When it comes to filing your federal income tax return in the United States, understanding the nuances of tax forms and deductions is essential to minimize your tax liability. One such crucial component of your tax return is Schedule A, an attachment to Form 1040, used for itemizing deductions. While many taxpayers opt for the standard deduction, there are situations where itemizing deductions can lead to significant tax savings. In this comprehensive guide, we will delve into the intricacies of Schedule A, explaining its purpose, the contrast with the standard deduction, and scenarios where itemizing is beneficial.

What is Schedule A in IRS Form 1040?

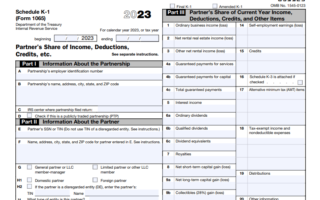

Schedule A is a supplementary tax form that serves as an attachment to IRS Form 1040, the individual income tax return form used by millions of Americans each year. Schedule A is specifically designed for taxpayers who choose to itemize their deductions instead of taking the standard deduction.

Explain Schedule A as an Attachment to Form 1040 for Itemizing Deductions

Before diving into Schedule A, it’s essential to understand the role of Form 1040 in the tax-filing process. Form 1040 is the primary tax form used by individuals to report their income and calculate their tax liability. It consists of various sections where taxpayers report their income, claim tax credits, and calculate their final tax bill.

The Standard Deduction vs. Itemized Deductions

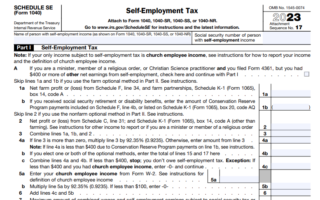

One of the fundamental decisions every taxpayer must make is whether to claim the standard deduction or itemize deductions on their Form 1040. The standard deduction is a predetermined amount that reduces your taxable income based on your filing status. It simplifies the tax-filing process but may not provide as significant a deduction as itemizing, depending on your specific financial circumstances.

Itemizing deductions, on the other hand, involves listing and totaling specific qualifying expenses you incurred throughout the tax year. These expenses can include things like medical expenses, state and local taxes, mortgage interest, charitable contributions, and casualty or theft losses. By itemizing, you may be able to deduct more than the standard deduction, potentially reducing your overall tax liability.

Who Should Itemize Deductions?

The decision to itemize deductions depends on several factors, including your eligible deductible expenses, filing status, and overall financial situation. Here are some scenarios in which itemizing deductions is likely to be beneficial:

High Deductible Expenses

If you have substantial deductible expenses that exceed the standard deduction amount for your filing status, it makes financial sense to itemize. Common high-deductible expenses include significant medical bills, substantial state and local taxes, and substantial mortgage interest.

Homeowners with Mortgage Interest

Homeowners often find itemizing advantageous, as they can deduct the interest paid on their mortgage loans. Mortgage interest can be a substantial expense, especially during the early years of homeownership when most of the monthly payment goes toward interest.

Charitable Contributions

Taxpayers who are generous donors to charitable organizations can benefit from itemizing their deductions. Charitable contributions, whether in the form of cash or donated goods, can be deducted if proper documentation is maintained.

State and Local Taxes (SALT)

Residents of states with high income or property taxes may find itemizing advantageous. State and local income taxes, property taxes, and even general sales taxes can be included in your itemized deductions.

Medical and Dental Expenses

Substantial medical and dental expenses that exceed a certain threshold may also make itemizing worthwhile. We’ll explore this in more detail in the next section.

Medical and Dental Expenses: What Can You Deduct?

List Common Deductible Medical and Dental Expenses

When itemizing deductions, one category that often warrants attention is medical and dental expenses. These expenses can add up quickly, especially if you or your family members have had significant healthcare needs during the tax year. Here are some common deductible medical and dental expenses:

Healthcare Expenses Deductions

| Expense Category | Description |

|---|---|

| Doctor’s Visits | Expenses related to visits to healthcare professionals, including doctors, dentists, and specialists, can be deducted. |

| Prescription Medications | The cost of prescription medications is deductible when not covered by insurance. |

| Hospital Bills | Expenses related to hospital stays, surgeries, and other inpatient or outpatient procedures are deductible. |

| Health Insurance Premiums | If you pay for health insurance premiums out of pocket, those premiums can be included in your itemized deductions. |

| Dental Care | Expenses for routine dental check-ups, cleanings, and more extensive dental work can be deducted. |

| Long-Term Care | Costs associated with long-term care services, such as nursing home care, may also be deductible. |

Mention Thresholds and Limits for These Deductions

It’s essential to be aware of the limitations and thresholds associated with deducting medical and dental expenses. As of the 2023 tax year, you can only deduct medical and dental expenses that exceed 7.5% of your adjusted gross income (AGI). For example, if your AGI is $50,000, you can only deduct medical and dental expenses that exceed $3,750 (7.5% of $50,000).

