Executors of an estate and other persons required to file estate tax forms after July 2015 may need to complete and file Form 8971, along with attached Schedule(s) A, with the IRS to report the final estate tax value of property distributions. This article provides an overview of Form 8971 filing requirement, deadlines, and penalties for failure to comply.

What is Form 8971?

Form 8971, United States Estate (and Generation-Skipping Transfer) Tax Return, is used by executors of an estate, and other persons required to file Form 706 or 706-NA, to report the final estate tax value of property distributed from the estate if the estate tax return is filed after July 2015. It is required to be filed with the IRS and a schedule A provided to each beneficiary receiving property before the earlier of 30 days after the form is filed or due, whichever is earlier. If the return is filed late, penalties may be imposed by the IRS, and beneficiaries may be subject to additional penalties for filing based on inconsistent values.

IRS Form 8971 – Who Needs to Fill It Out?

Form 8971 and its accompanying Schedule(s) A must be completed by executors of an estate or other persons required to file Form 706 or Form 706-NA after July 2015. This form is used to report values to the IRS, as specified by the Surface Transportation and Veterans Health Care Choice Improvement Act of 2015. Beneficiaries may be subject to an accuracy-related penalty of 20%, if the value reported on their own Schedule A is inconsistent with the amount on the form. All Forms 8971 and Schedules A must be filed with the IRS within 30 days of the Form 706/706-NA being due (including extensions) or of it being filed. Penalties may be imposed for failure to file and/or provide correct information.

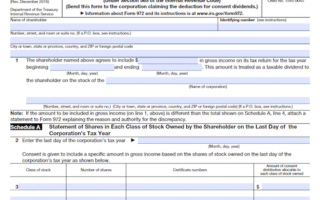

Step-by-Step: Form 8971 Instructions For Filling Out the Document

Filling out Form 8971, United States Estate (and Generation-Skipping Transfer) Tax Return, is a multi-step process for executors of an estate or any other persons required to file Form 706 or Form 706-NA. After filing the Forms 706 or 706-NA, executors should provide each beneficiary listed with a copy of that beneficiary’s own Schedule A, then file Form 8971 with attached Schedule(s) A with the IRS. The filing of Form 8971 and Schedule A is due no later than 30 days after the filing date of the initial Forms 706 or 706-NA, or within 30 days of its due date-whichever is earlier. Executors must then provide proof of mailing, proof of delivery, acknowledgement of receipt or other relevant information for the estate’s records if the Schedule A is delivered in person, by mail, or by private delivery service. If information reported on Form 8971 or Schedule(s) A differs from the final value, executors must then file a supplemental Form 8971 and affected Schedule(s) A, and provide an updated supplemental Schedule A to each affected beneficiary. They are also advised to seek penalties for failure to file or provide correct Forms 8971 and Schedules A, and furnish correct Schedules A to beneficiaries.

Below, we present a table that will help you understand how to fill out Form 8971.

| Key Information for Form 8971 | Details |

|---|---|

| Purpose | Required for executors filing Forms 706 or 706-NA for estate taxes |

| Filing Deadline | Within 30 days of filing the initial Forms 706 or 706-NA |

| Supplemental Filings | If information differs, file supplemental Form 8971 and updated Schedules A |

| Penalties | Penalties for failure to file or provide correct Forms 8971 and Schedules A |

Do You Need to File Form 8971 Each Year?

The Surface Transportation and Veterans Health Care Choice Improvement Act of 2015 requires executors of an estate and other persons who are required to file Form 706, United States Estate (and Generation-Skipping Transfer) Tax Return or Form 706-NA to file Form 8971, along with a copy of every Schedule A. Each Schedule A is provided to a single beneficiary, and that beneficiary must use the same value reported on the Schedule A as their initial basis in the property. Failure to file correct Forms 8971 and Schedules A by the due date, or to provide correct Schedules A to beneficiaries by the due date can result in costly penalties; however, exceptions can apply for reasonable cause and inconsequential errors or omissions. Penalties for inconsistent filing may also apply.

Download the official IRS Form 8971 PDF

On the official IRS website, you will find a link to download Form 8971. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 8971

Sources: