility includes income from only wages, salaries, tips, and refunds of state and local …

Are you a partner in a TEFRA or BBA partnership, S corporation shareholder, beneficiary of an estate or trust, owner of a foreign trust, or residual interest holder in a …

For Puerto Rican employers, the Social Security Administration (SSA) provides guidance on reporting employee wages, as well as some COVID-19-related tax relief. Learn more about form submission details, Additional Medicare …

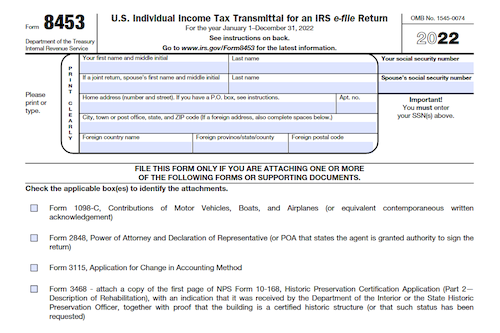

Submitting your tax return electronically can save you time, but there are times when you must also submit paper documents to the IRS. To do so, you’ll need to utilize …