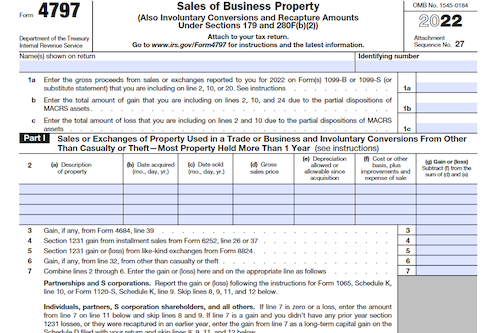

Form 4797 is a tax form issued by the IRS and used to report financial gains made from the sale or exchange of business property, including property used to generate rental income and property used for industrial, agricultural, or extractive resources. Information required includes a description of the property, purchase date, sale or transfer date, cost of purchase, gross sales price, and the depreciation amount.

What is Form 4797?

Form 4797 is a tax form distributed by the Internal Revenue Service (IRS) and is used to report gains made from the sale or exchange of business property, including property used to generate rental income. When filling out Form 4797, entities must provide details of the property, the purchase/sale date, cost and depreciation amount. Business property types may include rental income, homes used for business, and properties of industrial, agricultural, extractive resources. Furthermore, partial business use of a primary residence may qualify for tax exclusion. The net profit or loss of the sale is determined by deducting the cost basis from the gross sales price. Form 4797 has four parts which need to be completed when filing. Depending on the situation, Form 8949 may also need to be used to defer capital gains through qualified funds. Ultimately, Form 4797 ensures any capital gains are properly taxed.

IRS Form 4797 – Who Needs to Fill It Out?

IRS Form 4797 is a tax document used by those that have sold or exchanged business property, such as real estate used to generate rental income, industrial, agricultural, or extractive resources. The form requires information such as the description of the property, purchase date, sale or transfer date, cost of purchase, gross sales price, and the depreciation amount in order to accurately report the gains made. Those that have sold or exchanged business property must fill out Form 4797 in order to accurately report their gains.

Step-by-Step: Form 4797 Instructions For Filling Out the Document

Filling out Form 4797 requires providing information such as the description of the property, purchase and sale/transfer dates, cost of purchase, gross sales price, and depreciation amount. Business property reported on Form 4797 may include those purchased to generate rental income or used for industrial, agricultural, or extractive resources. Taxpayers may file Form 4797 for a home used as a business, for oil, gas, geothermal, or mineral property, or partially for business purposes. Net profit or loss from a business property transfer/sale is calculated by subtracting the purchases price from the sales price less depreciation costs. Form 4797 has four parts and most depreciable property held for more than a year is listed in Part I. In addition, Form 8949 must be used when deferring capital gains through investments in a qualified fund. Lastly, to avoid capital gains tax, one can reinvest in an opportunity zone.

Below, we present a table that will help you understand how to fill out Form 4797.

| Information Required for Form 4797 | Details |

|---|---|

| Description of the Property | Description of the property being reported |

| Purchase Date | Date of property purchase |

| Sale/Transfer Date | Date of property sale or transfer |

| Cost of Purchase | Cost of acquiring the property |

| Gross Sales Price | Total sales price of the property |

| Depreciation Amount | Amount of depreciation claimed |

| Types of Business Property | Various types of business property, e.g., rental, industrial, agricultural |

| Use of Property | How the property is used, e.g., as a home for business, for oil or gas |

| Net Profit or Loss | Profit or loss from property sale, calculated as sales price – purchase price – depreciation |

| Form 4797 Parts | Explanation of the four parts of Form 4797 |

| Depreciable Property | List of depreciable property held for more than a year in Part I |

| Form 8949 | Use of Form 8949 for deferring capital gains through investments |

| Opportunity Zone | Information on reinvesting in an opportunity zone to avoid capital gains tax |

Do You Need to File Form 4797 Each Year?

Do You Need to File Form 4797 Each Year? Form 4797 (Sales of Business Property) is an IRS tax form used to document gains from the sale or exchange of business property. The form contains four parts and requires details such as the purchase date, sales price, depreciation amount, and what is being reported. Taxpayers may need to fill out Form 4797 each year if they make gains from the sale of business property, such as property used to produce rental income, or their own home used in a business. Depending on the type of business property being transferred or sold, taxpayers may be able to avoid or defer capital gains tax by investing into an opportunity zone.

Download the official IRS Form 4797 PDF

On the official IRS website, you will find a link to download Form 4797: Sales of Business Property. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 4797

Sources:

https://www.irs.gov/forms-pubs/about-form-4797

https://www.irs.gov/instructions/i4797