For U.S. citizens and residents, filing Form 8960 is necessary if their modified adjusted gross income (MAGI) exceeds a certain threshold, in order to determine their Net Investment Income Tax …

For U.S. citizens and residents, filing Form 8960 is necessary if their modified adjusted gross income (MAGI) exceeds a certain threshold, in order to determine their Net Investment Income Tax …

Employers who operate a large food or beverage establishment must file Form 8027 to report annual receipts and tips from customers, as well as allocated tips for tipped employees. This …

Form 8938 is the form you will have to complete to report specified foreign financial assets, if you are a specified individual or a specified domestic entity. It requires you …

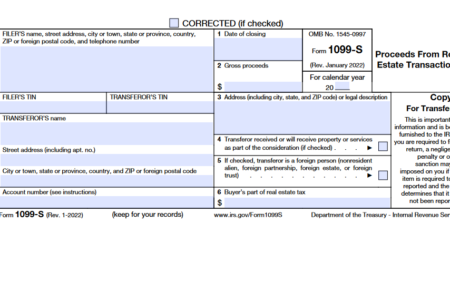

Form 8949 is used to report sales and exchanges of capital assets, and to reconcile amounts reported to the IRS on Forms 1099-B or 1099-S (or substitute statements). It is …

Enter Form 8835 to claim the renewable electricity production credit for qualified energy resources and qualified facilities eligible for the credit in the US or US territories. Recapture of the …

Form 5300 is used to request a Determination Letter from the IRS to check that a defined benefit or defined contribution plan, as well as any related trust, meets the …

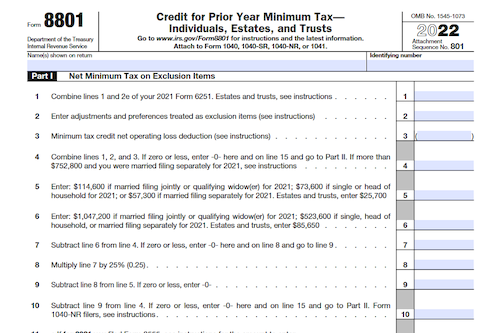

Have you paid alternative minimum tax (AMT) in a prior year? If so, make sure to calculate your minimum tax credit with IRS Form 8801, which can help you figure …

This article covers forms 8804, 8805 and 8813 which help pay and report US income tax for foreign partners based on their Effective Connected Taxable Income. It also explains how …

Use Form W-7A to apply for an IRS adoption taxpayer identification number for a child placed in your home for adoption purposes. However, this isn’t necessary if a social security …

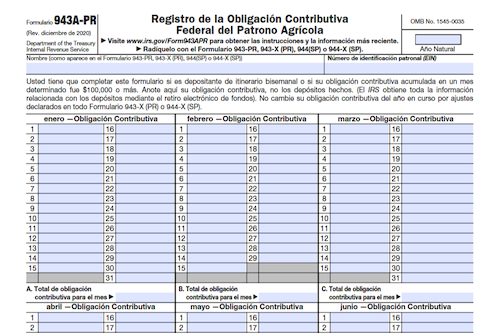

Federal tax filers in Puerto Rico must use Form 943A-PR to report their tax obligation when they are biweekly schedule depositors. This form must be included with Form 943-PR, 943-X …

As taxpayers continue to file their taxes, it is important to keep up-to-date with any changes to IRS forms like Form 3903. For the latest information related to the form …

Form 8288 is an important document used by withholding agents to report and pay over amounts withheld for certain dispositions and distributions of U.S. real property interests, transfers of partnership …

Form 8233 is an IRS form used to claim income exemption from US tax based on tax treaties with another country. To properly complete the form, one must know the …

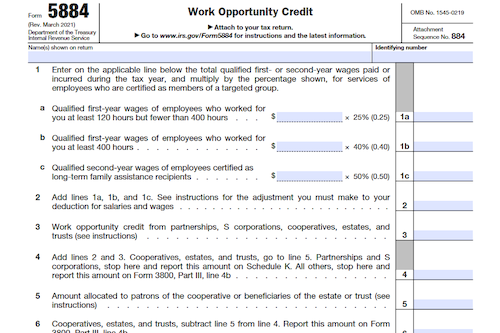

Use Form 5884 to claim the work opportunity credit for wages you paid to or incurred for targeted group employees – regardless of whether your business is located in an …

Form 5735 is a document used to calculate the American Samoa economic development credit available for use against income taxes. This credit has restrictions in place, which will be discussed …

Form 5713 is a crucial document for businesses and organizations that conduct operations in or related to boycotting countries, as well as for those who receive boycott requests and agreements. …

The 1099 form is used to report non-employment income to the IRS. Whether you’ve received interest payments from a bank account, stock dividends, freelance earnings, unemployment benefits, or other types …

Are you looking to fix mistakes on a previously filed Form 943? Use Form 943-X to adjust wages subject to social security tax, Medicare tax, and more, plus complete additional …

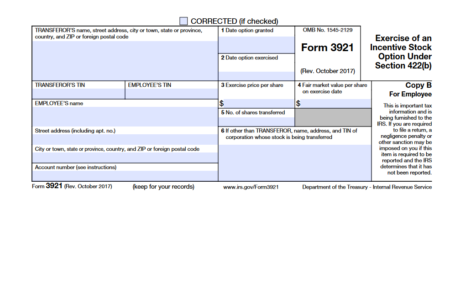

Employees granted Incentive Stock Options (ISOs) can purchase stock in their employer’s corporation at a predetermined price, called the “strike price”. To understand ISOs taxation, one must consider the date …

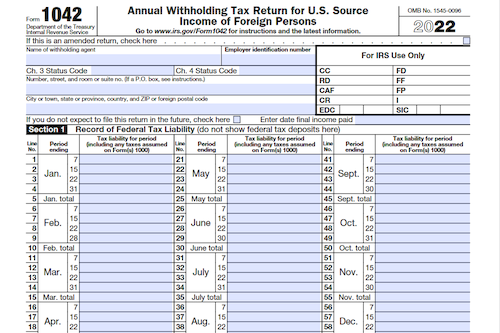

This article provides an overview of Form 1042 which is necessary to report tax withholding and payments from foreign persons, entities and trusts. Additionally, information is provided on the withholding …