Understanding State and Local Taxes on Schedule A

Another critical aspect of itemizing deductions on Schedule A involves state and local taxes. These taxes can significantly impact your overall tax liability, and deducting them can help reduce your taxable income. Here are the main types of state and local taxes that are deductible:

State Income Taxes

If you live in a state that imposes an income tax, the amount you pay in state income taxes can be included in your itemized deductions.

Property Taxes

Property taxes paid on real estate you own, such as your primary residence or vacation home, are deductible.

General Sales Taxes

Taxpayers residing in states without income taxes can choose to deduct the total amount of general sales taxes paid throughout the year. This is particularly advantageous if you made substantial purchases during the year.

Discuss the Impact of SALT Deduction Cap

The Tax Cuts and Jobs Act (TCJA) implemented a significant change related to state and local tax deductions. Starting in the 2018 tax year, there is a $10,000 cap on the total deduction for state and local taxes (SALT). This cap combines both property taxes and state income taxes or sales taxes. This limitation has a more substantial impact on taxpayers in high-tax states.

Navigating Mortgage Interest Deductions

For many homeowners, one of the most substantial deductions available when itemizing is the mortgage interest deduction. However, there are specific rules and limits to consider when claiming this deduction:

Eligibility

To claim the mortgage interest deduction, you must have a qualified mortgage, which is typically a loan used to buy, build, or improve your primary or second home.

Applicable Limits

As of the 2023 tax year, you can deduct the interest on the first $750,000 of mortgage debt if you are married filing jointly or $375,000 if you are single or married filing separately. This means that if your mortgage exceeds these limits, you can only deduct the interest on the applicable amount.

Emphasize the Importance of Understanding These Rules for Homeowners

Homeowners should be diligent in understanding the rules and limits associated with the mortgage interest deduction to maximize their tax savings. Failing to adhere to these rules can result in a lower deduction or even disqualification.

Charitable Contributions: How to Deduct Your Donations

Many taxpayers are generous contributors to charitable organizations, and these contributions can be deducted when itemizing. Here are some types of charitable donations that qualify for deductions:

| Category | Description | Deductibility |

|---|---|---|

| Cash Donations | Any cash donations made to qualified charitable organizations can be deducted. | Yes |

| Donated Goods | If you donated clothing, furniture, or other items to a qualified charity, you can deduct the fair market value of those items. |

Yes |

| Mileage and Travel Expenses | If you volunteered for a charitable organization and incurred mileage or travel expenses, these can be deductible. |

Yes |

Explain Limits and Necessary Documentation

While charitable contributions can lead to substantial deductions, it’s essential to keep proper documentation to support your claims. For cash donations of $250 or more, you must obtain a written acknowledgment from the charity. Additionally, you should maintain records, such as receipts or bank statements, for all charitable contributions.

Casualty and Theft Losses: What Counts?

In unfortunate situations where you experience property damage or theft, you may be eligible to deduct certain losses. Deductible casualty and theft losses typically include:

Damage to Your Home

Losses due to events like natural disasters, fires, or accidents that result in damage to your home can be deducted.

Stolen Property

If you are the victim of theft and lose personal property, the cost of replacing those items can be deductible.

Discuss Eligibility and Documentation Requirements

To claim casualty and theft losses, you must meet specific eligibility criteria, and documentation is crucial. Generally, losses must exceed 10% of your AGI, and you can only deduct the portion that exceeds this threshold. Detailed records and documentation of the event, including police reports or insurance claims, are necessary to support your deduction.

Avoiding Common Mistakes When Itemizing Deductions

Itemizing deductions can be complex, and taxpayers often make common mistakes that can lead to errors or audits. Some common errors to avoid include:

Math Errors

Simple arithmetic mistakes can result in incorrect deductions. Always double-check your calculations.

Insufficient Documentation

Failure to maintain proper records and receipts for your deductible expenses can result in disallowed deductions.

Claiming Ineligible Expenses

Attempting to deduct expenses that do not qualify as itemized deductions can lead to complications and potential audits.

Stress the Importance of Accurate Documentation

To avoid these mistakes, it is crucial to maintain accurate records, keep receipts, and seek professional tax advice when necessary. The IRS may request documentation to support your deductions, so being well-prepared is essential.

The Impact of Tax Law Changes on Itemized Deductions

Tax laws are subject to change, and these changes can have a significant impact on itemized deductions. Here are some key changes in recent years:

Tax Cuts and Jobs Act (TCJA)

The TCJA, enacted in 2017, made substantial changes to the tax code, including adjustments to itemized deductions. It introduced the SALT deduction cap and altered the rules for deducting mortgage interest.

Schedule 1 of Form 1040

Starting with the 2018 tax year, some itemized deductions were moved to Schedule 1 of Form 1040, affecting how taxpayers report their deductions.

Guide Readers Through These Changes and Their Implications

Understanding how recent tax law changes affect your itemized deductions is essential for accurate tax planning. Consult tax professionals or use tax software to navigate these changes effectively.

Navigating Schedule A with a Tax Professional

While many taxpayers can complete Schedule A on their own, there are scenarios where consulting a tax professional is highly beneficial. Some situations where professional guidance is crucial include:

Complex Tax Situations

If your tax situation is complicated, involving multiple sources of income, investments, or self-employment, a tax professional can help you navigate the complexities of itemizing deductions.

Tax Reform Implications

Tax professionals stay up-to-date with changes in tax laws and can provide valuable insights into how recent tax reform may impact your deductions.

Filing Your Itemized Deductions: A Step-by-Step Guide

Provide a Basic Guide to Completing and Filing Schedule A

For taxpayers who choose to itemize deductions, completing and filing Schedule A correctly is essential. Here is a step-by-step guide:

- Gather Documentation: Collect all relevant documentation, including receipts, invoices, and records of expenses.

- Download Schedule A: Obtain a copy of Schedule A from the IRS website or tax software.

- Fill Out Your Personal Information: Provide your name, Social Security number, and filing status.

- List Your Deductions: Carefully list each deductible expense in the appropriate category, such as medical expenses, taxes, mortgage interest, charitable contributions, and casualty or theft losses.

- Calculate Total Deductions: Sum up the deductions in each category to calculate your total itemized deductions.

- Transfer to Form 1040: On your Form 1040, report the total itemized deductions on the appropriate line.

- File Your Tax Return: Submit your completed tax return, including Schedule A, by the filing deadline.

Include Tips for Efficient and Error-Free Filing

To ensure a smooth and error-free filing process, consider the following tips:

- Double-check all calculations and ensure that you’ve included all eligible expenses.

- Keep copies of all supporting documentation in case of an audit.

- Use tax software or consult a tax professional for added accuracy and guidance.

- File your tax return electronically for faster processing and quicker refunds.

In Summary

In summary, Schedule A on IRS Form 1040 provides taxpayers with the opportunity to itemize deductions and potentially reduce their tax liability. By understanding the various categories of deductible expenses, staying informed about tax law changes, and seeking professional guidance when necessary, individuals can make informed decisions about whether to itemize or take the standard deduction. Proper documentation and accurate record-keeping are essential for a successful itemization process, ensuring that taxpayers receive the deductions they are entitled to.

Key Takeaways

- Schedule A is an attachment to IRS Form 1040 used for itemizing deductions.

- Itemizing deductions involves listing and totaling specific qualifying expenses, such as medical expenses, state and local taxes, mortgage interest, charitable contributions, and casualty or theft losses.

- Scenarios where itemizing is beneficial include having high deductible expenses, being a homeowner with mortgage interest, making substantial charitable contributions, and residing in a high-tax state.

- Common deductible expenses include medical and dental expenses, state and local taxes, mortgage interest, charitable contributions, and casualty or theft losses.

- Tax law changes, such as the Tax Cuts and Jobs Act (TCJA), have impacted itemized deductions.

- Consulting a tax professional is advisable in complex tax situations or when dealing with significant tax law changes.