Individuals, estates, and trusts who derive two-thirds or more of their gross income from farming or fishing can use Form 2210-F to determine if they owe a penalty for underpaying their estimated tax. The IRS can waive the penalty under certain circumstances.

What is Form 2210-F?

Form 2210-F is used by individuals, estates, or trusts, who earned at least two-thirds of their 2021 or 2022 income from farming and fishing, to figure their underpayment of estimated tax. Whether or not someone needs to file Form 2210-F, or must pay the associated penalty, depends on the amount of taxes owed, if the taxes were paid by the due date (including extensions), and if any of a variety of special circumstances apply. If necessary, the IRS will figure the penalty and send out a bill. Relief from the penalty may be available for those who retired after 62, became disabled, experienced casualty or disaster, or had unusual circumstances. Documentation must be submitted to request a waiver. For federally declared disasters, the penalty may be automatically waived.

IRS Form 2210-F – Who Needs to Fill It Out?

IRS Form 2210-F must be filled out by any individual, estate, or trust whose gross income for 2021 or 2022 is at least two-thirds from farming or fishing. The form is used to see if the filer owes a penalty for underpaying their estimated tax. The penalty will be automatically calculated and applied by the IRS for those who don’t check box A or B in Part I, but can be determined and added to the return by those who do. Exceptions to the penalty, with waivers for reasonable or equitable causes, exist in certain cases.

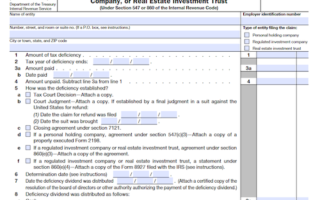

Step-by-Step: Form 2210-F Instructions For Filling Out the Document

Complete Part I of Form 2210-F to determine if you owe the underpayment penalty. Review the circumstances listed in the Exceptions and Waiver of Penalty sections to see if you qualify for a waiver. If you do not, figure the penalty yourself and attach the completed form to your return. If you are eligible for a waiver, request one by checking box A in Part I, completing Form 2210-F, adding an explanatory note and attaching any relevant documentation. If you are in a federally declared disaster area, the IRS will automatically apply the appropriate penalty relief; otherwise, you must call the IRS disaster hotline for assistance.

Below, we present a table that will help you understand how to fill out Form 2210-F.

| Information Required for Form 2210-F | Details |

|---|---|

| Complete Part I of Form 2210-F | To determine if you owe the underpayment penalty |

| Review the circumstances listed in the Exceptions and Waiver of Penalty sections | To see if you qualify for a waiver |

| Figure the penalty yourself | If you do not qualify for a waiver |

| Attach the completed form to your return | If you do not qualify for a waiver |

| Request a waiver | By checking box A in Part I and completing Form 2210-F |

| Include an explanatory note | If you are eligible for a waiver |

| Attach any relevant documentation | If you are eligible for a waiver |

| Automatic penalty relief in federally declared disaster area | The IRS will automatically apply the appropriate penalty relief |

| Call the IRS disaster hotline for assistance | If you are not in a federally declared disaster area |

Do You Need to File Form 2210-F Each Year?

Do You Need to File Form 2210-F Each Year? You may need to file Form 2210-F each year if at least two-thirds of your 2021 or 2022 gross income is from farming or fishing. If you didn’t check box A or B in Part I of Form 2210-F, you don’t need to figure the penalty or file the form, as the IRS will automatically send you a bill if you owe a penalty. If you do owe a penalty and meet any of the waiver requirements, attach Form 2210-F and a statement to your return, explaining why you were unable to meet the estimated tax requirements. In certain federally declared disaster areas, certain estimated tax payment deadlines may be postponed and the IRS may apply the waiver automatically.

Download the official IRS Form 2210-F PDF

On the official IRS website, you will find a link to download Form 2210-F. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 2210-F

Sources: