Form 1098-MA is a tax document used to report mortgage assistance payments made by a governmental unit or nonprofit organization. This form is used to report payments made to a lender, servicer, borrower, or owner of a residential structure containing one to four units.

What is Form 1098-MA?

Form 1098-MA is an IRS document used to report payments made by a governmental unit or nonprofit organization on behalf of a borrower or owner of a residential structure with up to four units. It is used to report payments made to a lender, servicer, or other mortgage holder, as well as payments made directly to a borrower or owner. This form is important for mortgage holder tax filing purposes and should be kept as evidence of payments made.

IRS Form 1098-MA – Who Needs to Fill It Out?

IRS Form 1098-MA is required to be filled out for two situations: when a governmental unit or nonprofit organization makes a mortgage assistance payment on behalf of a borrower to a lender, servicer, or other mortgage holder; and when a payment is made to the borrower or owner of a residential structure containing one to four units. The form also serves to report payments made to a lender, servicer, or other mortgage holder. Regardless of the situation, any entity that makes or has received mortgage assistance payments must fill out IRS Form 1098-MA.

Step-by-Step: Form 1098-MA Instructions For Filling Out the Document

Form 1098-MA is used to report payments related to mortgages made by governmental units or nonprofits. It should be filled out by the lender, servicer, or other mortgage holder and provide information such as the payment made to the borrower or owner of a residential structure with one to four units. This form should also be used to report payments made to the lender, servicer, or other mortgage holder of the same residential structure. To properly fill out Form 1098-MA, each payment made needs to be reported separately and accurately.

| Instructions for Filling out Form 1098-MA | Details |

|---|---|

| Lender’s Responsibility | The lender, servicer, or other mortgage holder should fill out the form. |

| Payment Reporting | Report payments made to the borrower or owner of a residential structure with one to four units. |

| Payment Details | Report each payment made separately and accurately. |

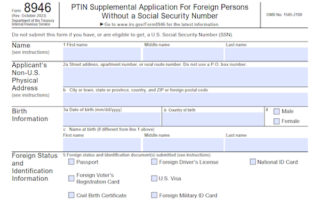

| Recipient Information | Include the social security number or other taxpayer identification number of the foreign recipient. |

| Submission | Once completed, submit the form with all required payment details. |

Do You Need to File Form 1098-MA Each Year?

Yes, Form 1098-MA is used to report mortgage assistance payments made by a governmental unit or nonprofit organization on behalf of a borrower or on behalf of an owner of a residential structure containing one to four units. This form is used to report payments to a lender, servicer, or other mortgage holder, and payments made to a borrower or homeowner. Therefore, it is important to file Form 1098-MA each year to accurately track and report payments that have been made.

Download the official IRS Form 1098-MA PDF

On the official IRS website, you will find a link to download Form 1098-MA. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 1098-MA

Sources: