If you employ household workers or domestic help, it’s essential to understand your tax obligations. Schedule H is a tax form used by household employers to report and pay household employment taxes. In this comprehensive guide, we will delve into every aspect of Schedule H, from what it is to how to file it correctly. Whether you’re a new household employer or have been employing domestic workers for years, this article is worth reading to ensure you’re compliant with the IRS and avoid potential pitfalls.

What is Schedule H?

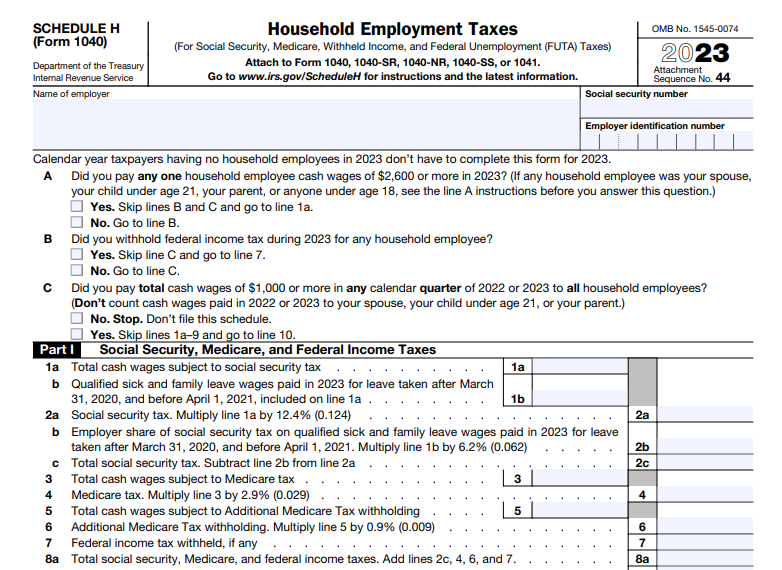

Schedule H is a tax form specifically designed for household employers to report and pay household employment taxes to the IRS. Household employment taxes include Social Security, Medicare, and federal unemployment taxes (FUTA). These taxes are required when you pay cash wages to a household employee and meet certain criteria outlined by the IRS.

Who Needs to File Schedule H?

Household employers who meet the following criteria need to file Schedule H:

- You pay cash wages of $2,300 or more to a household employee in a tax year.

- You withhold federal income tax from your employee’s wages.

- You’re not a business owner or engaged in a trade or profession as a sole proprietor.

- You’re not required to file a Schedule C (Profit or Loss from Business) or Schedule F (Profit or Loss from Farming).

How to File Schedule H

To file Schedule H, you’ll need to complete and attach it to your individual income tax return (usually Form 1040). Here are the basic steps:

- Gather information about your household employee, including their Social Security number.

- Calculate the total cash wages you paid to the employee during the tax year.

- Determine the federal income tax you withheld.

- Calculate the Social Security and Medicare taxes you owe as the employer.

- Complete Schedule H and include it with your Form 1040 when filing your taxes.

Calculating Household Employment Taxes

Calculating household employment taxes involves several steps, including:

- Determining the total cash wages paid to the household employee.

- Calculating the Social Security and Medicare taxes at the applicable rates.

- Computing the federal unemployment tax (FUTA) owed, if applicable.

Common Pitfalls and How to Avoid Them

Filing Schedule H can be complex, and there are common pitfalls to watch out for. Here are some examples and how to resolve them:

- Misclassifying Workers: Ensure you correctly classify workers as household employees, not independent contractors.

- Underreporting Cash Wages: Report all cash wages accurately, including those paid in cash.

- Failing to Withhold Taxes: If required, withhold federal income tax from your employee’s wages.

- Incorrectly Calculating Taxes: Double-check your calculations for Social Security, Medicare, and FUTA taxes.

- Missing Deadlines: File Schedule H and make tax payments on time to avoid penalties and interest.

Tax Benefits for Household Employers

While household employment taxes can be a burden, there are potential tax benefits for household employers. For example, you may be eligible for the Earned Income Credit (EIC) if you have a qualifying child living with you. Understanding these benefits can help offset some of the tax liabilities associated with household employment.

Keeping Accurate Records

Maintaining accurate records is crucial when employing household workers. Keep records of cash wages paid, tax withholdings, and employment details. This documentation will be essential for completing Schedule H accurately and for potential IRS audits.

Federal Unemployment Taxes (FUTA)

In addition to Social Security and Medicare taxes, household employers may be required to pay federal unemployment taxes (FUTA). FUTA tax helps fund unemployment benefits for workers who lose their jobs. If you meet the FUTA tax requirements, be sure to calculate and remit this tax as part of your household employment tax obligations.

State-Specific Requirements

In addition to federal requirements, it’s crucial to be aware of your state’s specific regulations when it comes to household employment taxes. Each state may have its own unique rules and guidelines, and staying compliant at the state level is essential. State unemployment insurance and tax laws can vary widely, so understanding your state’s specific requirements is paramount.

For instance, let’s consider the scenario of filing a Schedule H tax form. This is a crucial step for any household employer. When you employ a household worker, such as a nanny or plumber, you may be considered a household employer and must adhere to specific tax obligations. Filing Schedule H allows you to report household employment taxes to the IRS accurately.

When it comes to Schedule H, you need to know about it if you’ve paid a household employee cash wages of $2,300 or more in the current or previous tax year. This includes not only wages paid to a nanny or a household worker but also to other individuals who provide services at your home.

Conclusion: Key Takeaways of Household Employee Taxes

In conclusion, Schedule H is a vital tax form for household employers to fulfill their tax obligations for household employees. By understanding who needs to file, how to calculate taxes, and common pitfalls to avoid, you can navigate this process successfully. Keep accurate records, be aware of potential tax benefits, and stay informed about state-specific requirements to ensure compliance with both federal and state tax authorities.

In summary, here are the key takeaways:

- Schedule H is for reporting and paying household employment taxes to the IRS.

- Household employers meeting specific criteria must file Schedule H.

- Properly calculate and report cash wages, withholdings, and taxes to avoid common pitfalls.

- Explore potential tax benefits and keep meticulous records.

- Be aware of federal unemployment taxes and state-specific requirements.

- Filing Schedule H accurately ensures compliance with tax authorities and avoids penalties.

Understanding and correctly filing Schedule H is essential for any household employer, and this guide provides the information you need to navigate the process successfully.