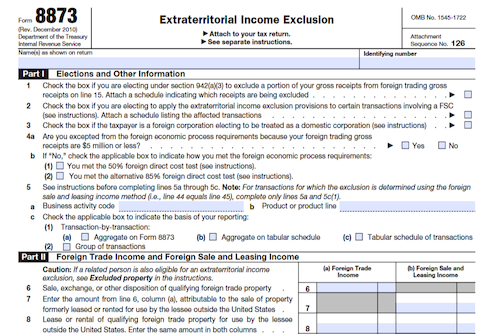

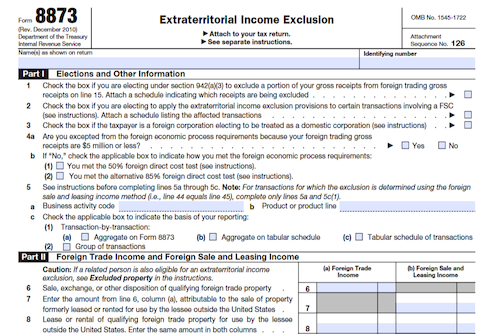

With the repeal of the American Jobs Creation Act of 2004, taxpayers may still claim an ETI exclusion for certain transactions under a binding contract before 2005. This article provides …

With the repeal of the American Jobs Creation Act of 2004, taxpayers may still claim an ETI exclusion for certain transactions under a binding contract before 2005. This article provides …

Form 8898 is used by US taxpayers to notify the IRS when they have become or stopped being a bona fide resident of a US possession according to Section 937(c). …

Learn how to correctly file Form 6251 to calculate the alternative minimum tax (AMT) liability for taxpayers with higher economic incomes. Find out the latest on exemption amounts, tax brackets, …

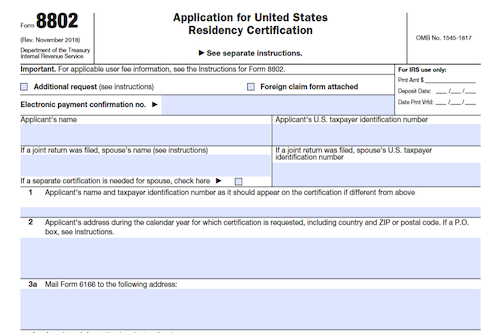

Individuals and entities looking to claim benefits under income tax treaties or VAT exemption must submit Form 8802 to the IRS to request Form 6166, a letter of U.S. residency …

This article explains the recapture tax on the mortgage subsidy for federally subsidized home buyers who have sold or otherwise disposed of their home. It outlines who must file, when …

In this article, we explore like-kind exchanges and special rules for capital gains invested in Qualified Opportunity Funds (QOFs). Discover the eligibility of certain government officials for a section 1031 …

For personal service corporations and closely held corporations, Form 8810 is used to figure the amount of passive activity loss or credit for the current tax year as well as …

Claim the Indian Employment Credit with Form 8845! Partnerships, S corporations, cooperatives, estates, and trusts must file the form to claim the credit. Wages paid must meet all the requirements …

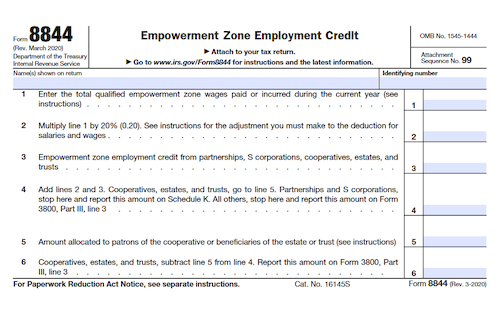

This article explores Form 8844 and how to use it to claim the empowerment zone employment credit, including instructions on who may be a qualified zone employee and what types …

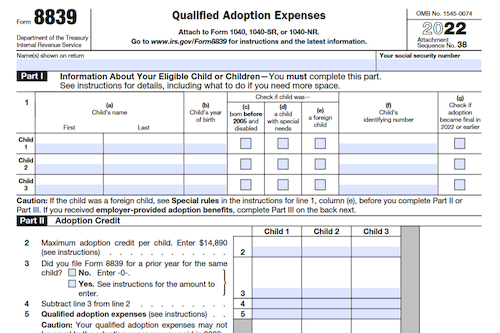

Taking an adoption credit or exclusion for employer-provided adoption benefits can help reduce your tax liability. Learn the requirements for taking an adoption credit or exclusion, as well as how …

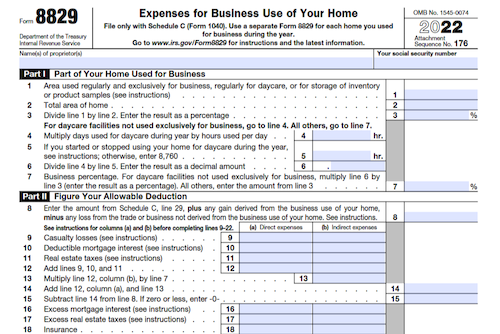

Use Form 8829 when filing your taxes to determine the full extent of the allowable expenses for business use of your home, and any carryover to the next tax year. …

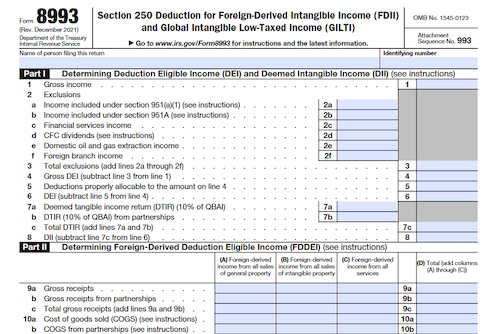

Domestic corporations and individual shareholders of controlled foreign corporations making a section 962 election must use Form 8993 to determine the deduction under section 250 of the Tax Cuts and …

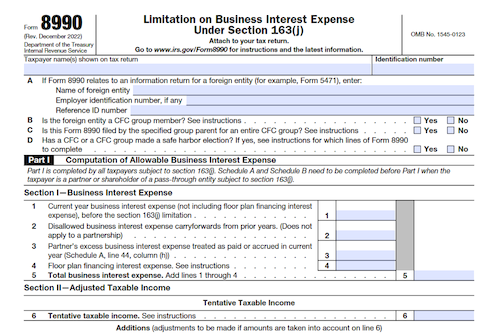

Taxpayers (individuals, partnerships, corporations, etc.) must file Form 8990 to calculate the deductible business interest expenses and carry forward any disallowed expenses to the next tax year. Exclusions from filing …

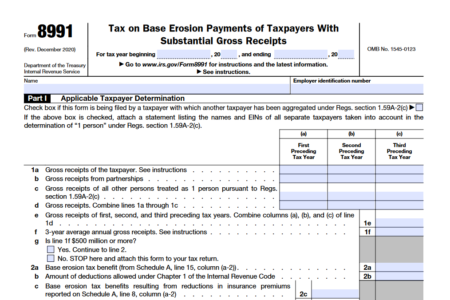

Form 8991 is used to determine an applicable taxpayer’s base erosion minimum tax amount based on their base erosion percentage, modified taxable income, and regular tax liability. Taxpayers must consider …

This article discusses the requirements for an employer to qualify for the employer credit for paid family and medical leave, including what constitutes a qualifying employee, written policy documentary requirements, …

Eligible taxpayers can now claim the Railroad Track Maintenance Credit (RTMC) for Qualified Railroad Track Maintenance Expenditures (QRTME), which have been retroactively extended to cover qualified railroad track maintenance expenditures …

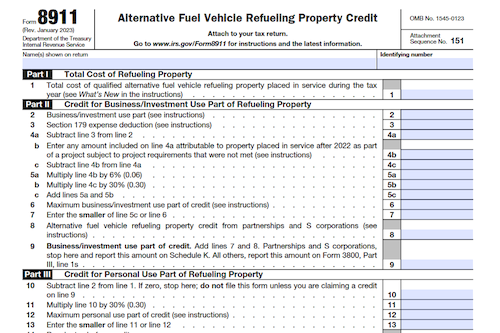

Form 8911 is used by taxpayers to claim credits for the purchase of alternative fuel vehicle refueling property, either as a general business credit or personal credit. Depending on the …

Use Form 8910 to figure your credit for alternative motor vehicles placed in service during your tax year, which is treated as either a general business or personal credit. Partnerships …

This article will discuss the Form 8941, used by eligible small employers to figure the credit for small employer health insurance premiums. It will also cover the requirements for eligibility, …

Organizations seeking a miscellaneous determination from the IRS must file Form 8940, which includes providing information about the organization’s past, present, and planned activities, and attaching documents such as a …